Answered step by step

Verified Expert Solution

Question

1 Approved Answer

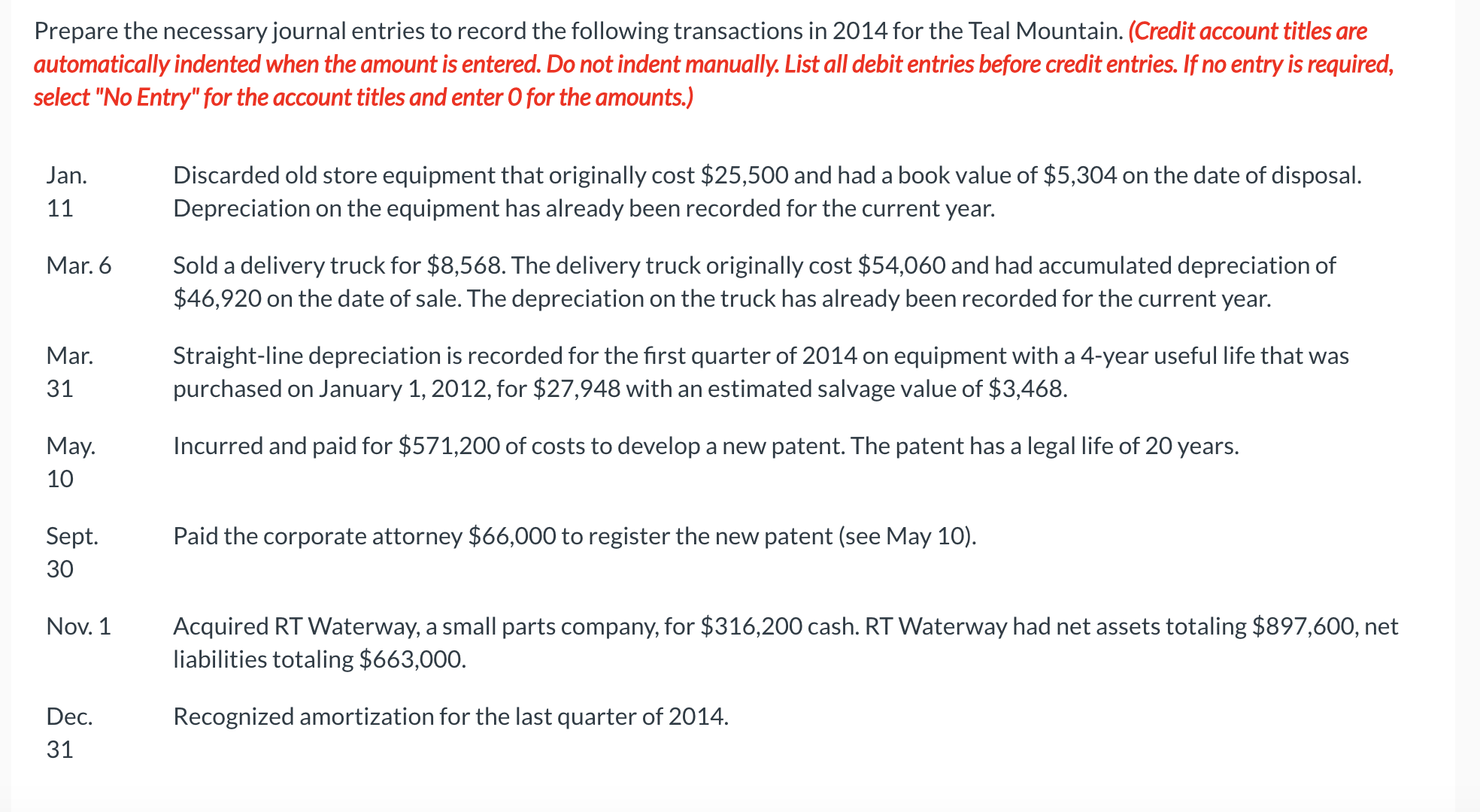

Prepare the necessary journal entries to record the following transactions in 2014 for the Teal Mountain. (Credit account titles are automatically indented when the amount

