Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare the journal entries to record the acquisition of the drilling platform and the asset retirement obligation for the platform on Jan 1, 2023. An

Prepare the journal entries to record the acquisition of the drilling platform and the asset retirement obligation for the platform on Jan 1, 2023. An appropriate interest or discount rate is 8%

To recognize the retirement liability

Dr Drilling platform ??

Cr Asset retirement obligation ??

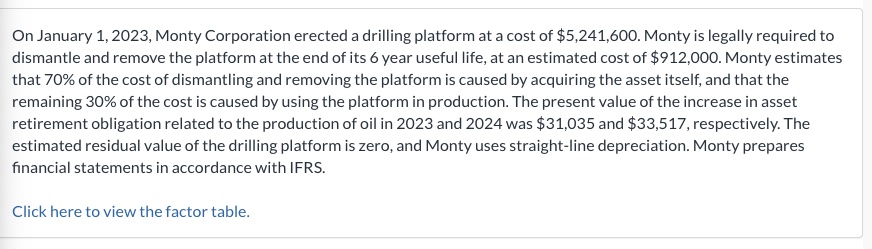

On January 1,2023 , Monty Corporation erected a drilling platform at a cost of $5,241,600. Monty is legally required to dismantle and remove the platform at the end of its 6 year useful life, at an estimated cost of $912,000. Monty estimates that 70% of the cost of dismantling and removing the platform is caused by acquiring the asset itself, and that the remaining 30% of the cost is caused by using the platform in production. The present value of the increase in asset retirement obligation related to the production of oil in 2023 and 2024 was $31,035 and $33,517, respectively. The estimated residual value of the drilling platform is zero, and Monty uses straight-line depreciation. Monty prepares financial statements in accordance with IFRS. Click here to view the factor tableStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started