Prepare the following statements for the company in compliance with the Companies Act 2016 and the relevant Malaysian Financial Reporting Standards (MFRS); d. The

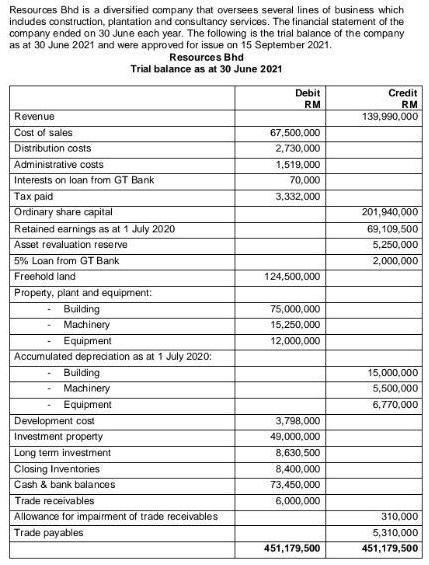

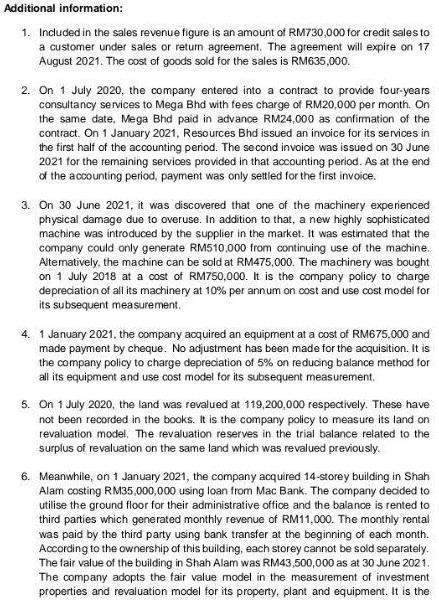

Prepare the following statements for the company in compliance with the Companies Act 2016 and the relevant Malaysian Financial Reporting Standards (MFRS); d. The relevant Notes to the Financial Statements including the Notes on: i. Property, plant and equipment Resources Bhd is a diversified company that oversees several lines of business which includes construction, plantation and consultancy services. The financial statement of the company ended on 30 June each year. The following is the trial balance of the company as at 30 June 2021 and were approved for issue on 15 September 2021. Resources Bhd Trial balance as at 30 June 2021 Revenue Cost of sales Distribution costs Administrative costs Interests on loan from GT Bank Tax paid Ordinary share capital Retained earnings as at 1 July 2020 Asset revaluation reserve 5% Loan from GT Bank Freehold land Property, plant and equipment: Building Machinery Equipment Accumulated depreciation as at 1 July 2020: - . Building Machinery Equipment Development cost Investment property Long term investment Closing Inventories Cash & bank balances Trade receivables Allowance for impairment of trade receivables. Trade payables Debit RM 67,500,000 2,730,000 1,519,000 70,000 3,332,000 124,500,000 75,000,000 15,250,000 12,000,000 3,798,000 49,000,000 8,630,500 8,400,000 73,450,000 6,000,000 451,179,500 Credit RM 139,990,000 201,940,000 69,109,500 5,250,000 2,000,000 15,000,000 5,500,000 6,770,000 310,000 5,310,000 451,179,500 Additional information: 1. Included in the sales revenue figure is an amount of RM730,000 for credit sales to a customer under sales or return agreement. The agreement will expire on 17 August 2021. The cost of goods sold for the sales is RM635,000. 2. On 1 July 2020, the company entered into a contract to provide four-years consultancy services to Mega Bhd with fees charge of RM20,000 per month. On the same date. Mega Bhd paid in advance RM24,000 as confirmation of the contract. On 1 January 2021, Resources Bhd issued an invoice for its services in the first half of the accounting period. The second invoice was issued on 30 June 2021 for the remaining services provided in that accounting period. As at the end of the accounting period, payment was only settled for the first invoice. 3. On 30 June 2021, it was discovered that one of the machinery experienced physical damage due to overuse. In addition to that, a new highly sophisticated machine was introduced by the supplier in the market. It was estimated that the company could only generate RM510,000 from continuing use of the machine. Alternatively, the machine can be sold at RM475,000. The machinery was bought on 1 July 2018 at a cost of RM750,000. It is the company policy to charge. depreciation of all its machinery at 10% per annum on cost and use cost model for its subsequent measurement. 4. 1 January 2021, the company acquired an equipment at a cost of RM675,000 and made payment by cheque. No adjustment has been made for the acquisition. It is the company policy to charge depreciation of 5% on reducing balance method for all its equipment and use cost model for its subsequent measurement. 