Answered step by step

Verified Expert Solution

Question

1 Approved Answer

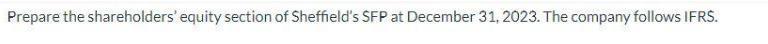

Prepare the shareholders' equity section of Sheffield's SFP at December 31, 2023. The company follows IFRS. Accounts payable Accounts receivable Post-Closing Trial Balance December

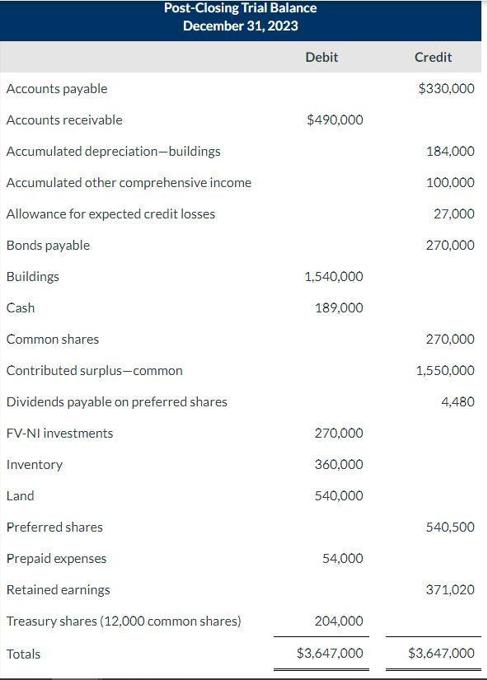

Prepare the shareholders' equity section of Sheffield's SFP at December 31, 2023. The company follows IFRS. Accounts payable Accounts receivable Post-Closing Trial Balance December 31, 2023 Accumulated depreciation-buildings Accumulated other comprehensive income Allowance for expected credit losses Bonds payable Buildings Cash Common shares Contributed surplus-common Dividends payable on preferred shares FV-NI investments Inventory Land Preferred shares Prepaid expenses Retained earnings Treasury shares (12,000 common shares) Totals Debit $490,000 1,540,000 189,000 270,000 360,000 540,000 54,000 204,000 $3,647,000 Credit $330,000 184,000 100,000 27,000 270,000 270,000 1,550,000 4,480 540,500 371,020 $3,647,000 At December 31, 2023, Sheffield had the following numbers for its common and preferred shares: Authorized Issued Outstanding Common Preferred 590,000 59,000 270,000 258,000 11,500 11,500 The dividends on preferred shares are $6 cumulative. In addition, the preferred shares have a preference in liquidation of $47 per share.

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the shareholders equity section of Sheffields Statement of Financial Position SFP at Dec...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started