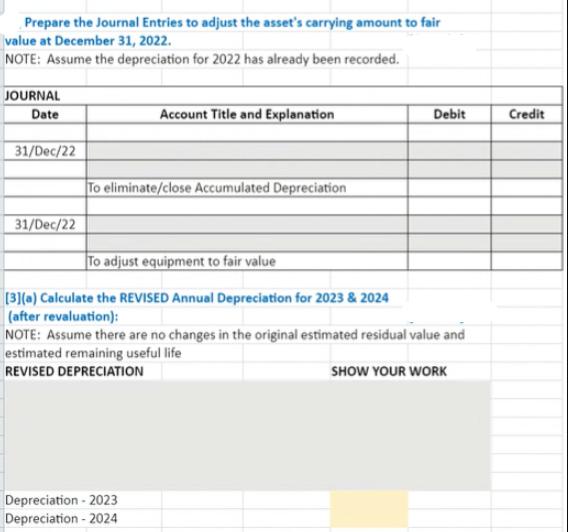

Prepare the Journal Entries to adjust the asset's carrying amount to fair value at December 31, 2022. NOTE: Assume the depreciation for 2022 has

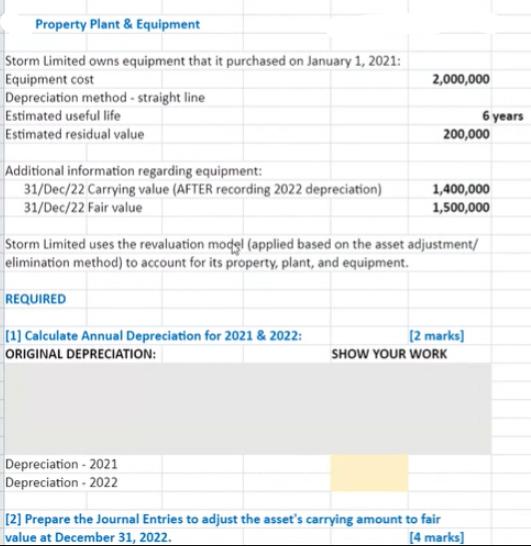

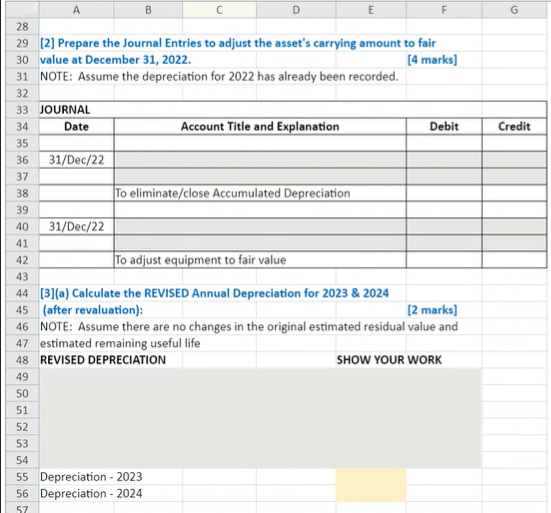

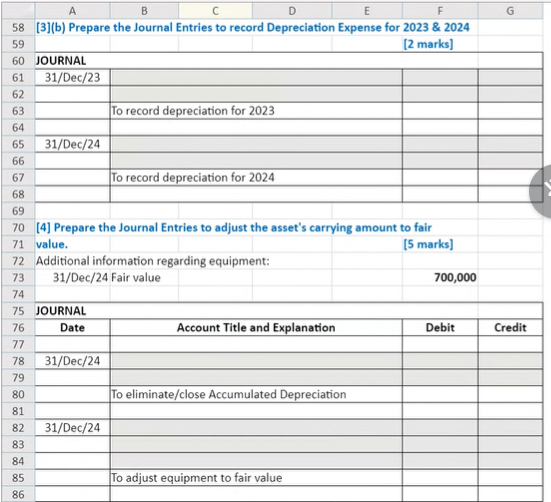

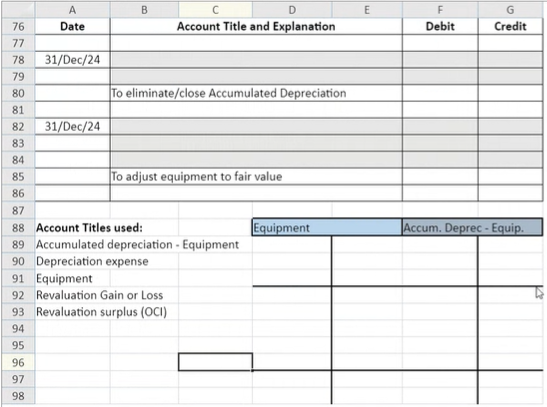

Prepare the Journal Entries to adjust the asset's carrying amount to fair value at December 31, 2022. NOTE: Assume the depreciation for 2022 has already been recorded. JOURNAL Date 31/Dec/22 31/Dec/22 Account Title and Explanation To eliminate/close Accumulated Depreciation Debit Credit To adjust equipment to fair value [3](a) Calculate the REVISED Annual Depreciation for 2023 & 2024 (after revaluation): NOTE: Assume there are no changes in the original estimated residual value and estimated remaining useful life REVISED DEPRECIATION SHOW YOUR WORK Depreciation - 2023 Depreciation-2024 Property Plant & Equipment Storm Limited owns equipment that it purchased on January 1, 2021: Equipment cost Depreciation method - straight line Estimated useful life Estimated residual value 2,000,000 6 years 200,000 Additional information regarding equipment: 31/Dec/22 Carrying value (AFTER recording 2022 depreciation) 31/Dec/22 Fair value 1,400,000 1,500,000 Storm Limited uses the revaluation model (applied based on the asset adjustment/ elimination method) to account for its property, plant, and equipment. REQUIRED [1] Calculate Annual Depreciation for 2021 & 2022: ORIGINAL DEPRECIATION: [2 marks] SHOW YOUR WORK Depreciation - 2021 Depreciation 2022 [2] Prepare the Journal Entries to adjust the asset's carrying amount to fair value at December 31, 2022. [4 marks] 28 A B C D E F G 29 [2] Prepare the Journal Entries to adjust the asset's carrying amount to fair 30 value at December 31, 2022. 31 NOTE: Assume the depreciation for 2022 has already been recorded. [4 marks] 32 33 JOURNAL 34 Date 35 36 31/Dec/22 37 38 39 40 31/Dec/22 41 42 Account Title and Explanation To eliminate/close Accumulated Depreciation Debit Credit 43 To adjust equipment to fair value 44 [3](a) Calculate the REVISED Annual Depreciation for 2023 & 2024 45 (after revaluation): [2 marks] 46 NOTE: Assume there are no changes in the original estimated residual value and 47 estimated remaining useful life 48 REVISED DEPRECIATION 49 50 51 52 53 54 55 Depreciation - 2023 56 Depreciation - 2024 57 SHOW YOUR WORK A B C D 58 [3](b) Prepare the Journal Entries to record Depreciation Expense for 2023 & 2024 59 60 JOURNAL 61 31/Dec/23 62 63 To record depreciation for 2023 64 65 31/Dec/24 66 67 To record depreciation for 2024 [2 marks] 68 69 70 [4] Prepare the Journal Entries to adjust the asset's carrying amount to fair 71 value. 72 Additional information regarding equipment: 73 31/Dec/24 Fair value [5 marks] 700,000 74 75 JOURNAL 76 Date 77 78 31/Dec/24 79 80 81 82 31/Dec/24 83 84 85 86 G Account Title and Explanation Debit Credit To eliminate/close Accumulated Depreciation To adjust equipment to fair value C D Account Title and Explanation To eliminate/close Accumulated Depreciation A B 76 Date 77 78 31/Dec/24 79 80 81 82 31/Dec/24 83 84 85 86 87 To adjust equipment to fair value 88 Account Titles used: 89 Accumulated depreciation - Equipment 90 Depreciation expense 91 Equipment 92 Revaluation Gain or Loss 93 Revaluation surplus (OCI) 94 95 96 97 98 E F G Debit Credit Equipment Accum. Deprec-Equip.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started