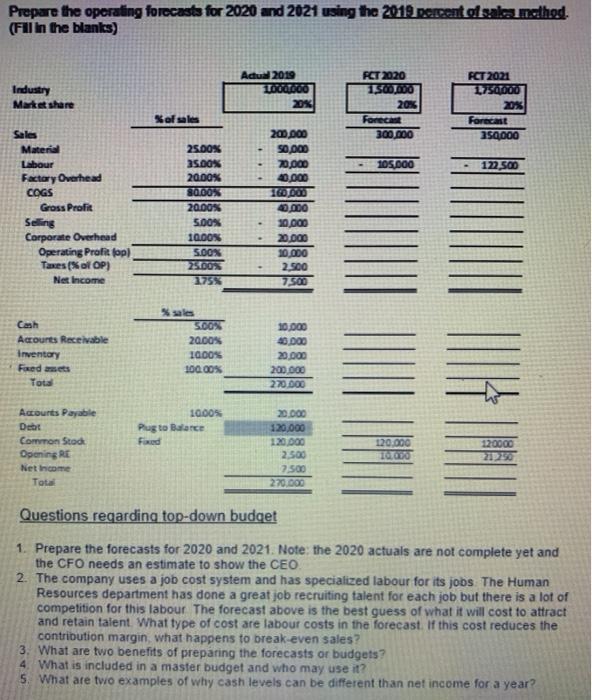

Prepare the operating forecast for 2020 and 2021 using the 2019 percent of sales method. (Fill in the blanks) Actu 2019 Toooo Industry Market share FCT 2020 1.500.000 20% Foreca 300.000 FCT 2021 1750000 20% Forecast 250000 Sof sales 105.000 122.500 Sales Material Labour Factory Overhead COGS Gross Profit Seling Corporate Overhead Operating Profit fop) Taxes (of OP) Net Income 25.00% 25.OON 20.00% SODOX 20.00% 5.00% 10.00% SOOX 2500X 200 DOO 50,000 70,000 40.000 TO DOO 40.000 30,000 20.000 10.000 2.500 Cash Accounts Receivable Inventory Fored mets Total SOON 20.00 1000% 100.00% 10.000 40.000 20.000 200.000 270.000 1000S Plug to Balance Foxed Accounts Payable Dett Common Stock Opening RE Net Income Tot 20.000 120.000 120.000 2.500 7.500 270.000 120.000 TOTO 120000 21250 Questions regarding top-down budget 1. Prepare the forecasts for 2020 and 2021. Note: the 2020 actuals are not complete yet and the CFO needs an estimate to show the CEO 2. The company uses a job cost system and has specialized labour for its jobs The Human Resources department has done a great job recruiting talent for each job but there is a lot of competition for this labour. The forecast above is the best guess of what it will cost to attract and retain talent What type of cost are labour costs in the forecast. If this cost reduces the contribution margin, what happens to break-even sales? 3. What are two benefits of preparing the forecasts or budgets? 4 What is included in a master budget and who may use it? 5. What are two examples of why cash levels can be different than net income for a year? Prepare the operating forecast for 2020 and 2021 using the 2019 percent of sales method. (Fill in the blanks) Actu 2019 Toooo Industry Market share FCT 2020 1.500.000 20% Foreca 300.000 FCT 2021 1750000 20% Forecast 250000 Sof sales 105.000 122.500 Sales Material Labour Factory Overhead COGS Gross Profit Seling Corporate Overhead Operating Profit fop) Taxes (of OP) Net Income 25.00% 25.OON 20.00% SODOX 20.00% 5.00% 10.00% SOOX 2500X 200 DOO 50,000 70,000 40.000 TO DOO 40.000 30,000 20.000 10.000 2.500 Cash Accounts Receivable Inventory Fored mets Total SOON 20.00 1000% 100.00% 10.000 40.000 20.000 200.000 270.000 1000S Plug to Balance Foxed Accounts Payable Dett Common Stock Opening RE Net Income Tot 20.000 120.000 120.000 2.500 7.500 270.000 120.000 TOTO 120000 21250 Questions regarding top-down budget 1. Prepare the forecasts for 2020 and 2021. Note: the 2020 actuals are not complete yet and the CFO needs an estimate to show the CEO 2. The company uses a job cost system and has specialized labour for its jobs The Human Resources department has done a great job recruiting talent for each job but there is a lot of competition for this labour. The forecast above is the best guess of what it will cost to attract and retain talent What type of cost are labour costs in the forecast. If this cost reduces the contribution margin, what happens to break-even sales? 3. What are two benefits of preparing the forecasts or budgets? 4 What is included in a master budget and who may use it? 5. What are two examples of why cash levels can be different than net income for a year