Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare the journal entry. Both for Permanent and Periodic system. Required: Prepare the journal entries corresponding to the transactions listed below. This exercise should be

Prepare the journal entry. Both for Permanent and Periodic system.

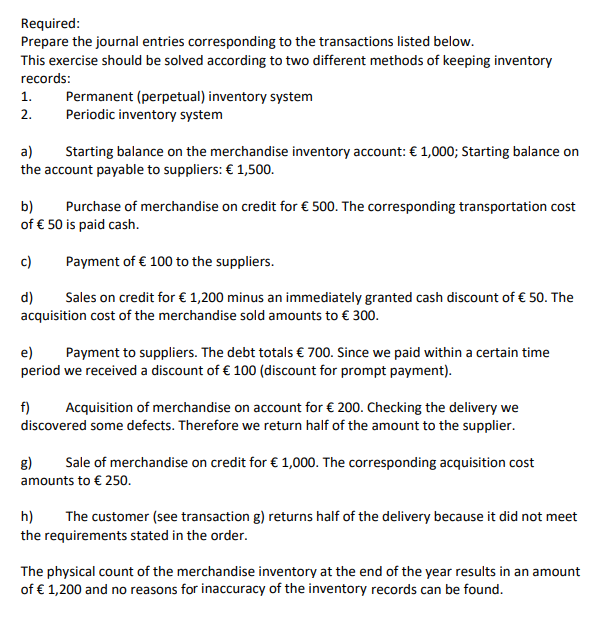

Required: Prepare the journal entries corresponding to the transactions listed below. This exercise should be solved according to two different methods of keeping inventory records: 1. Permanent (perpetual) inventory system 2. Periodic inventory system a) Starting balance on the merchandise inventory account: 1,000; Starting balance on the account payable to suppliers: 1,500. b) Purchase of merchandise on credit for 500. The corresponding transportation cost of 50 is paid cash. c) Payment of 100 to the suppliers. d) Sales on credit for 1,200 minus an immediately granted cash discount of 50. The acquisition cost of the merchandise sold amounts to 300. e) Payment to suppliers. The debt totals 700. Since we paid within a certain time period we received a discount of 100 (discount for prompt payment). f) Acquisition of merchandise on account for 200. Checking the delivery we discovered some defects. Therefore we return half of the amount to the supplier. g) Sale of merchandise on credit for 1,000. The corresponding acquisition cost amounts to 250. h) The customer (see transaction g) returns half of the delivery because it did not meet the requirements stated in the order. The physical count of the merchandise inventory at the end of the year results in an amount of 1,200 and no reasons for inaccuracy of the inventory records can be foundStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started