Question

Prepare the income statement of TT Company for the year to 31 March 20x9 and the statement of financial position as at that date. The

Prepare the income statement of TT Company for the year to 31 March 20x9 and the statement of financial position as at that date.

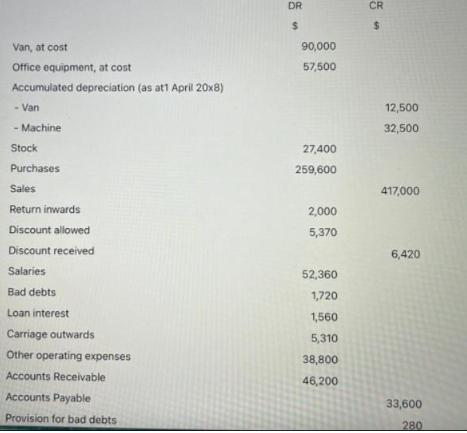

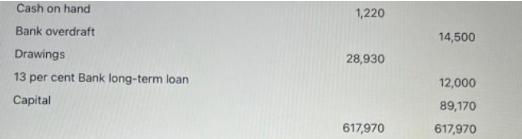

The following trial balance was extracted from the books of TT company on 31 March 20x9

The following additional information is provided:

1. Depreciation for the year ended 31 March 20x9 has yet to be provided as follows: Van: 5 per cent using the reducing balance method. Office Equipment: 15 percent on cost using the straight-line method.

2. Salaries are accrued by $5,500.

3. The closing stock is $35,900. "Other operating expenses' include certain expenses prepaid by $2,500.

4. Other expenses included under this heading are accrued by $2,200.

5. A provision for bad debts of 1% is to be made on the Accounts Receivable balance.

6. The proprietor took $4,050 worth of goods for own use. No entry was made in the books.

Van, at cost Office equipment, at cost Accumulated depreciation (as at1 April 20x8) - Van - Machine Stock Purchases Sales Return inwards Discount allowed Discount received Salaries Bad debts Loan interest Carriage outwards Other operating expenses Accounts Receivable Accounts Payable Provision for bad debts DR $ 90,000 57,500 27,400 259,600 2,000 5,370 52,360 1,720 1,560 5,310 38,800 46,200 CR S 12,500 32,500 417,000 6,420 33,600 280

Step by Step Solution

3.33 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Income Statement of TT Company for the Year to 31 March 20x9 Description Amount Sales 417000 Less Re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started