Prepare the Statement of Profit or Loss and Other Comprehensive Income of Crispy (Pty) Ltd for the financial year ended 30 June 2023 in accordance with International Financial Reporting Standards. Comparative figures are not required. Show all workings, and reference accordingly.

Prepare the Statement of Profit or Loss and Other Comprehensive Income of Crispy (Pty) Ltd for the financial year ended 30 June 2023 in accordance with International Financial Reporting Standards. Comparative figures are not required. Show all workings, and reference accordingly.

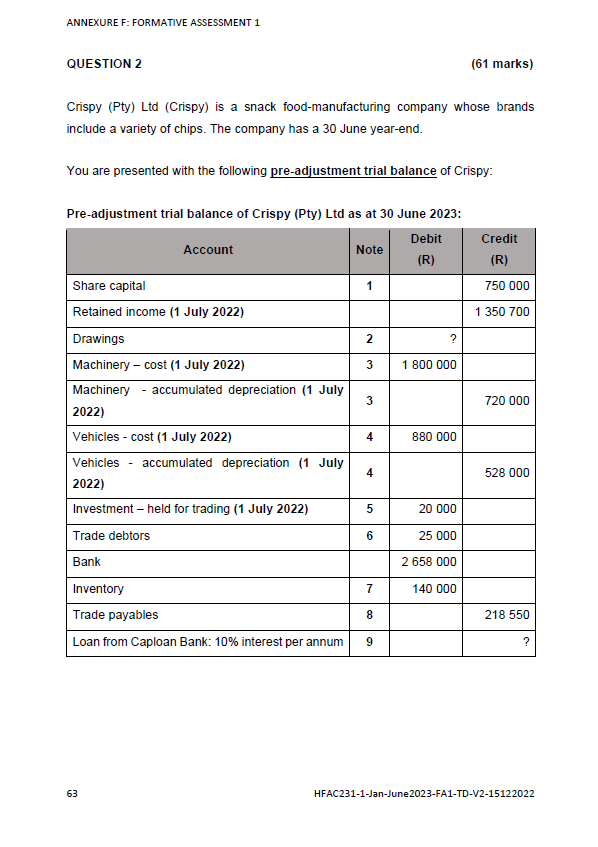

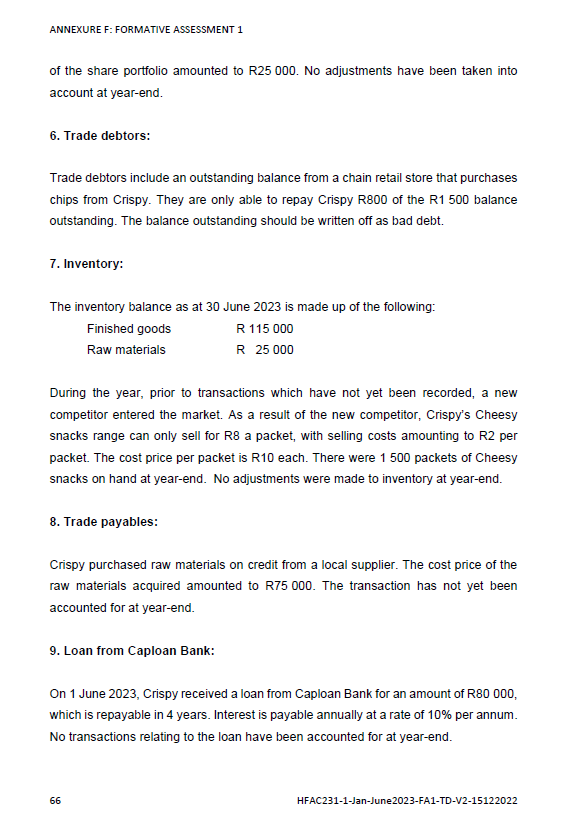

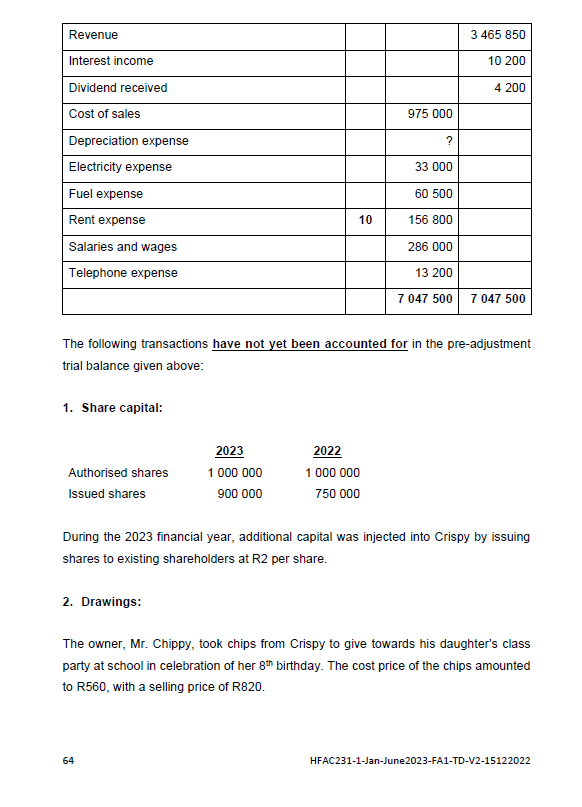

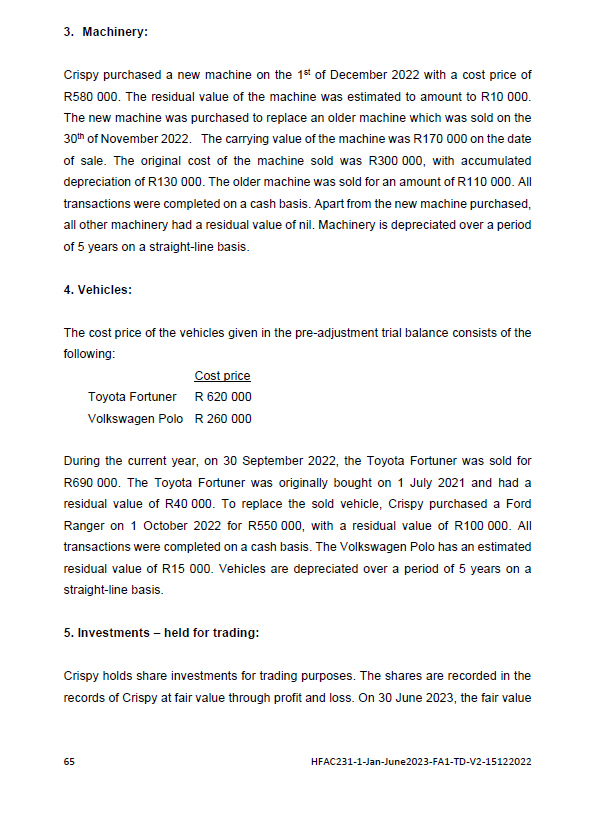

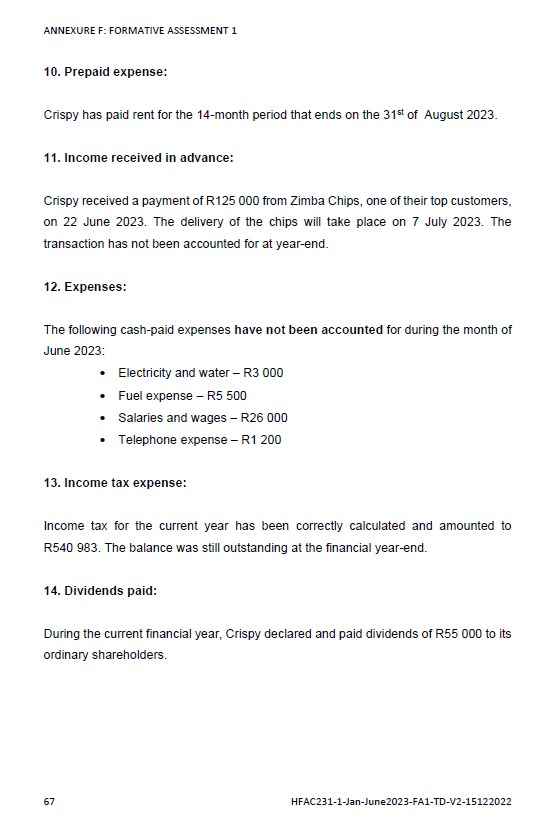

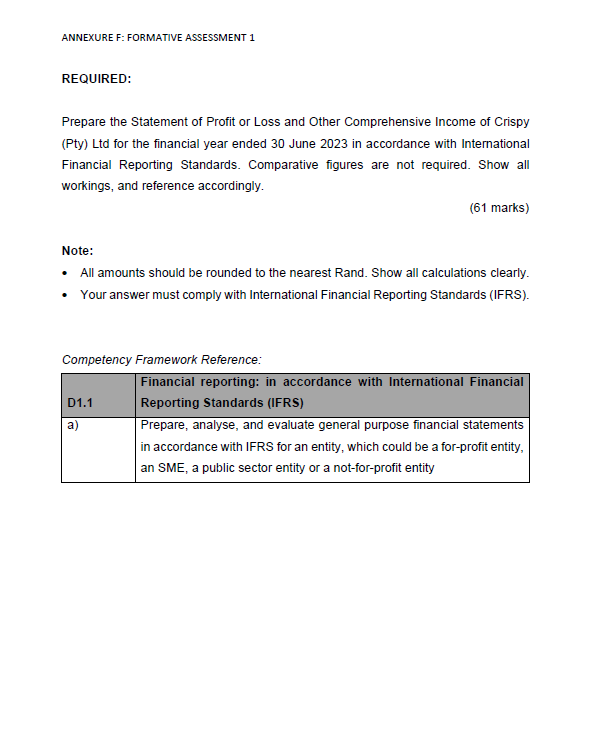

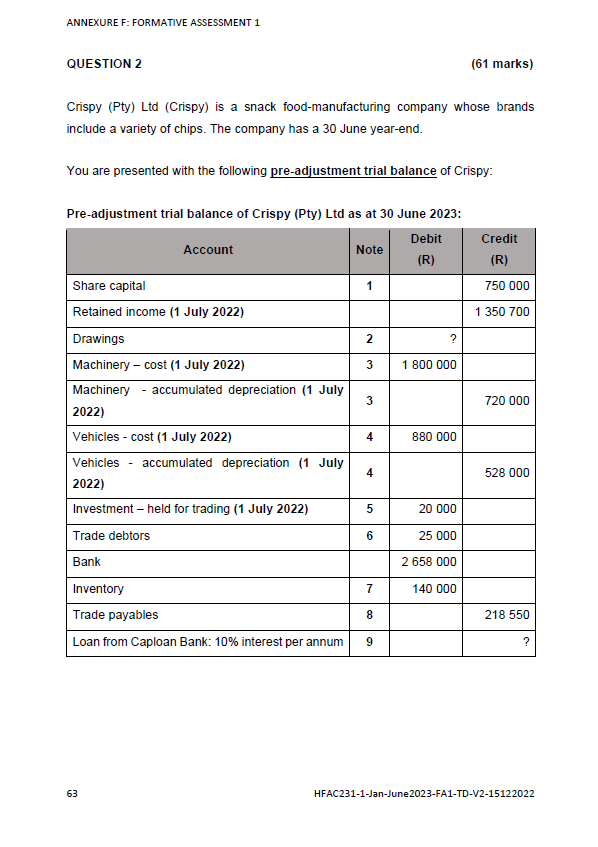

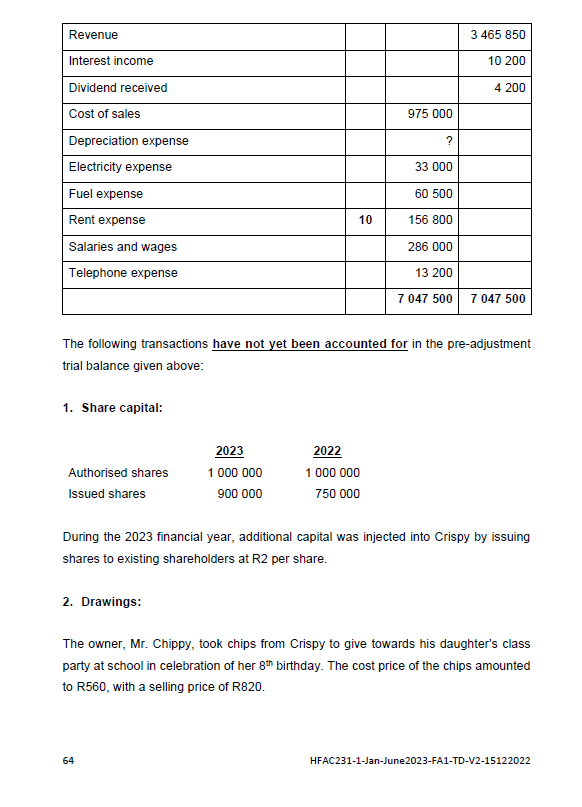

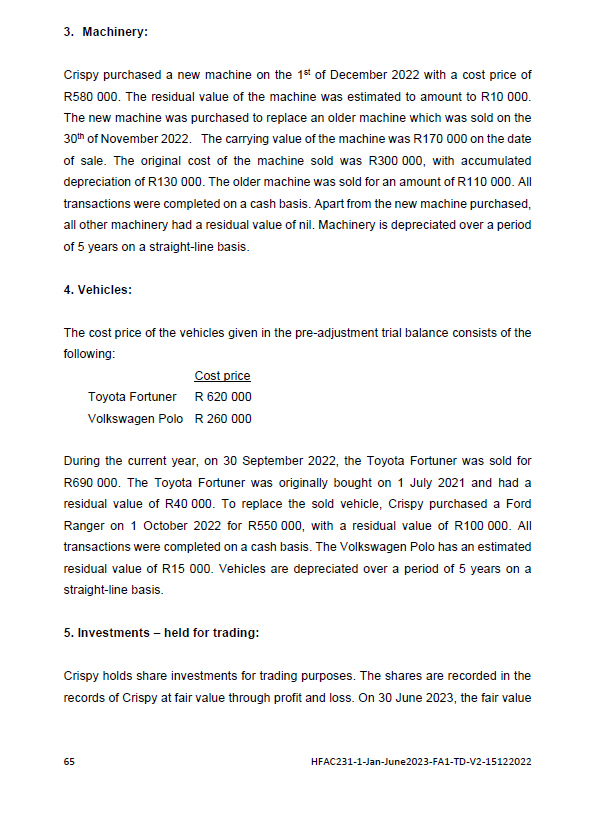

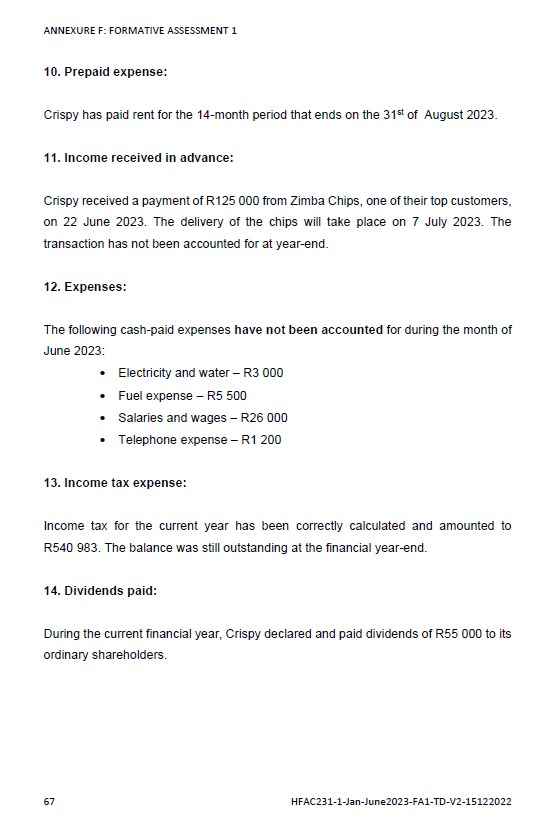

QUESTION 2 (61 marks) Crispy (Pty) Ltd (Crispy) is a snack food-manufacturing company whose brands include a variety of chips. The company has a 30 June year-end. You are presented with the following pre-adjustment trial balance of Crispy: Pre-adjustment trial balance of Crispy (Pty) Ltd as at 