Prepare the relevant journal entries for the year ended 31 December 2021 for each question.

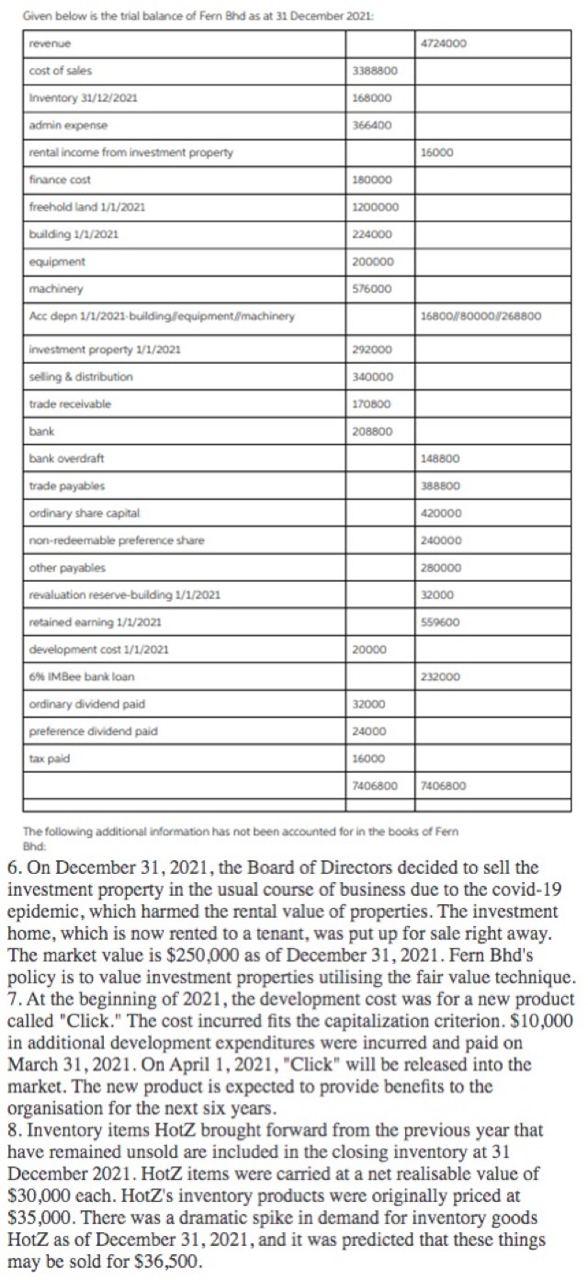

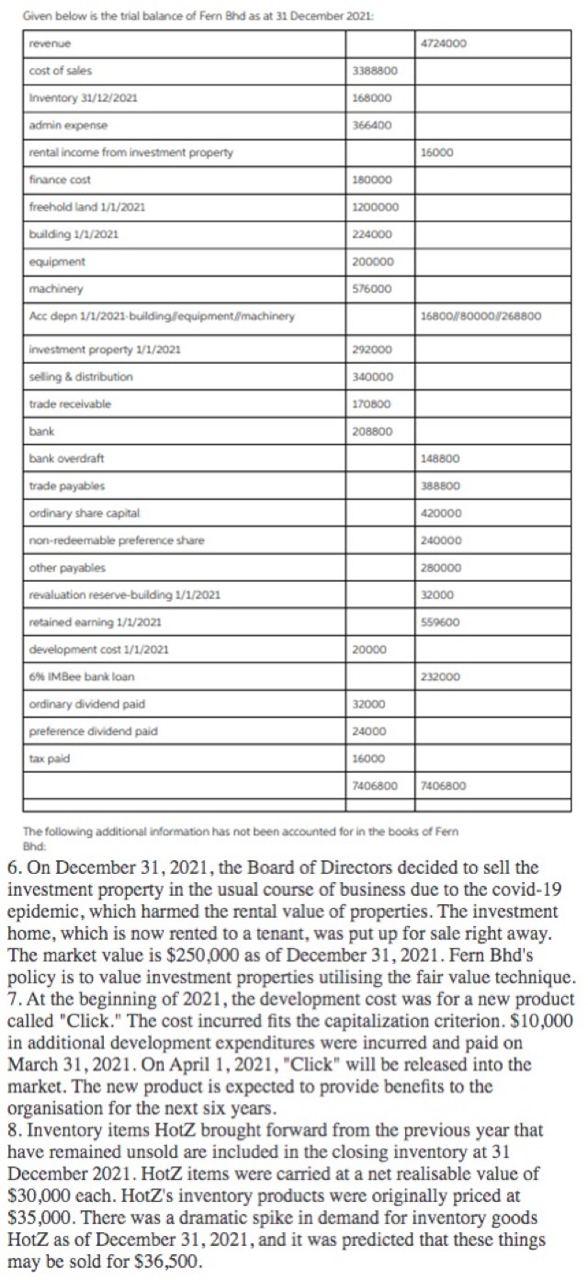

Given below is the trial balance of Fern Bhd as at 31 December 2021 revenue 4724000 cost of sales 3388800 Inventory 31/12/2021 168000 admin expense 366400 rental income from investment property 16000 finance cost 180000 freehold land 1/1/2021 1200000 building 1/1/2021 224000 equipment 200000 machinery 576000 Ace depn 1/1/2021 building equipment machinery 15800/800001268800 investment property 1/1/2021 292000 seling & distribution 340000 trade receivable 370800 bank 208800 bank overdraft 148800 trade payables 38.8800 ordinary share capital 420000 non-redeemable preference share 240000 other payables 280000 32000 revaluation reserve-building 1/1/2021 retained earning 1/1/2021 559600 development cost 1/1/2021 20000 6% IMBee bank loan 232000 ordinary dividend paid 32000 preference dividend paid 24000 tax paid 16000 7406800 7406800 The following additional information has not been accounted for in the books of Fern Bhd 6. On December 31, 2021, the Board of Directors decided to sell the investment property in the usual course of business due to the covid-19 epidemic, which harmed the rental value of properties. The investment home, which is now rented to a tenant, was put up for sale right away. The market value is $250,000 as of December 31, 2021. Fern Bhd's policy is to value investment properties utilising the fair value technique. 7. At the beginning of 2021, the development cost was for a new product called "Click." The cost incurred fits the capitalization criterion. $10,000 in additional development expenditures were incurred and paid on March 31, 2021. On April 1, 2021, "Click" will be released into the market. The new product is expected to provide benefits to the organisation for the next six years. 8. Inventory items HotZ brought forward from the previous year that have remained unsold are included in the closing inventory at 31 December 2021. HotZ items were carried at a net realisable value of $30,000 each. HotZ's inventory products were originally priced at $35,000. There was a dramatic spike in demand for inventory goods HotZ as of December 31, 2021, and it was predicted that these things may be sold for $36,500. Given below is the trial balance of Fern Bhd as at 31 December 2021 revenue 4724000 cost of sales 3388800 Inventory 31/12/2021 168000 admin expense 366400 rental income from investment property 16000 finance cost 180000 freehold land 1/1/2021 1200000 building 1/1/2021 224000 equipment 200000 machinery 576000 Ace depn 1/1/2021 building equipment machinery 15800/800001268800 investment property 1/1/2021 292000 seling & distribution 340000 trade receivable 370800 bank 208800 bank overdraft 148800 trade payables 38.8800 ordinary share capital 420000 non-redeemable preference share 240000 other payables 280000 32000 revaluation reserve-building 1/1/2021 retained earning 1/1/2021 559600 development cost 1/1/2021 20000 6% IMBee bank loan 232000 ordinary dividend paid 32000 preference dividend paid 24000 tax paid 16000 7406800 7406800 The following additional information has not been accounted for in the books of Fern Bhd 6. On December 31, 2021, the Board of Directors decided to sell the investment property in the usual course of business due to the covid-19 epidemic, which harmed the rental value of properties. The investment home, which is now rented to a tenant, was put up for sale right away. The market value is $250,000 as of December 31, 2021. Fern Bhd's policy is to value investment properties utilising the fair value technique. 7. At the beginning of 2021, the development cost was for a new product called "Click." The cost incurred fits the capitalization criterion. $10,000 in additional development expenditures were incurred and paid on March 31, 2021. On April 1, 2021, "Click" will be released into the market. The new product is expected to provide benefits to the organisation for the next six years. 8. Inventory items HotZ brought forward from the previous year that have remained unsold are included in the closing inventory at 31 December 2021. HotZ items were carried at a net realisable value of $30,000 each. HotZ's inventory products were originally priced at $35,000. There was a dramatic spike in demand for inventory goods HotZ as of December 31, 2021, and it was predicted that these things may be sold for $36,500