Answered step by step

Verified Expert Solution

Question

1 Approved Answer

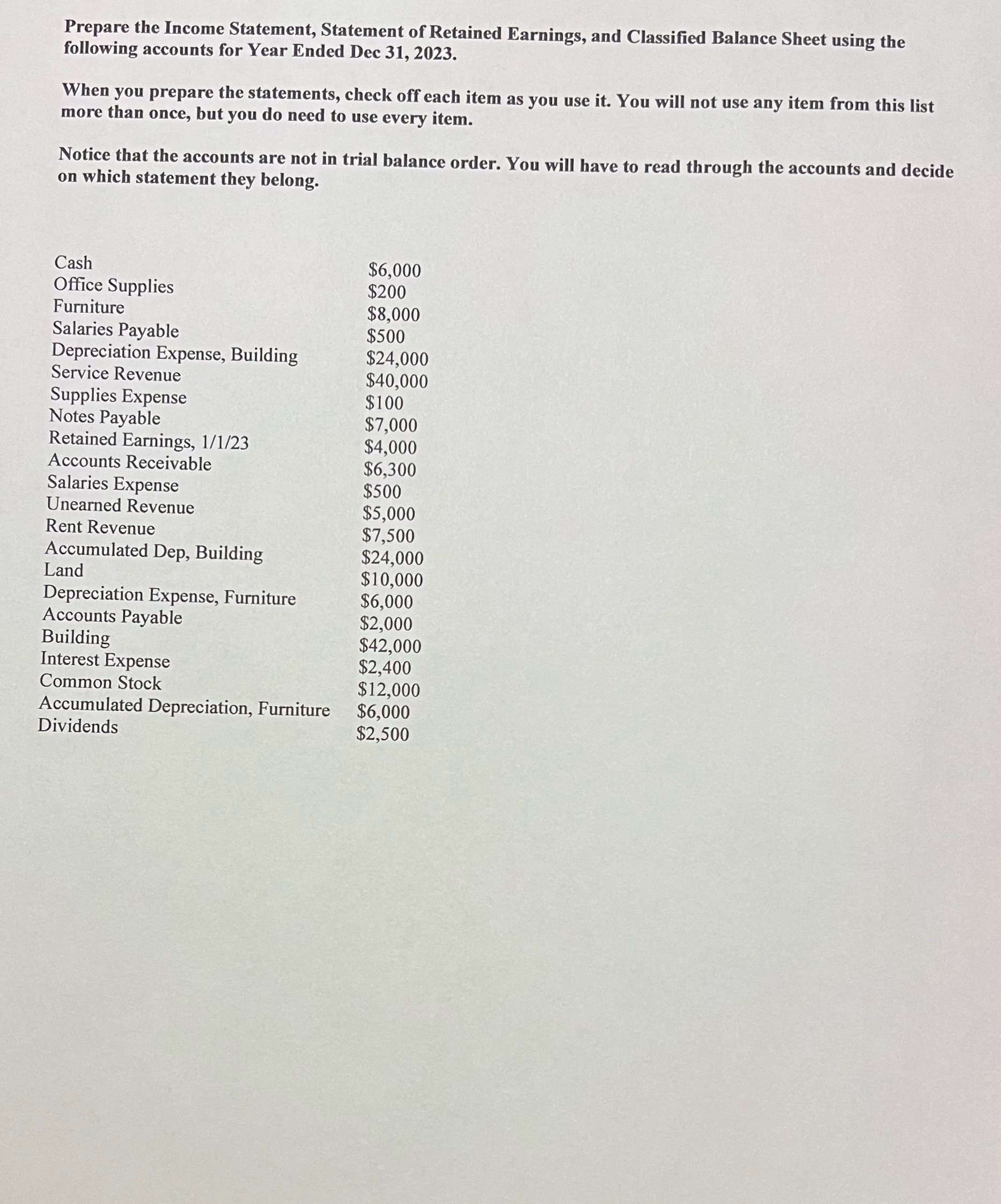

Prepare the Income Statement, Statement of Retained Earnings, and Classified Balance Sheet using the following accounts for Year Ended Dec 31, 2023. When you

Prepare the Income Statement, Statement of Retained Earnings, and Classified Balance Sheet using the following accounts for Year Ended Dec 31, 2023. When you prepare the statements, check off each item as you use it. You will not use any item from this list more than once, but you do need to use every item. Notice that the accounts are not in trial balance order. You will have to read through the accounts and decide on which statement they belong. Cash Office Supplies $6,000 $200 Furniture $8,000 Salaries Payable $500 Depreciation Expense, Building $24,000 Service Revenue $40,000 Supplies Expense $100 Notes Payable $7,000 Retained Earnings, 1/1/23 $4,000 Accounts Receivable $6,300 Salaries Expense $500 Unearned Revenue $5,000 Rent Revenue $7,500 Accumulated Dep, Building $24,000 Land $10,000 Depreciation Expense, Furniture $6,000 Accounts Payable $2,000 Building $42,000 Interest Expense $2,400 Common Stock $12,000 Accumulated Depreciation, Furniture $6,000 Dividends $2,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Okay lets get started with the financial statements for Sandhill Co for the year ended December ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started