Prepare various adjusting entries:

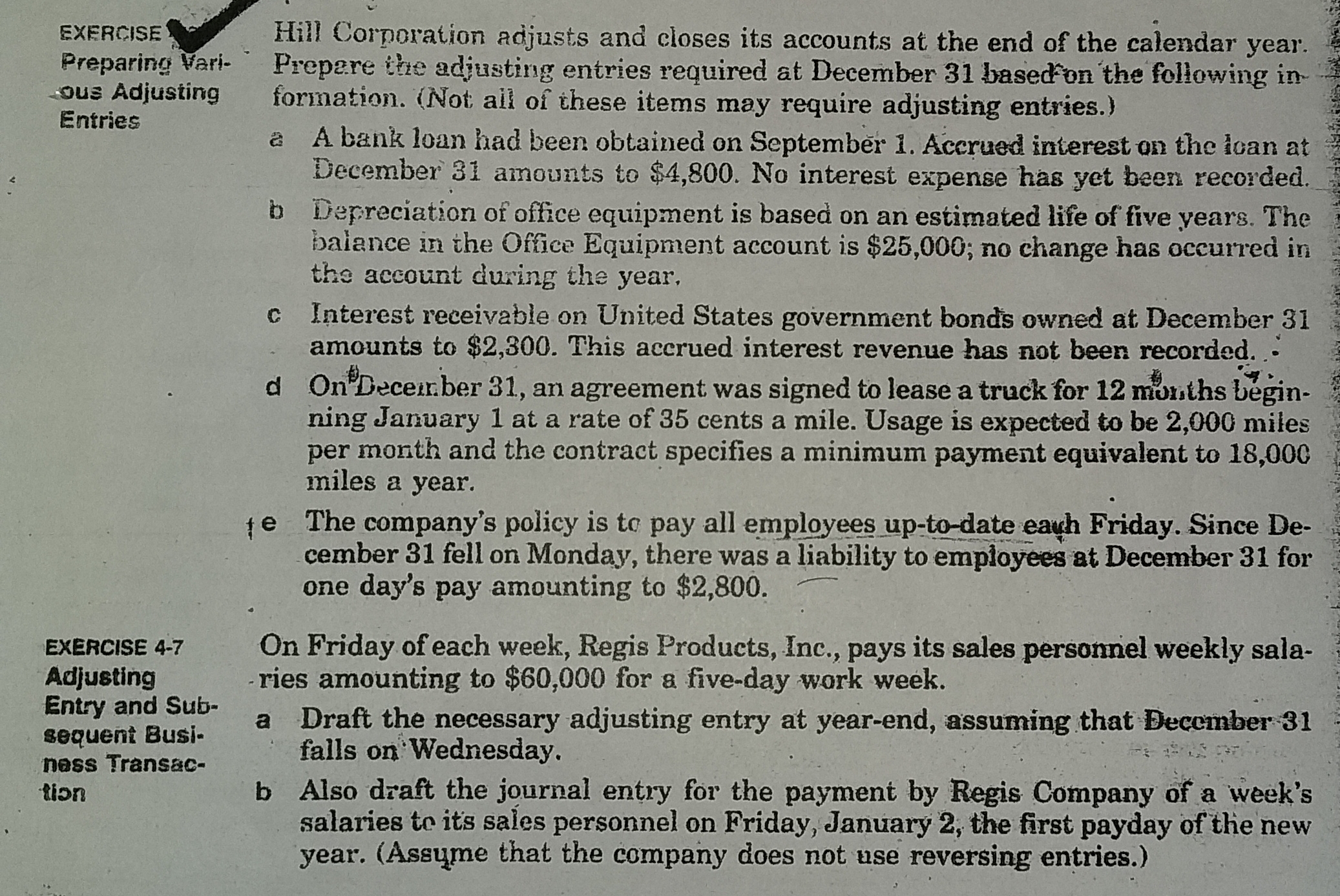

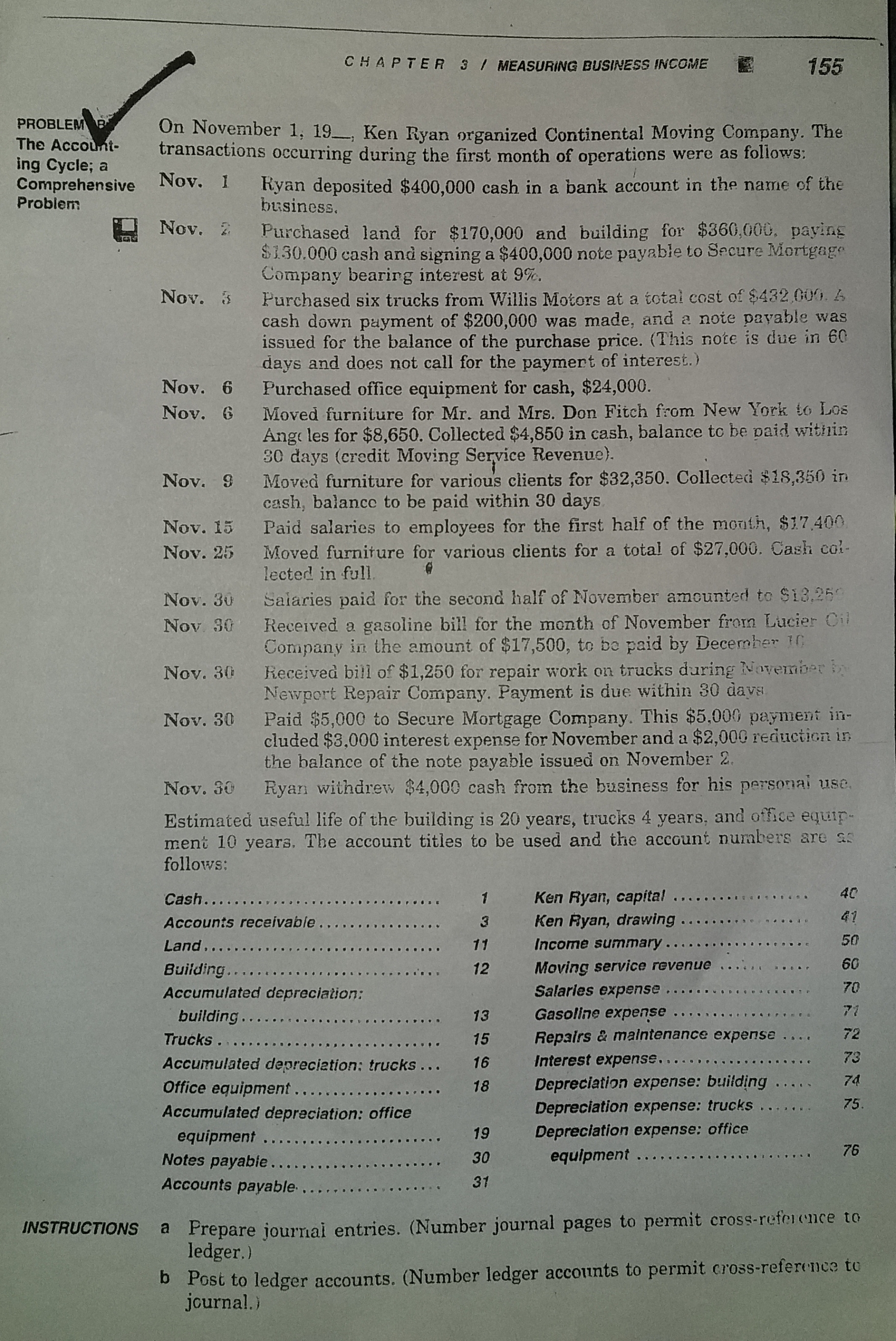

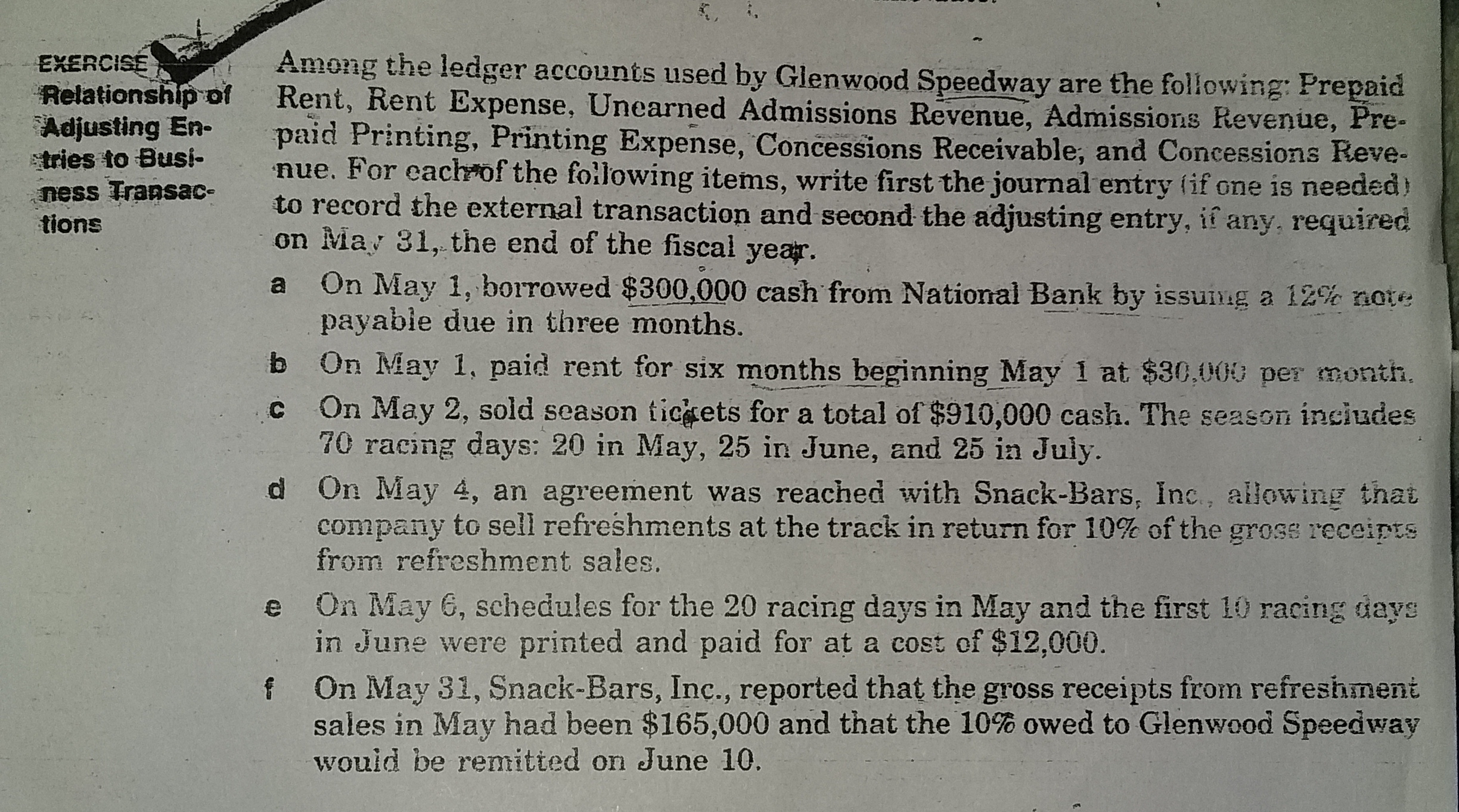

EXERCISE Preparing Vari- Hill Corporation adjusts and closes its accounts at the end of the calendar year. ous Adjusting Prepare the adjusting entries required at December 31 based on the following in Entries formation. (Not all of these items may require adjusting entries.) a A bank loan had been obtained on September 1. Accrued interest on the loan at December 31 amounts to $4,800. No interest expense has yet been recorded. b Depreciation of office equipment is based on an estimated life of five years. The balance in the Office Equipment account is $25,000; no change has occurred in the account during the year, c Interest receivable on United States government bonds owned at December 31 amounts to $2,300. This accrued interest revenue has not been recorded. .- d On December 31, an agreement was signed to lease a truck for 12 months begin- ning January 1 at a rate of 35 cents a mile. Usage is expected to be 2,000 miles per month and the contract specifies a minimum payment equivalent to 18,000 miles a year. e The company's policy is to pay all employees up-to-date each Friday. Since De- cember 31 fell on Monday, there was a liability to employees at December 31 for one day's pay amounting to $2,800.