30 June 2023: 63 HFAC231-1-Jan-June2023-FA1-TD-V2-15122022 ANNEXURE F: FORMATIVE ASSESSMENT 1 of the share portfolio amounted to R25 000. No adjustments have been taken into account at year-end. 6. Trade debtors: Trade debtors include an outstanding balance from a chain retail store that purchases chips from Crispy. They are only able to repay Crispy R 800 of the R1 500 balance outstanding. The balance outstanding should be written off as bad debt. 7. Inventory: The inventory balance as at 30 June 2023 is made up of the following: FinishedgoodsRawmaterialsR115000R25000 During the year, prior to transactions which have not yet been recorded, a new competitor entered the market. As a result of the new competitor, Crispy's Cheesy snacks range can only sell for R8 a packet, with selling costs amounting to R2 per packet. The cost price per packet is R10 each. There were 1500 packets of Cheesy snacks on hand at year-end. No adjustments were made to inventory at year-end. 8. Trade payables: Crispy purchased raw materials on credit from a local supplier. The cost price of the raw materials acquired amounted to R75 000. The transaction has not yet been accounted for at year-end. 9. Loan from Caploan Bank: On 1 June 2023, Crispy received a loan from Caploan Bank for an amount of R80 000, which is repayable in 4 years. Interest is payable annually at a rate of 10% per annum. No transactions relating to the loan have been accounted for at year-end. The following transactions have not yet been accounted for in the pre-adjustment trial balance given above: 1. Share capital: During the 2023 financial year, additional capital was injected into Crispy by issuing shares to existing shareholders at R2 per share. 2. Drawings: The owner, Mr. Chippy, took chips from Crispy to give towards his daughter's class party at school in celebration of her 8th birthday. The cost price of the chips amounted to R560, with a selling price of R820. 3. Machinery: Crispy purchased a new machine on the 1st of December 2022 with a cost price of R580000. The residual value of the machine was estimated to amount to R10 000 . The new machine was purchased to replace an older machine which was sold on the 30th of November 2022 . The carrying value of the machine was R170 000 on the date of sale. The original cost of the machine sold was R300 000, with accumulated depreciation of R130000. The older machine was sold for an amount of R110 000 . All transactions were completed on a cash basis. Apart from the new machine purchased, all other machinery had a residual value of nil. Machinery is depreciated over a period of 5 years on a straight-line basis. 