Answered step by step

Verified Expert Solution

Question

1 Approved Answer

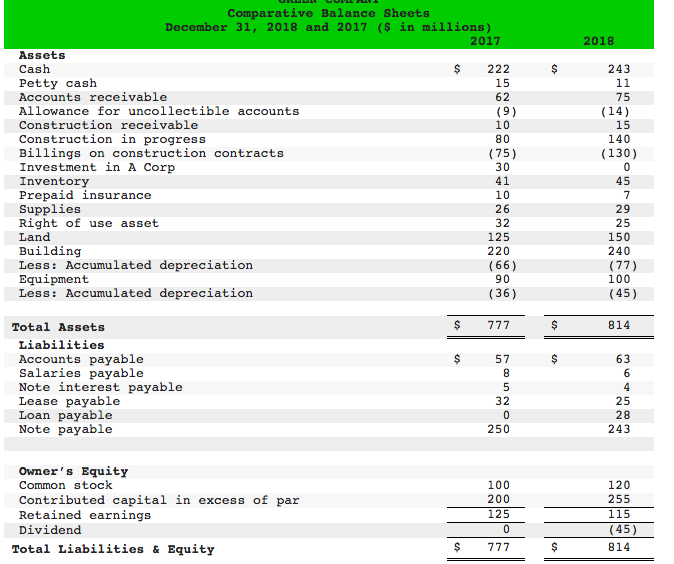

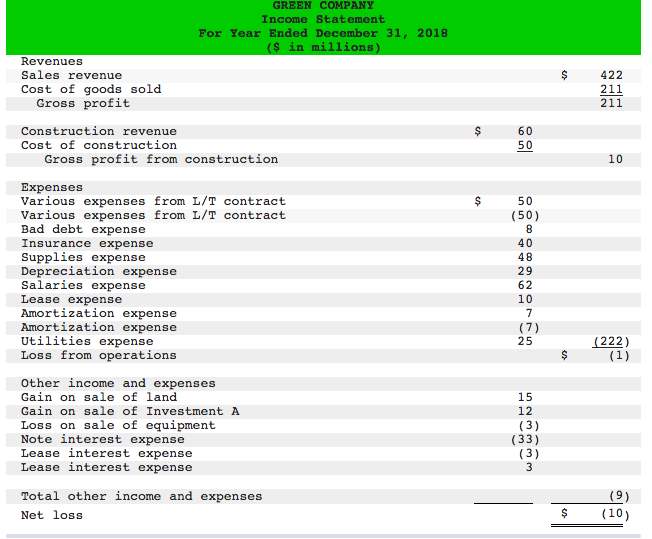

Prepare the statement of cash flows for Green Company using direct method. Comparative Balance Sheets December 31, 2018 and 2017 ($ in millions) 2017 2018

Prepare the statement of cash flows for Green Company using direct method.

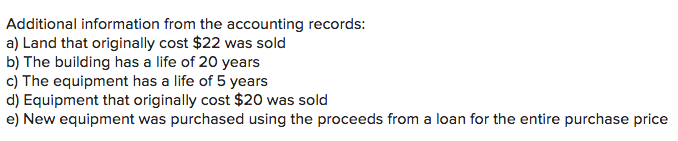

Comparative Balance Sheets December 31, 2018 and 2017 ($ in millions) 2017 2018 $ 222 243 11 62 75 (9) (14) 15 (75) 140 (130) Assets Cash Petty cash Accounts receivable Allowance for uncollectible accounts Construction receivable Construction in progress Billings on construction contracts Investment in A Corp Inventory Prepaid insurance Supplies Right of use asset Land Building Less: Accumulated depreciation Equipment Less: Accumulated depreciation 45 7 26 29 32 125 220 (66) 90 (36) 150 240 (77) 100 (45) $ 777 $ 814 Total Assets Liabilities Accounts payable Salaries payable Note interest payable Lease payable Loan payable Note payable 243 Owner's Equity Common stock Contributed capital in excess of par Retained earnings Dividend Total Liabilities & Equity 100 200 125 120 255 115 (45) 814 $ 777 GREEN COMPANY Income Statement For Year Ended December 31, 2018 ($ in millions) 422 Revenues Sales revenue Cost of goods sold Gross profit $ Construction revenue Cost of construction Gross profit from construction 60 50 10 50 (50) 40 Expenses Various expenses from L/T contract Various expenses from L/T contract Bad debt expense Insurance expense Supplies expense Depreciation expense Salaries expense Lease expense Amortization expense Amortization expense Utilities expense Loss from operations $ (222) (1) Other income and expenses Gain on sale of land Gain on sale of Investment A Loss on sale of equipment Note interest expense Lease interest expense Lease interest expense WWW Total other income and expenses Net loss $ (10) Additional information from the accounting records: a) Land that originally cost $22 was sold b) The building has a life of 20 years c) The equipment has a life of 5 years d) Equipment that originally cost $20 was sold e) New equipment was purchased using the proceeds from a loan for the entire purchase price Comparative Balance Sheets December 31, 2018 and 2017 ($ in millions) 2017 2018 $ 222 243 11 62 75 (9) (14) 15 (75) 140 (130) Assets Cash Petty cash Accounts receivable Allowance for uncollectible accounts Construction receivable Construction in progress Billings on construction contracts Investment in A Corp Inventory Prepaid insurance Supplies Right of use asset Land Building Less: Accumulated depreciation Equipment Less: Accumulated depreciation 45 7 26 29 32 125 220 (66) 90 (36) 150 240 (77) 100 (45) $ 777 $ 814 Total Assets Liabilities Accounts payable Salaries payable Note interest payable Lease payable Loan payable Note payable 243 Owner's Equity Common stock Contributed capital in excess of par Retained earnings Dividend Total Liabilities & Equity 100 200 125 120 255 115 (45) 814 $ 777 GREEN COMPANY Income Statement For Year Ended December 31, 2018 ($ in millions) 422 Revenues Sales revenue Cost of goods sold Gross profit $ Construction revenue Cost of construction Gross profit from construction 60 50 10 50 (50) 40 Expenses Various expenses from L/T contract Various expenses from L/T contract Bad debt expense Insurance expense Supplies expense Depreciation expense Salaries expense Lease expense Amortization expense Amortization expense Utilities expense Loss from operations $ (222) (1) Other income and expenses Gain on sale of land Gain on sale of Investment A Loss on sale of equipment Note interest expense Lease interest expense Lease interest expense WWW Total other income and expenses Net loss $ (10) Additional information from the accounting records: a) Land that originally cost $22 was sold b) The building has a life of 20 years c) The equipment has a life of 5 years d) Equipment that originally cost $20 was sold e) New equipment was purchased using the proceeds from a loan for the entire purchase priceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started