- EXERCISE 4-7 On Friday of each week, Regis Products, Inc., pays its sales personnel weekly sala- Adjusting ries amounting to $60,000 for a five-day work week. Entry and Sub- sequent Busi- a Draft the necessary adjusting entry at year-end, assuming that December 31 ness Transac- falls on Wednesday. tion b Also draft the journal entry for the payment by Regis Company of a week's salaries to its sales personnel on Friday, January 2, the first payday of the new year. (Assume that the company does not use reversing entries.)CHAPTER 3 / MEASURING BUSINESS INCOME E 155 PROBLEM The Account- On November 1, 19_, Ken Ryan organized Continental Moving Company. The ing Cycle; a transactions occurring during the first month of operations were as follows: Comprehensive Nov. I Problem Ryan deposited $400,000 cash in a bank account in the name of the business. Nov. Z Purchased land for $170,000 and building for $360,000, paying $130.000 cash and signing a $400,000 note payable to Secure Mortgage Nov. 3 Company bearing interest at 9%. Purchased six trucks from Willis Motors at a total cost of $432,609. A cash down payment of $200,000 was made, and a note payable was issued for the balance of the purchase price. (This note is due in 60 days and does not call for the payment of interest.) Nov. 6 Purchased office equipment for cash, $24,000. Nov. 6 Moved furniture for Mr. and Mrs. Don Fitch from New York to Los Angeles for $8,650. Collected $4,850 in cash, balance to be paid within 30 days (credit Moving Service Revenue). Nov. 9 Moved furniture for various clients for $32,350. Collected $18,350 in cash, balance to be paid within 30 days Nov. 15 Paid salaries to employees for the first half of the mouth, $17.400 Nov. 25 Moved furniture for various clients for a total of $27,000. Cash col- lected in