4. Vehicles: The cost price of the vehicles given in the pre-adjustment trial balance consists of the following: During the current year, on 30 September 2022, the Toyota Fortuner was sold for R690 000. The Toyota Fortuner was originally bought on 1 July 2021 and had a residual value of R40 000. To replace the sold vehicle, Crispy purchased a Ford Ranger on 1 October 2022 for R550 000, with a residual value of R100 000 . All transactions were completed on a cash basis. The Volkswagen Polo has an estimated residual value of R15 000 . Vehicles are depreciated over a period of 5 years on a straight-line basis. 5. Investments - held for trading: Crispy holds share investments for trading purposes. The shares are recorded in the records of Crispy at fair value through profit and loss. On 30 June 2023, the fair value 10. Prepaid expense: Crispy has paid rent for the 14-month period that ends on the 31st of August 2023. 11. Income received in advance: Crispy received a payment of R125 000 from Zimba Chips, one of their top customers, on 22 June 2023. The delivery of the chips will take place on 7 July 2023. The transaction has not been accounted for at year-end. 12. Expenses: The following cash-paid expenses have not been accounted for during the month of June 2023: - Electricity and water - R3 000 - Fuel expense - R5 500 - Salaries and wages - R26 000 - Telephone expense - R1 200 13. Income tax expense: Income tax for the current year has been correctly calculated and amounted to R540 983. The balance was still outstanding at the financial year-end. 14. Dividends paid: During the current financial year, Crispy declared and paid dividends of R55 000 to its ordinary shareholders. Note: - All amounts should be rounded to the nearest Rand. Show all calculations clearly. - Your answer must comply with International Financial Reporting Standards (IFRS). Competencv Framework Reference

Prepare the Statement of Profit or Loss and Other Comprehensive Income of Crispy (Pty) Ltd for the financial year ended 30 June 2023 in accordance with International Financial Reporting Standards. Comparative figures are not required. Show all workings, and reference accordingly.

Prepare the Statement of Profit or Loss and Other Comprehensive Income of Crispy (Pty) Ltd for the financial year ended 30 June 2023 in accordance with International Financial Reporting Standards. Comparative figures are not required. Show all workings, and reference accordingly.