Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare the following workings, analysed by product, based on the information: 2.1.2. Calculate fixed and variable overheads using the high/low method. (4 marks) 2.1.3.

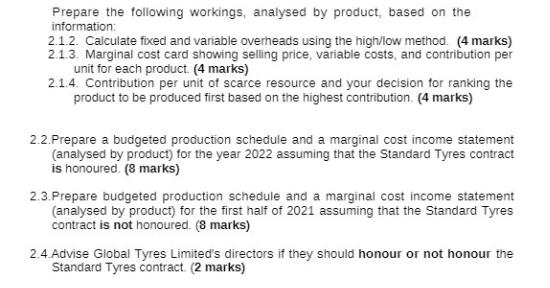

Prepare the following workings, analysed by product, based on the information: 2.1.2. Calculate fixed and variable overheads using the high/low method. (4 marks) 2.1.3. Marginal cost card showing selling price, variable costs, and contribution per unit for each product. (4 marks) 2.1.4. Contribution per unit of scarce resource and your decision for ranking the product to be produced first based on the highest contribution. (4 marks) 2.2.Prepare a budgeted production schedule and a marginal cost income statement (analysed by product) for the year 2022 assuming that the Standard Tyres contract is honoured. (8 marks) 2.3. Prepare budgeted production schedule and a marginal cost income statement (analysed by product) for the first half of 2021 assuming that the Standard Tyres contract is not honoured. (8 marks) 2.4.Advise Global Tyres Limited's directors if they should honour or not honour the Standard Tyres contract. (2 marks)

Step by Step Solution

★★★★★

3.40 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

To address the questions and provide the requested workings I need additional information ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started