full. Nov. 30 Salaries paid for the second half of November amounted to $18,250 Nov. 30 Received a gasoline bill for the month of November from Lucier Cil Company in the amount of $17,500, to be paid by December 10 Nov. 30 Received bill of $1,250 for repair work on trucks during November by Newport Repair Company. Payment is due within 30 days Nov. 30 Paid $5,000 to Secure Mortgage Company. This $5,000 payment in- cluded $3,000 interest expense for November and a $2,000 reduction in the balance of the note payable issued on November 2. Nov. 30 Ryan withdrew $4,000 cash from the business for his personal use, Estimated useful life of the building is 20 years, trucks 4 years, and office equip. ment 10 years. The account titles to be used and the account numbers are as follows: Cash. .. .. . . .. Ken Ryan, capital . . . . . . . . . . . .... 40 Accounts receivable . .. 3 Ken Ryan, drawing ..... . . . ... . . . . . 41 Land . . . .. . . . . . . . . . .. 11 Income summary . ... . . . . ........ .. 50 Building .... . . ... .i... 12 Moving service revenue ....... .... 60 Accumulated depreciation: Salaries expense . 70 building . ... . . . . . . . . . .. 13 Gasoline expense .... 71 Trucks .. . . . . ..... 15 Repairs & maintenance expense . ... 72 Accumulated depreciation: trucks ... 16 Interest expense. ... . . . . . . .. 73 Office equipment ..... . . . . . . . . . . ... 18 Depreciation expense: building . .... 74 Accumulated depreciation: office Depreciation expense: trucks ....... 75 equipment . ..... . . . . . .... 19 Depreciation expense: office Notes payable . ..... 