Answered step by step

Verified Expert Solution

Question

1 Approved Answer

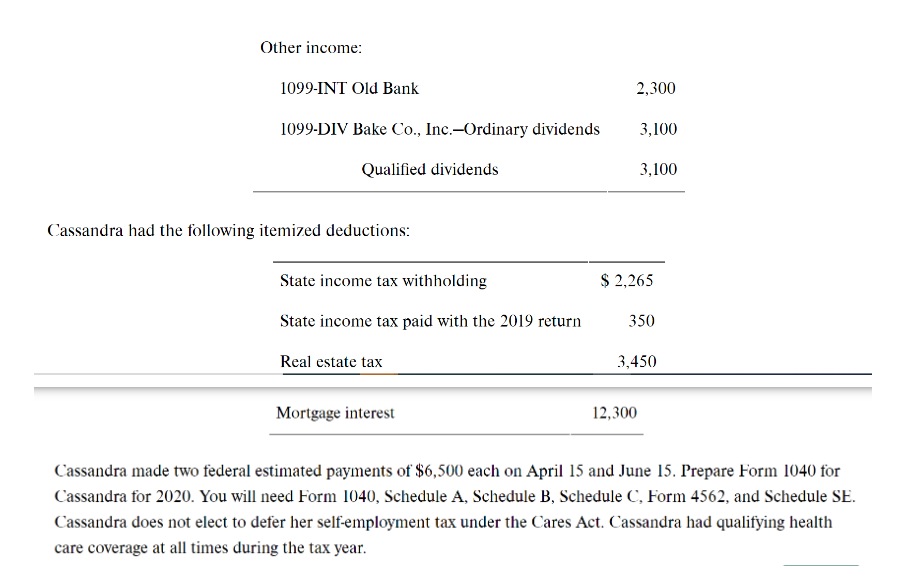

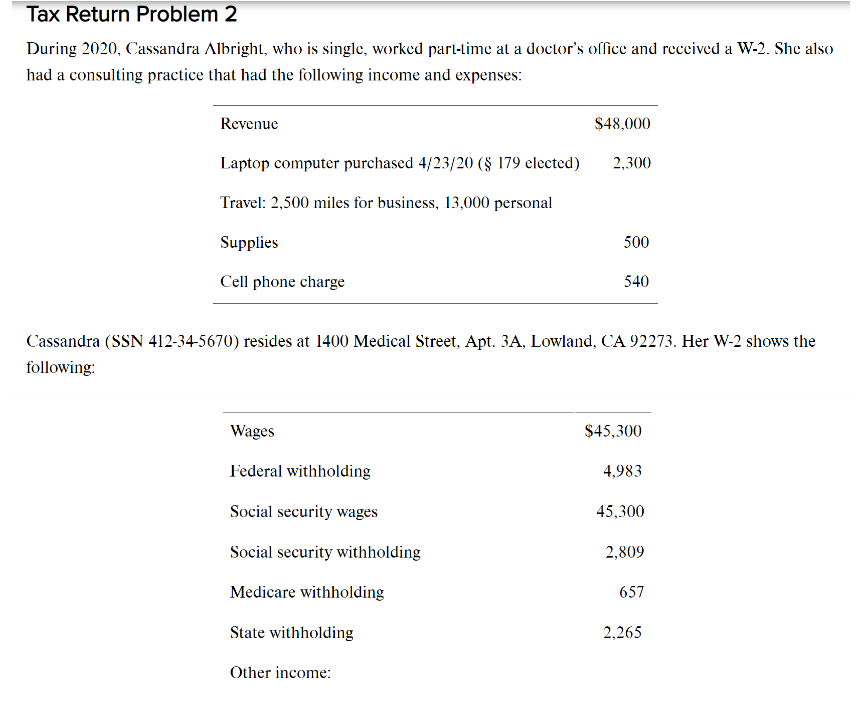

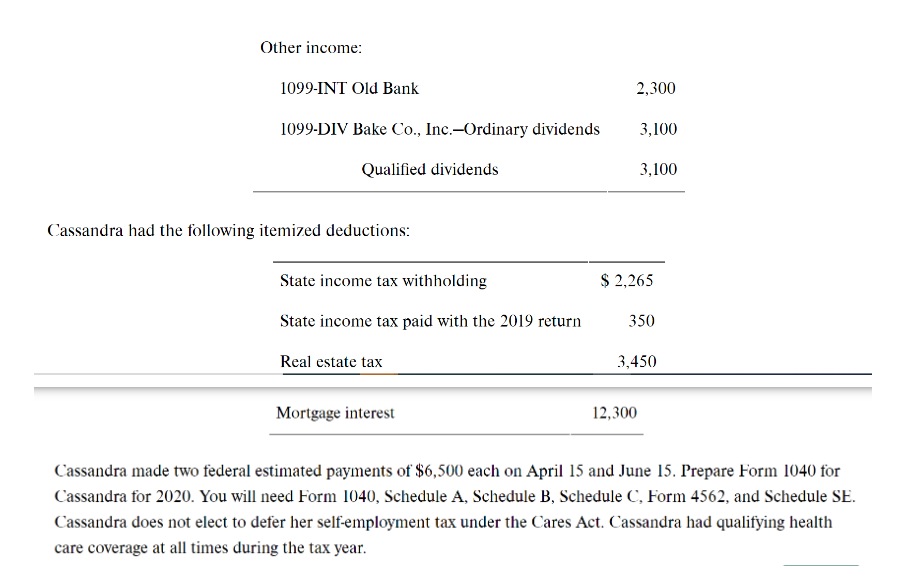

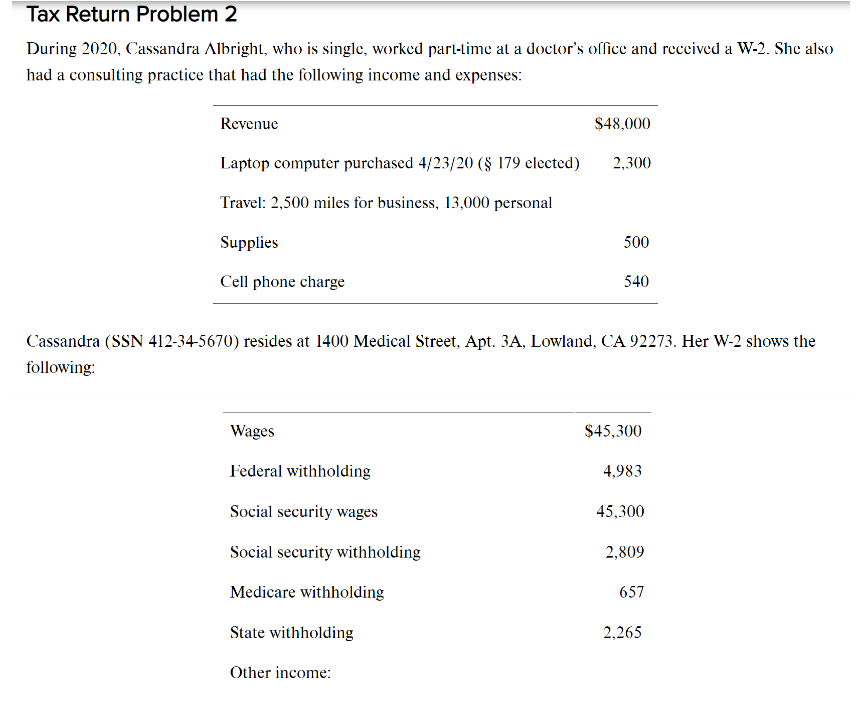

Prepare the Form 1040 by given the table below. Other income: 1099-INT Old Bank 2,300 1099-DIV Bake Co., Inc.-Ordinary dividends 3,100 Qualified dividends 3,100 Cassandra

Prepare the Form 1040 by given the table below.

Other income: 1099-INT Old Bank 2,300 1099-DIV Bake Co., Inc.-Ordinary dividends 3,100 Qualified dividends 3,100 Cassandra had the following itemized deductions: State income tax withholding $ 2,265 State income tax paid with the 2019 return 350 Real estate tax 3,450 Mortgage interest 12,300 Cassandra made two federal estimated payments of $6,500 each on April 15 and June 15. Prepare Form 1040 for Cassandra for 2020. You will need Form 1040, Schedule A, Schedule B, Schedule C, Form 4562, and Schedule SE. Cassandra does not elect to defer her self-employment tax under the Cares Act. Cassandra had qualifying health care coverage at all times during the tax year.

Step by Step Solution

★★★★★

3.46 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

Answer To prepare Cassandra Albrights Form 1040 for 2020 well need to include all the relevant incom...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started