Answered step by step

Verified Expert Solution

Question

1 Approved Answer

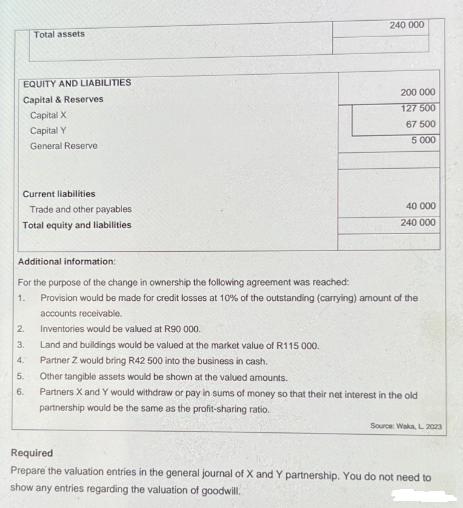

Prepare the valuation entries in the general journal and partnership. You do not need to show any entries regarding the valuation of goodwill. Total assets

Prepare the valuation entries in the general journal and partnership. You do not need to show any entries regarding the valuation of goodwill.

Total assets EQUITY AND LIABILITIES Capital & Reserves Capital X Capital Y General Reserve Current liabilities Trade and other payables Total equity and liabilities 2. 3. 4. 5. 6. 240 000 200 000 127 500 67 500 5 000 40 000 240 000 Additional information: For the purpose of the change in ownership the following agreement was reached: 1. Provision would be made for credit losses at 10% of the outstanding (carrying) amount of the accounts receivable. Inventories would be valued at R90 000. Land and buildings would be valued at the market value of R115 000. Partner Z would bring R42 500 into the business in cash. Other tangible assets would be shown at the valued amounts. Partners X and Y would withdraw or pay in sums of money so that their net interest in the old partnership would be the same as the profit-sharing ratio. Source: Waka, L. 2023 Required Prepare the valuation entries in the general journal of X and Y partnership. You do not need to show any entries regarding the valuation of goodwill.

Step by Step Solution

★★★★★

3.50 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION Based on the information provided here are the valuation entries that would be recorded in the general journal of X and Y Partnership 1 Provi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started