prepare the indirect method for the statement of cash flow. please include calcuations as much as possible

same fact sheet. prepare the direct method of statement of cash flows

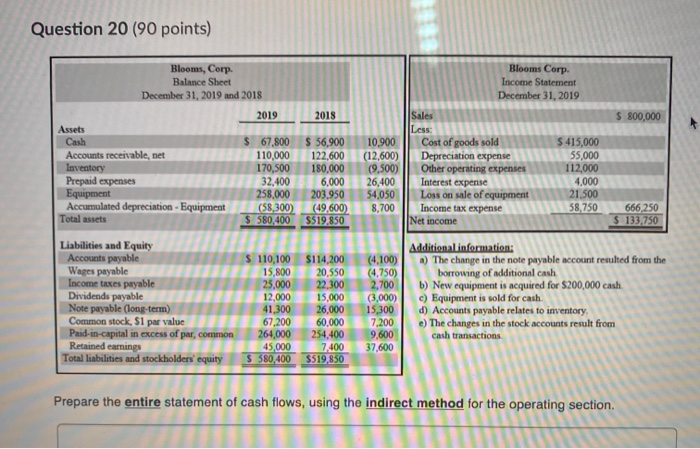

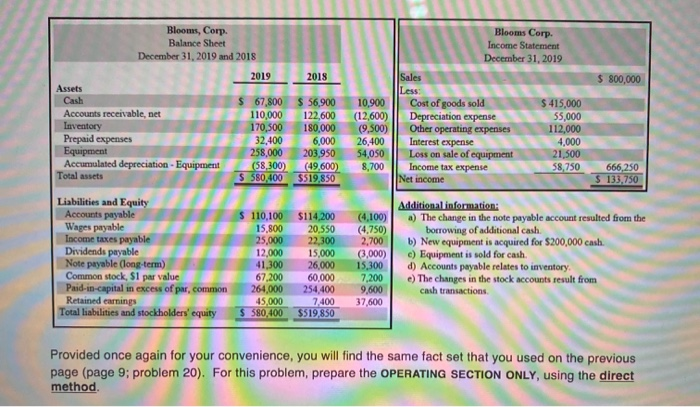

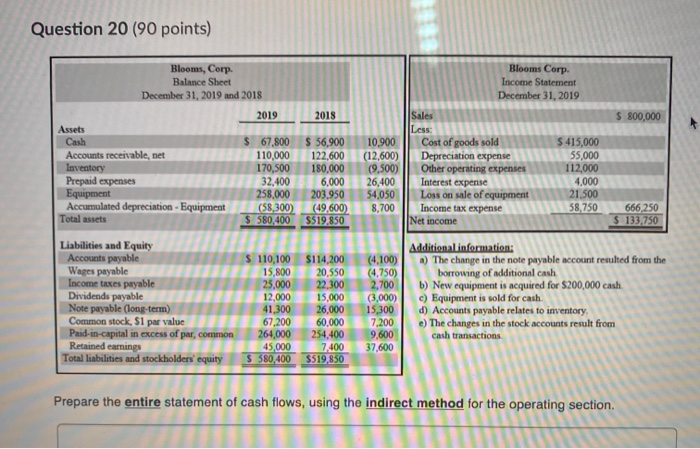

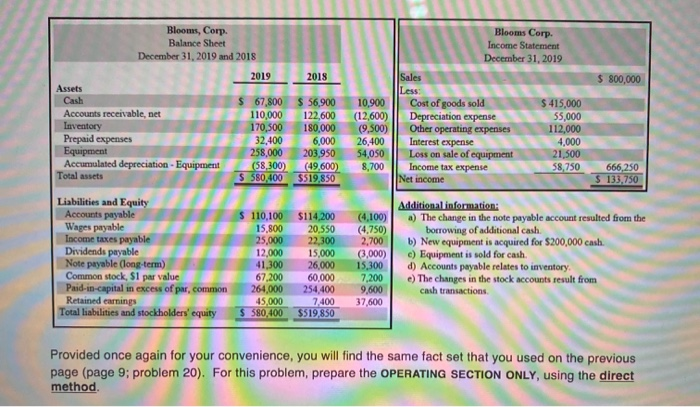

Question 20 (90 points) Blooms Corp. Income Statement December 31, 2019 2018 $ 800,000 Blooms, Corp. Balance Sheet December 31, 2019 and 2018 2019 Assets Cash $ 67,800 Accounts receivable, net 110,000 Inventory 170,500 Prepaid expenses 32.400 Equipment 258.000 Accumulated depreciation - Equipment (58,300) Total assets $ 580,400 $ 56.900 122,600 180.000 6,000 203.950 (49,600) S519.850 10,900 (12,600) (9,500) 26,400 54,050 8,700 Less Cost of goods sold Depreciation expense Other operating expenses Interest expense Loss on sale of equipment Income tax expense Net income S 415,000 55,000 112,000 4,000 21,500 58,750 666,250 $ 133.750 S 110,100 Liabilities and Equity Accounts payable Wages payable Income taxes payable Dividends payable Note payable (long-term) Common stock, S1 par value Paid-in-capital in excess of par, common Retained earnings Total liabilities and stockholders' equity (4 100) (4.750) 2,700 (3,000) 15,300 7,200 9.600 Additional information: a) The change in the note payable account resulted from the borrowing of additional cash b) New equipment is acquired for $200,000 cash c) Equipment is sold for cash. d) Accounts payable relates to inventory. e) The changes in the stock accounts result from cash transactions 2 37,600 SS Prepare the entire statement of cash flows, using the indirect method for the operating section. Blooms, Corp Blooms Corp. Balance Sheet December 31, 2019 and 2018 TO Income Statement December 31, 2019 2018 sales 2018 2019 $ 800,000 567800 S56900 10900 -Cost of goods sold $415,000 $ 415,000 Assets Cach Accounts receivable, net Inventory Prepaid expenses Equipment Accumulated depreciation - Equipment Total assets 122,600 180,000 112,000 6,000 Less: 10,900 Il Cost of goods sold (12,600) | Depreciation expense (9,500) Other operating expenses 26,400 Interest expense 54,050 | Loss on sale of equipment 8,700 Income tax expense Net income 4,000 21,500 58,750 58.300 AUER 203,950 (49,600) $519,850 666,250 S 133.750 Liabilities and Equity Accounts payable Wages payable Income taxes payable Dividends payable Note payable (long-term) Common stock, S1 par val Paid-in-capital in excess of par, common Retained earnings Total liabilities and stockholders' equity 110,100 15,800 25,000 12,000 41,300 67,200 264.000 45,000 $ 580, 400 3,000 $114,200 20,550 22,300 15,000 26.000 60,000 254,400 7400 $519,850 (4.100) (4.750) 2,700 (3.000) 15,300 15.300 7,200 9.500 37,600 Additional information: a) The change in the note payable account resulted from the borrowing of additional cash. b) New equipment is acquired for $200,000 cash. c) Equipment is sold for cash. d) Accounts payable relates to inventory e) The changes in the stock accounts result from cash transactions Provided once again for your convenience, you will find the same fact set that you used on the previous page (page 9; problem 20). For this problem, prepare the OPERATING SECTION ONLY, using the direct method

prepare the indirect method for the statement of cash flow. please include calcuations as much as possible

prepare the indirect method for the statement of cash flow. please include calcuations as much as possible same fact sheet. prepare the direct method of statement of cash flows

same fact sheet. prepare the direct method of statement of cash flows