Prepare the necessary adjusting journal entries. Cash Accounts receivable Teaching supplies Prepaid insurance Prepaid rent Professional library. Accumulated depreciation-Professional library Equipment Accumulated depreciation-Equipment Accounts payable

Prepare the necessary adjusting journal entries.

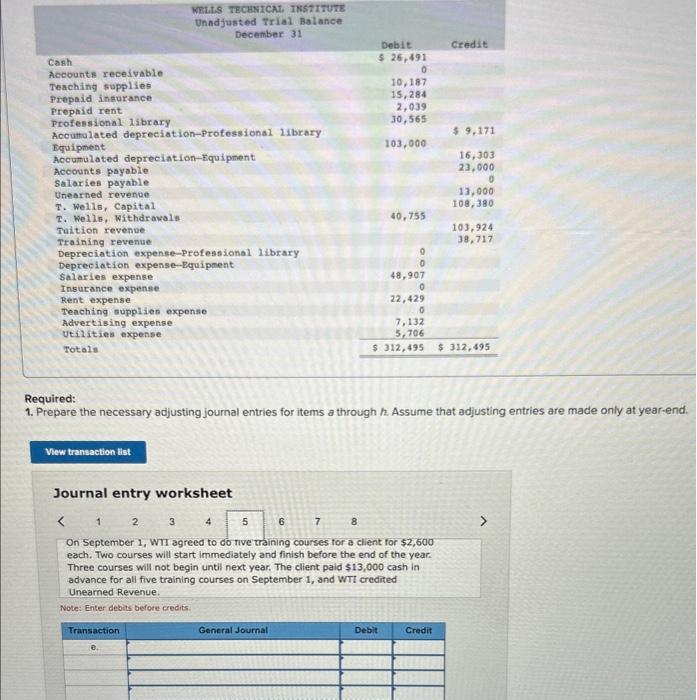

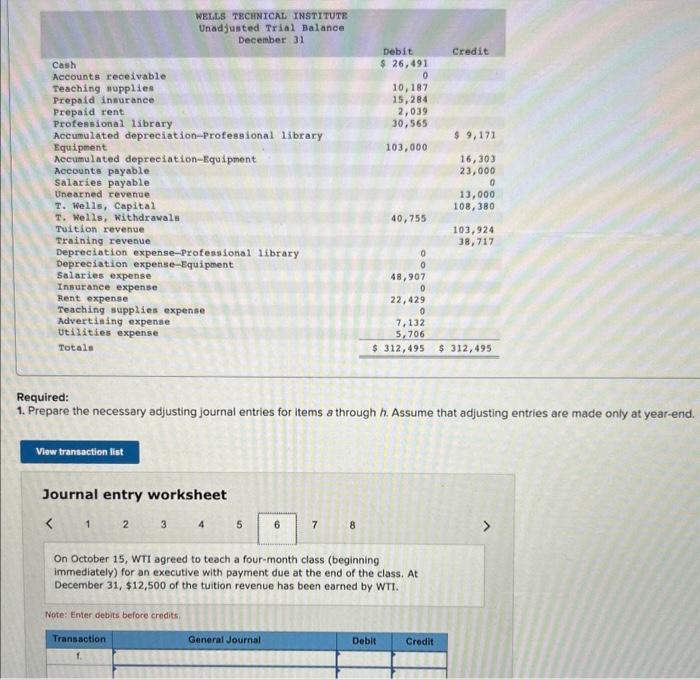

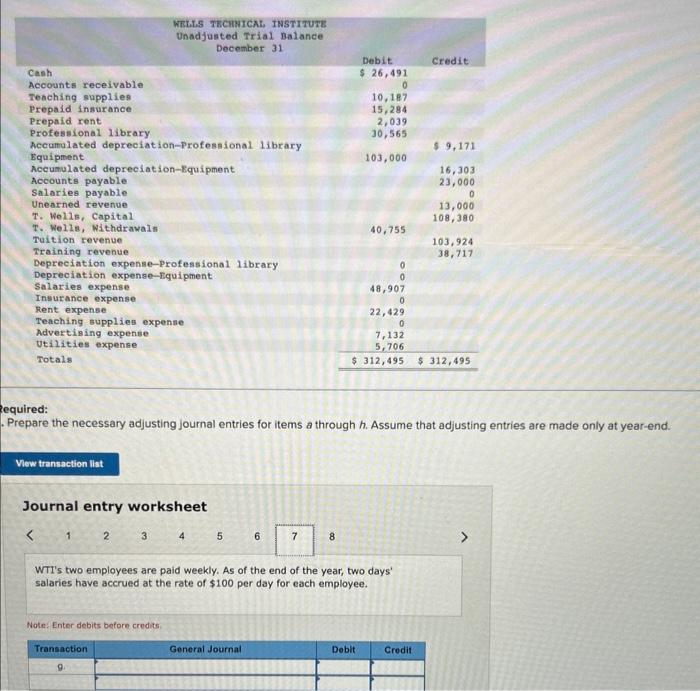

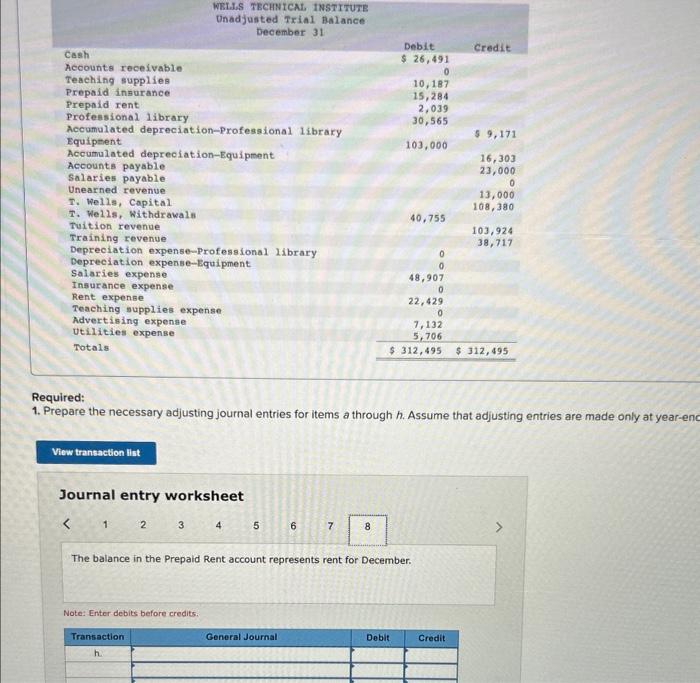

Cash Accounts receivable Teaching supplies Prepaid insurance Prepaid rent Professional library. Accumulated depreciation-Professional library Equipment Accumulated depreciation-Equipment Accounts payable Salaries payable Unearned revenue T. Wells, Capital T. Wells, Withdrawals Tuition revenue Training revenue Depreciation expense-Professional library Depreciation expense-Equipment Salaries expense Insurance expense WELLS TECHNICAL INSTITUTE Unadjusted Trial Balance December 31 Rent expense Teaching supplies expense Advertising expense Utilities expense Totals View transaction list Journal entry worksheet 3 Transaction General Journal Debit $ 26,491 0 6 8 10,187 15,284 2,039 30,565 103,000 2 4 5 7 On September 1, WTI agreed to do tive training courses for a client for $2,600 each. Two courses will start immediately and finish before the end of the year. Three courses will not begin until next year. The client paid $13,000 cash in advance for all five training courses on September 1, and WTI credited Unearned Revenue. Note: Enter debits before credits. 40,755 Required: 1. Prepare the necessary adjusting journal entries for items a through h. Assume that adjusting entries are made only at year-end. 0 Debit 48,907 0 Credit $9,171 16,303 23,000 0 22,429 0 7,132 5,706 $ 312,495 $ 312,495 Credit 13,000 108,380 103,924 38,717

Step by Step Solution

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started