Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare the opening journal entries and journalize each transaction in the general journal referring to the following chart of accounts in selecting the accounts to

Prepare the opening journal entries and journalize each transaction in the general journal referring to the following chart of accounts in selecting the accounts to be debited and credited and include a narration for each transaction: Post the journal entries to their respective ledger accounts Prepare a trial balance based on the balances derived after completing requirement # The company presented the following adjustments and required you to preparing the adjusting entries in the general journal Narration required for each journal entry:i Insurance for the period January to December were expired during the year.i Supplies on hand on December $ ii Unpaid salary on December $iv Rent not expired on December $v Unearned fees on December $ Post the adjusting entries to their respective ledger accounts already started in requirement # Do Not create new accounts, simply update the accounts used for requirement # with the adjusting entries Prepare the adjusted trial balance Prepare all three financial statements for presentation to Miss Smart Journalize the closing entries and balance off the ledger accounts including the income summary account

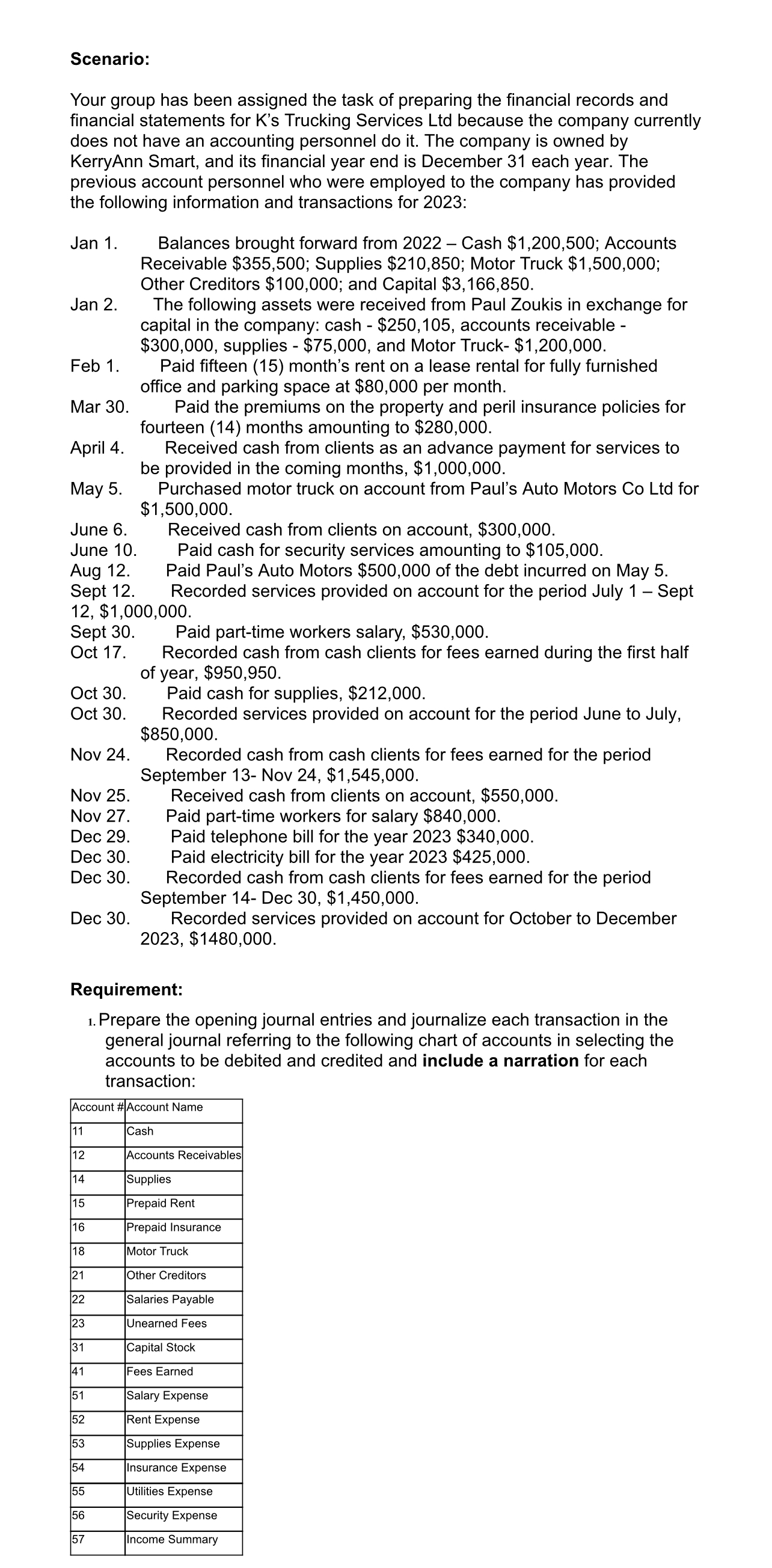

Scenario:

Your group has been assigned the task of preparing the financial records and

financial statements for Ks Trucking Services Ltd because the company currently

does not have an accounting personnel do it The company is owned by

KerryAnn Smart, and its financial year end is December each year. The

previous account personnel who were employed to the company has provided

the following information and transactions for :

Jan Balances brought forward from Cash $; Accounts

Receivable $; Supplies $; Motor Truck $;

Other Creditors $; and Capital $

Jan The following assets were received from Paul Zoukis in exchange for

capital in the company: cash $ accounts receivable

$ supplies $ and Motor Truck $

Feb Paid fifteen month's rent on a lease rental for fully furnished

office and parking space at $ per month.

Mar Paid the premiums on the property and peril insurance policies for

fourteen months amounting to $

April Received cash from clients as an advance payment for services to

be provided in the coming months, $

May Purchased motor truck on account from Paul's Auto Motors Co Ltd for

$

June Received cash from clients on account, $

June Paid cash for security services amounting to $

Aug Paid Paul's Auto Motors $ of the debt incurred on May

Sept Recorded services provided on account for the period July Sept

$

Sept Paid parttime workers salary, $

Oct Recorded cash from cash clients for fees earned during the first half

of year, $

Oct Paid cash for supplies, $

Oct Recorded services provided on account for the period June to July,

$

Nov Recorded cash from cash clients for fees earned for the period

September Nov $

Nov Received cash from clients on account, $

Nov Paid parttime workers for salary $

Dec Paid telephone bill for the year $

Dec Paid electricity bill for the year $

Dec Recorded cash from cash clients for fees earned for the period

September Dec $

Dec Recorded services provided on account for October to December

$

Requirement:

Prepare the opening journal entries and journalize each transaction in the

general journal referring to the following chart of accounts in selecting the

accounts to be debited and credited and include a narration for each

transaction: Prepare the postclosing trial balance.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started