Answered step by step

Verified Expert Solution

Question

1 Approved Answer

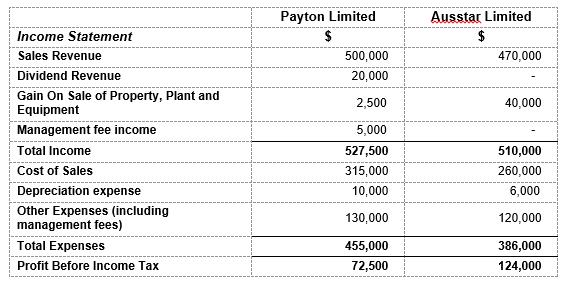

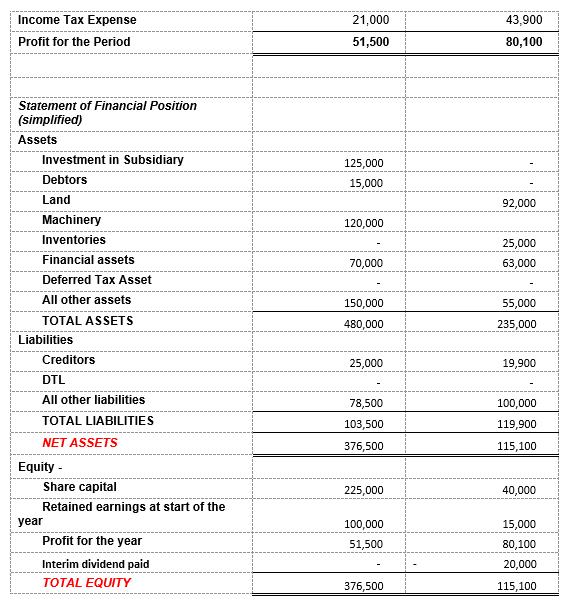

Prepare the journal to eliminate the investment in subsidiary at 31 December 2019. Financial Information for Payton Limited and its 100% owned subsidiary, Ausstar Limited,

- Prepare the journal to eliminate the investment in subsidiary at 31 December 2019.

Financial Information for Payton Limited and its 100% owned subsidiary, Ausstar Limited, for the period ended 31 December 2019 is shown in the table below:

ADDITIONAL INFORMATION (each may or may not result in a consolidation adjustment):

- a Payton Limited acquired the shares in Ausstar Limited at 1 January 2019, buying the 10,000 shares in Ausstar Pty Limited for $100,0000 cash, plus 10,000 shares in itself. At acquisition date, Payton’s shares were trading at $2.50 each. Also at that date, Ausstar Pty Limited had share capital of $40,000 and retained earnings of $30,000. The shares were bought on a come div basis. Ausstar Pty Limited had declared prior to the acquisition a dividend of $15,000 that was paid in March 2019.

- b At 1 January 2019, all identifiable assets and liabilities of Ausstar Limited were recorded at fair value, except for land, for which the carrying amount was $8,000 less than fair value.

- c During the 2019 year, the subsidiary was charged a management fee of $5,000 by the parent company. $4,000 was paid during the year, but $1,000 remained a debtor in the books of the parent as at 31 December 2019.

- d Inventories on hand in Ausstar Pty Limited at 31 December 2019 also include some items acquired from Payton Limited during the period ended 31 December 2019. Total sales of inventory for the year from Payton to Ausstar were $50,000, which had been sold to Ausstar at a mark-up of 25% on what it had originally cost Payton to produce the inventory. Half of the stock sold during the year was still on hand at year-end.

- e As the result of an impairment test on 31 December 2019, the value of the goodwill was determined to be $90,000..

- f On 1 July 2019, Ausstar Pty Limited sold machinery to Payton Limited at a gain of $40,000. At the time of sale, this machinery had a carrying amount to Ausstar Limited of $80,000 and was being charged depreciation at the rate of $12,000 per year. Payton considered that this machinery had a 6 year life from the date they acquired it.

- g By 31 December 2019, financial assets such as shares in listed companies, which were acquired by Payton Limited and Ausstar Pty Limited from external entities increased $20,000 and $13,000 respectively, with gains and losses being recognised in other comprehensive income.

- h The TAX RATE is 25%.

Income Statement Sales Revenue Dividend Revenue Gain On Sale of Property, Plant and Equipment Management fee income Total Income Cost of Sales Depreciation expense Other Expenses (including management fees) Total Expenses Profit Before Income Tax Payton Limited $ 500,000 20,000 2,500 5,000 527,500 315,000 10,000 130,000 455,000 72,500 Ausstar Limited $ 470,000 40,000 510,000 260,000 6,000 120,000 386,000 124,000

Step by Step Solution

★★★★★

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

The Hereford Plant produces a single part used in airplane hydraulic s determine the monthly volume ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started