30 equipment .... . . . . . . . . . . . 76 Accounts payable . .... . .. .... 31 INSTRUCTIONS a Prepare journal entries. (Number journal pages to permit cross-reference to ledger.) b Post to ledger accounts. (Number ledger accounts to permit cross-reference to journal.)EXERCISE Relationship of Among the ledger accounts used by Glenwood Speedway are the following: Prepaid `Adjusting En- Rent, Rent Expense, Unearned Admissions Revenue, Admissions Revenue, Pre- tries to Busi- paid Printing, Printing Expense, Concessions Receivable, and Concessions Reve- ness Transac- nue. For each of the following items, write first the journal entry (if one is needed) tions to record the external transaction and second the adjusting entry, if any, required on May 31, the end of the fiscal year. a On May 1, borrowed $300,000 cash from National Bank by issuing a 12 note payable due in three months. b On May 1, paid rent for six months beginning May 1 at $30,000 per month. c On May 2, sold season tickets for a total of $910,000 cash. The season includes 70 racing days: 20 in May, 25 in June, and 25 in July. d On May 4, an agreement was reached with Snack-Bars, Inc., allowing that company to sell refreshments at the track in return for 10% of the gross receipts from refreshment sales. e On May 6, schedules for the 20 racing days in May and the first 10 racing days in June were printed and paid for at a cost of $12,000. f On May 31, Snack-Bars, Inc., reported that the gross receipts from refreshment sales in May had been $165,000 and that the 10% owed to Glenwood Speedway would be remitted on June 10