Answered step by step

Verified Expert Solution

Question

1 Approved Answer

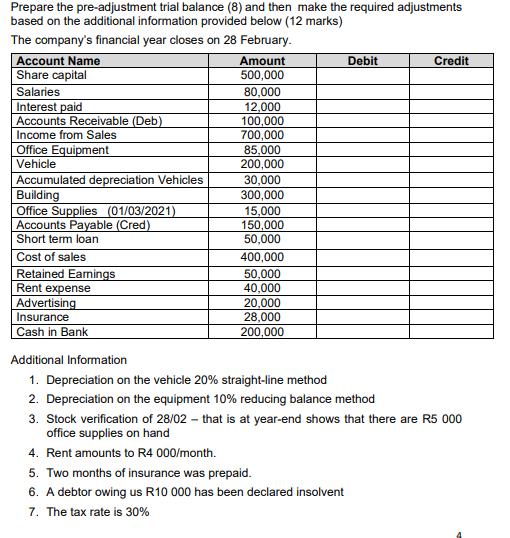

Prepare the pre-adjustment trial balance (8) and then make the required adjustments based on the additional information provided below (12 marks) The company's financial

Prepare the pre-adjustment trial balance (8) and then make the required adjustments based on the additional information provided below (12 marks) The company's financial year closes on 28 February. Account Name Share capital Salaries Interest paid Accounts Receivable (Deb) Income from Sales Office Equipment Vehicle Accumulated depreciation Vehicles Building Office Supplies (01/03/2021) Accounts Payable (Cred) Short term loan Cost of sales Retained Earnings Rent expense Advertising Insurance Cash in Bank Amount 500,000 80,000 12,000 100,000 700,000 85,000 200,000 30,000 300,000 15,000 150,000 50,000 400,000 50,000 40,000 20,000 28,000 200,000 Debit 5. Two months of insurance was prepaid. 6. A debtor owing us R10 000 has been declared insolvent 7. The tax rate is 30% Credit Additional Information 1. Depreciation on the vehicle 20% straight-line method 2. Depreciation on the equipment 10% reducing balance method 3. Stock verification of 28/02- that is at year-end shows that there are R5 000 office supplies on hand 4. Rent amounts to R4 000/month.

Step by Step Solution

★★★★★

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

PreAdjustment Trial Balance Sr No Particulars Amoun...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started