Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare the journal entries if the foreign currency option was classified as a fair value hedge. Estimated Time: 90 to 120 minutes) Felix Toy Company

Prepare the journal entries if the foreign currency option was classified as a fair value hedge.

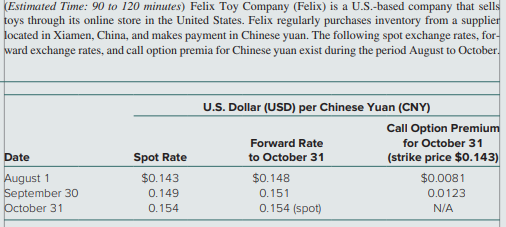

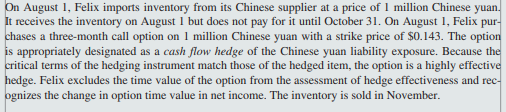

Estimated Time: 90 to 120 minutes) Felix Toy Company (Felix) is a U.S.-based company that sells toys through its online store in the United States. Felix regularly purchases inventory from a supplier located in Xiamen, China, and makes payment in Chinese yuan. The following spot exchange rates, for- ward exchange rates, and call option premia for Chinese yuan exist during the period August to October. Date August 1 September 30 October 31 Spot Rate $0.143 0.149 0.154 U.S. Dollar (USD) per Chinese Yuan (CNY) Call Option Premium Forward Rate for October 31 to October 31 (strike price $0.143) $0.148 $0.0081 0.151 0.0123 0.154 (spot) N/A On August 1, Felix imports inventory from its Chinese supplier at a price of 1 million Chinese yuan. It receives the inventory on August 1 but does not pay for it until October 31. On August 1, Felix pur- chases a three-month call option on 1 million Chinese yuan with a strike price of $0.143. The option is appropriately designated as a cash flow hedge of the Chinese yuan liability exposure. Because the critical terms of the hedging instrument match those of the hedged item, the option is a highly effective hedge. Felix excludes the time value of the option from the assessment of hedge effectiveness and rec ognizes the change in option time value in net income. The inventory is sold in November. Estimated Time: 90 to 120 minutes) Felix Toy Company (Felix) is a U.S.-based company that sells toys through its online store in the United States. Felix regularly purchases inventory from a supplier located in Xiamen, China, and makes payment in Chinese yuan. The following spot exchange rates, for- ward exchange rates, and call option premia for Chinese yuan exist during the period August to October. Date August 1 September 30 October 31 Spot Rate $0.143 0.149 0.154 U.S. Dollar (USD) per Chinese Yuan (CNY) Call Option Premium Forward Rate for October 31 to October 31 (strike price $0.143) $0.148 $0.0081 0.151 0.0123 0.154 (spot) N/A On August 1, Felix imports inventory from its Chinese supplier at a price of 1 million Chinese yuan. It receives the inventory on August 1 but does not pay for it until October 31. On August 1, Felix pur- chases a three-month call option on 1 million Chinese yuan with a strike price of $0.143. The option is appropriately designated as a cash flow hedge of the Chinese yuan liability exposure. Because the critical terms of the hedging instrument match those of the hedged item, the option is a highly effective hedge. Felix excludes the time value of the option from the assessment of hedge effectiveness and rec ognizes the change in option time value in net income. The inventory is sold in NovemberStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started