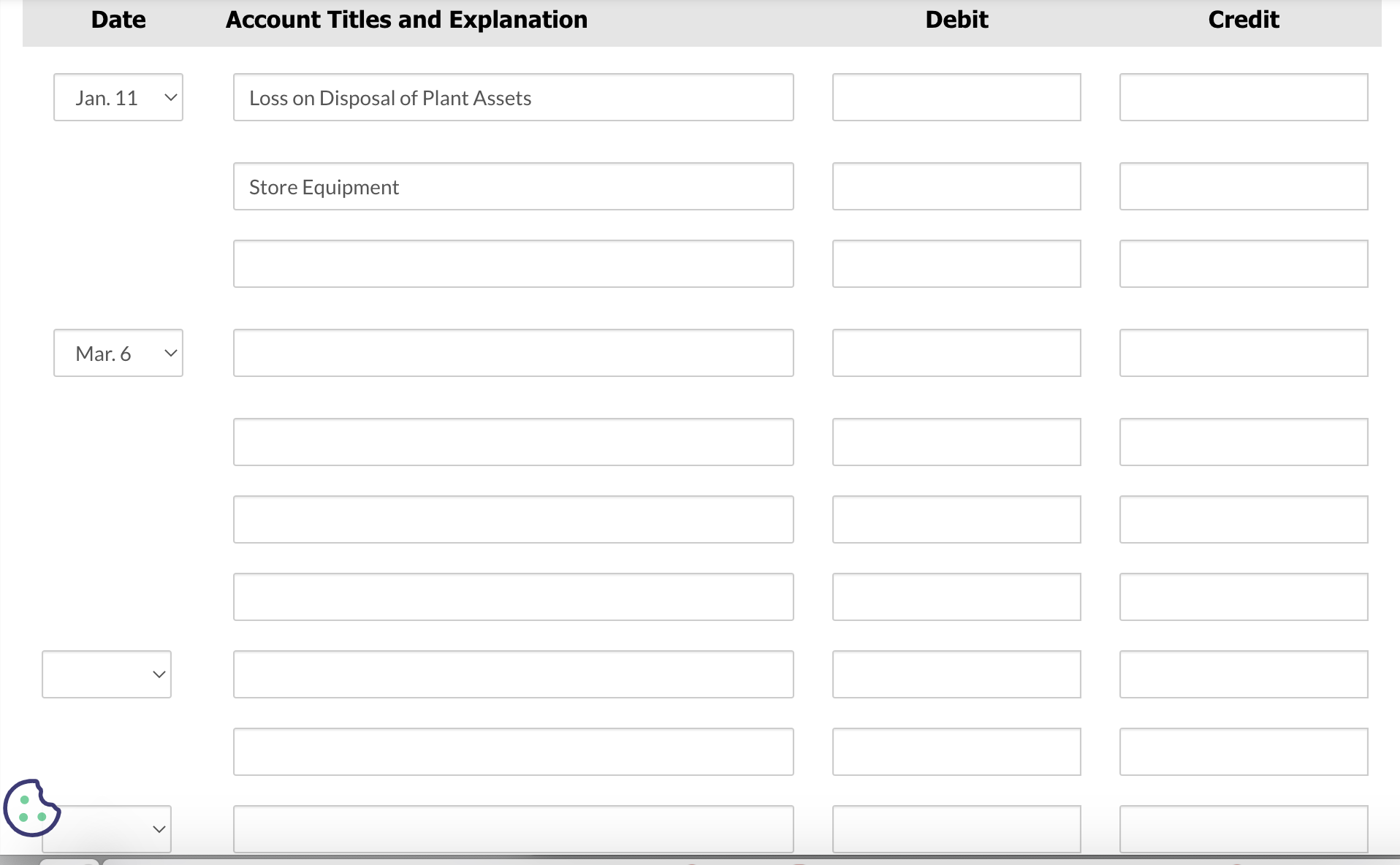

Prepare the necessary journal entries to record the following transactions in 2014 for the Teal Mountain. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Jan. Discarded old store equipment that originally cost $25,500 and had a book value of $5,304 on the date of disposal. 11 Depreciation on the equipment has already been recorded for the current year. Mar. 6 Sold a delivery truck for $8,568. The delivery truck originally cost $54,060 and had accumulated depreciation of $46,920 on the date of sale. The depreciation on the truck has already been recorded for the current year. Mar. Straight-line depreciation is recorded for the first quarter of 2014 on equipment with a 4-year useful life that was 31 purchased on January 1 , 2012, for $27,948 with an estimated salvage value of $3,468. May. Incurred and paid for $571,200 of costs to develop a new patent. The patent has a legal life of 20 years. 10 Sept. Paid the corporate attorney $66,000 to register the new patent (see May 10 ). 30 Nov. 1 Acquired RT Waterway, a small parts company, for $316,200 cash. RT Waterway had net assets totaling $897,600, net liabilities totaling $663,000. Dec. Recognized amortization for the last quarter of 2014. 31 Date Account Titles and Explanation Debit Credit Loss on Disposal of Plant Assets Store Equipment Mar. 6

Prepare the necessary journal entries to record the following transactions in 2014 for the Teal Mountain. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Jan. Discarded old store equipment that originally cost $25,500 and had a book value of $5,304 on the date of disposal. 11 Depreciation on the equipment has already been recorded for the current year. Mar. 6 Sold a delivery truck for $8,568. The delivery truck originally cost $54,060 and had accumulated depreciation of $46,920 on the date of sale. The depreciation on the truck has already been recorded for the current year. Mar. Straight-line depreciation is recorded for the first quarter of 2014 on equipment with a 4-year useful life that was 31 purchased on January 1 , 2012, for $27,948 with an estimated salvage value of $3,468. May. Incurred and paid for $571,200 of costs to develop a new patent. The patent has a legal life of 20 years. 10 Sept. Paid the corporate attorney $66,000 to register the new patent (see May 10 ). 30 Nov. 1 Acquired RT Waterway, a small parts company, for $316,200 cash. RT Waterway had net assets totaling $897,600, net liabilities totaling $663,000. Dec. Recognized amortization for the last quarter of 2014. 31 Date Account Titles and Explanation Debit Credit Loss on Disposal of Plant Assets Store Equipment Mar. 6 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started