5. On 1 July 2020, the land was revalued at 119,200,000 respectively. These have not been recorded in the books. It is the company policy to measure its land on revaluation model. The revaluation reserves in the trial balance related to the surplus of revaluation on the same land which was revalued previously. 6. Meanwhile, on 1 January 2021, the company acquired 14-storey building in Shah Alam costing RM35,000,000 using loan from Mac Bank. The company decided to utilise the ground floor for their administrative office and the balance is rented to third parties which generated monthly revenue of RM11,000. The monthly rental was paid by the third party using bank transfer at the beginning of each month. According to the ownership of this building, each storey cannot be sold separately. The fair value of the building in Shah Alam was RM43,500,000 as at 30 June 2021. The company adopts the fair value model in the measurement of investment properties and revaluation model for its property, plant and equipment. It is the company policy to charge depreciation of 5% per annum for its building. As at year end, no adjustment has been made for these transactions. 7. During the year, a customer who allegedly fall sick after consuming the company's product sued the company. The company's lawyer is of the opinion that that there is a very low possibility that the customer will win the court case. The amount of damages that the company will incur is estimated at RM211,000. On another case, the company also has been sued by a customer claiming defects at its property. The suit was filed early April 2021, but the case was heard in July 2021. The management expected they would win the case, thus, no provision being made. Such event has been disclosed as contingent liability in the draft financial statements. However, on 20 July 2021, the court found Resources Bhd was liable for the amount of the customer's claim amounted to RM137,000 and expected to be paid within 12 months' period. 8. In the month of April 2021, an unused building owned by the company has to be demolished due to safety reasons ordered by the local authority department. On 1 May 2021, the department made a press statement stating it will pay a compensation to all the parties affected by the order. On 15 June 2021, the company received a letter specifying that the company would receive RM250,000 as the compensation. 9. On 1 June 2021, the company discovered that an amount of RM96,000 for credit purchases for year ended 30 June 2020 has been wrongly recorded as RM69,000 in the books of the company. The correct amount was already incorporated in the closing inventories. 10. On 15 May 2021, a receivable who owed the company RM45.000 was declared a bankrupt. The amount was not expected to be recovered since the where about of the receivable is unknown. 11. In June 2021, the company has entered into a contract to purchase a piece of high- tech machine at a cost of RM25,000,000. 12. Tax charged for the year ended 31 July is estimated at RM3,500,000.

Step by Step Solution

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Particulars Gross Profit cd Distribution cost Aministrative cost Depreciat...

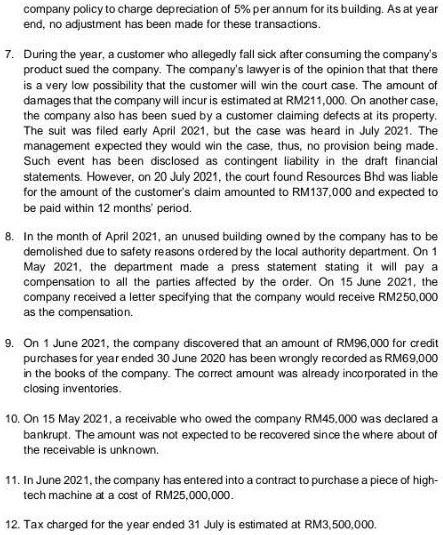

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started