Question

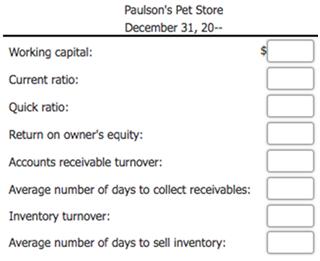

Prepare the following financial ratios. If required, round your answers to two decimal places. Assume 365 days per year. For return on owner's equity, enter

Prepare the following financial ratios. If required, round your answers to two decimal places. Assume 365 days per year. For return on owner's equity, enter as a percent but do not include percent sign.

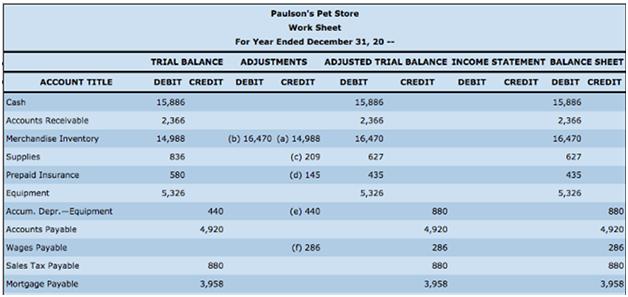

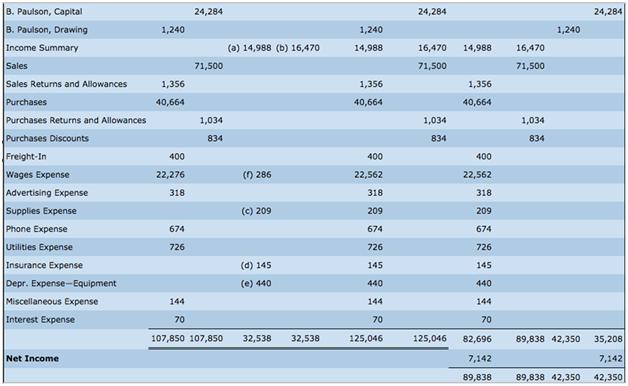

Paulson's Pet Store completed the worksheet below for the year ended December 31, 20--. Owner's equity as of January 1, 20--, was $22,332 and the Accounts Receivable balance on January 1, 20--, was $3,816. The current portion of Mortgage Payable is $542. All sales are credit sales.

Step by Step Solution

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

1 Working Capital Current Assets Current Liability Current Assets Cash Accounts Receivable Merchandi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting in an Economic Context

Authors: Jamie Pratt

8th Edition

9781118139424, 9781118139431, 470635290, 1118139429, 1118139437, 978-0470635292

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App