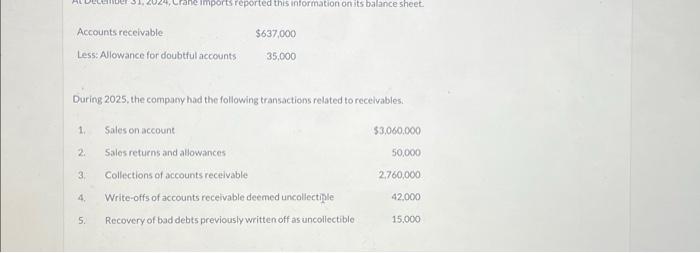

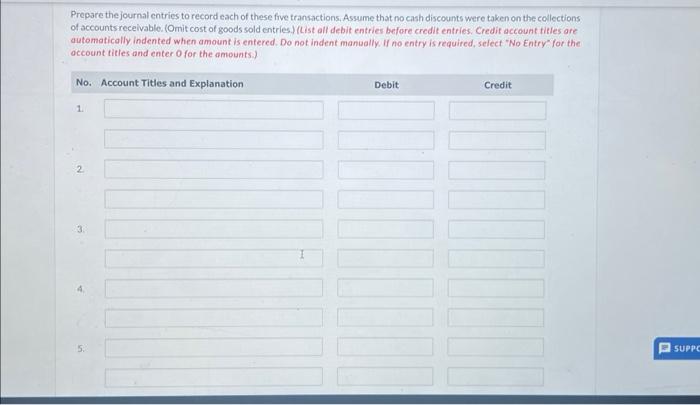

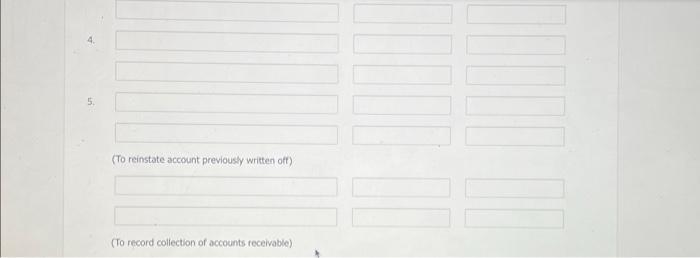

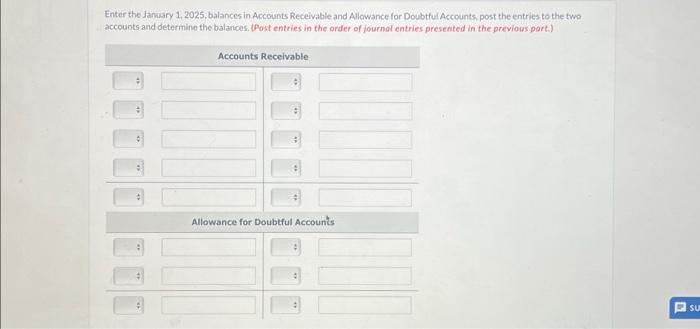

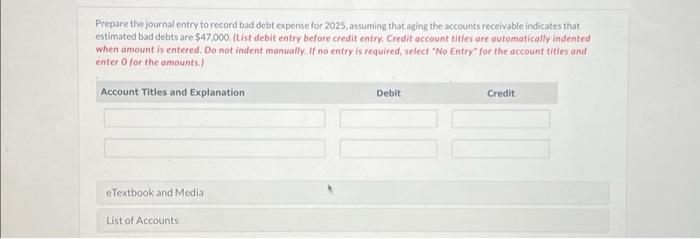

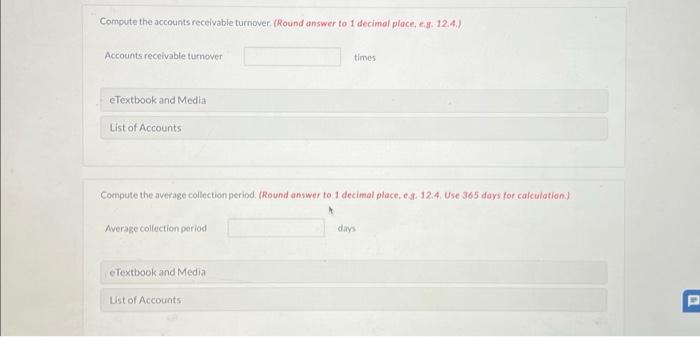

Prepare the journal entry to record bad debt expense for 2025, assuming that aging the accounts receivable indicates that estimated bad debts are $47,000. ( t ist debit entry before credit entry Credit account titles are tutomaticalfy indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account tities and enter ofor the amounts.) 4. 5. (To reinstate account previously written off) (To record collection of accounts receivable) Compute the accounts receivable turnover. (Round answer to 1 decimal place, e.g. 12.4.) Accountsreceivable turnover times Compute the average collection period. (Round answer to 1 decimal place, esa. 12.4. Use 365 days for calculation.) Average collection period dives Enter the January 1,2025, balances in Accounts Receivable and Alowance for Doubtful Accounts, post the entries to the two accounts and determine the balances, (Post entries in the order of joarnol entries aresented in the previous port ? Prepare the journal entries to record each of these five transactions. Assume that no cash discounts were taken on the collections of sccounts recelvable. (Omit cost of goods sold entrfes) (tist all debit entries before credit entries. Credit accounf thiles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" lor the account titles and enter o for the amounts.) During 2025, the company had the following transactions related to recelvables. Prepare the journal entry to record bad debt expense for 2025, assuming that aging the accounts receivable indicates that estimated bad debts are $47,000. ( t ist debit entry before credit entry Credit account titles are tutomaticalfy indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account tities and enter ofor the amounts.) 4. 5. (To reinstate account previously written off) (To record collection of accounts receivable) Compute the accounts receivable turnover. (Round answer to 1 decimal place, e.g. 12.4.) Accountsreceivable turnover times Compute the average collection period. (Round answer to 1 decimal place, esa. 12.4. Use 365 days for calculation.) Average collection period dives Enter the January 1,2025, balances in Accounts Receivable and Alowance for Doubtful Accounts, post the entries to the two accounts and determine the balances, (Post entries in the order of joarnol entries aresented in the previous port ? Prepare the journal entries to record each of these five transactions. Assume that no cash discounts were taken on the collections of sccounts recelvable. (Omit cost of goods sold entrfes) (tist all debit entries before credit entries. Credit accounf thiles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" lor the account titles and enter o for the amounts.) During 2025, the company had the following transactions related to recelvables