Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare vertical and horizontal analysis on the income statement and balance sheet and comment on positive or negative trends for this analysis. Complete vertical anlaysis

Prepare vertical and horizontal analysis on the income statement and balance sheet and comment on positive or negative trends for this analysis. Complete vertical anlaysis for multiple years and comment on the vertical analysis within a single year as well as changes in these %s over time.

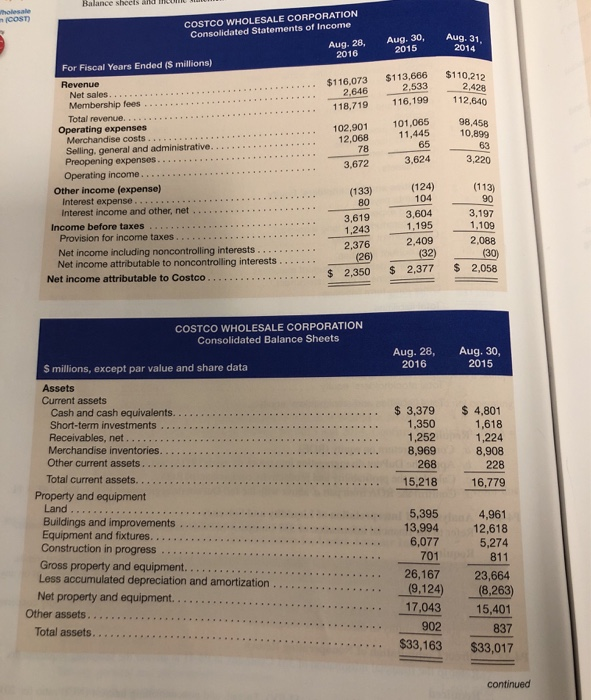

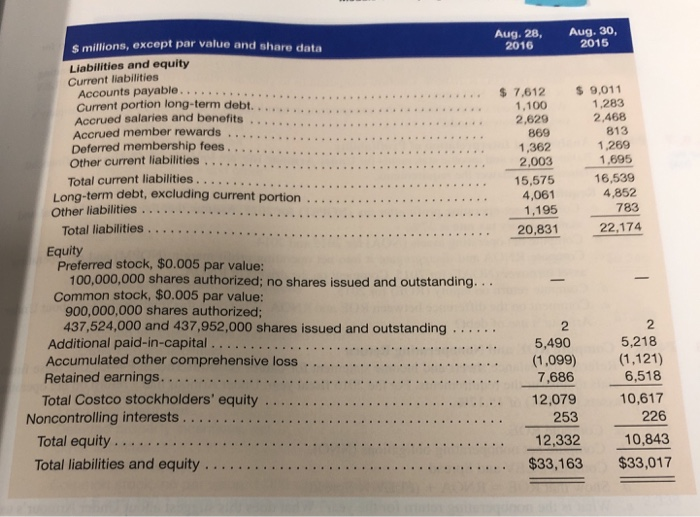

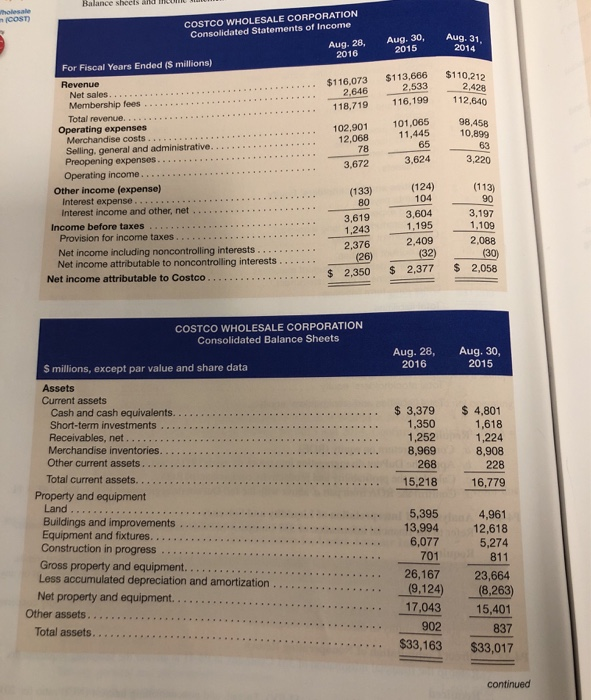

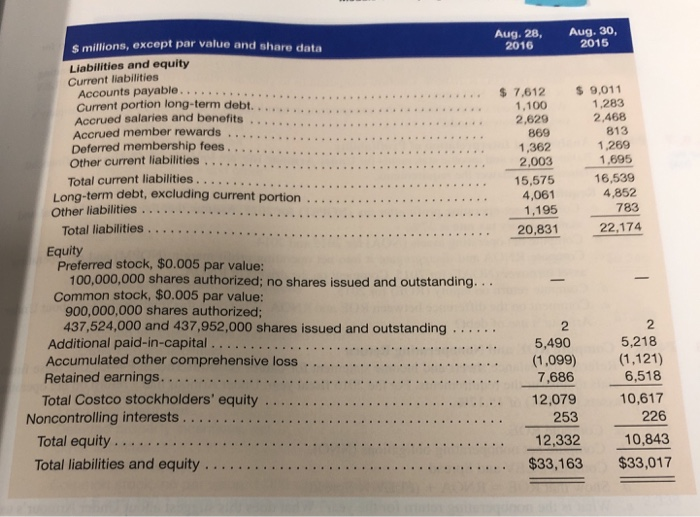

Balance sheels and Wholesale COST COSTCO WHOLESALE CORPORATION Consolidated Statements of Income Aug. 28, For Fiscal Years Ended ($ millions) 2016 Aug. 30, 2015 Aug. 31 2014 $116.073 2,646 118,719 $113,666 2,533 116,199 $110.212 2,428 112,640 102.901 12,068 78 3,672 101,065 11,445 65 3,624 98.458 10.899 63 3.220 Revenue Net sales Membership fees Total revenue Operating expenses Merchandise costs Selling, general and administrative. Preopening expenses.. Operating income.. Other income (expense) Interest expense.. Interest income and other, net Income before taxes Provision for income taxes Net income including noncontrolling interests Net income attributable to noncontrolling interests Net income attributable to Costco.. (133) 80 3,619 1,243 2,376 (26) $ 2,350 (124) 104 3,604 1,195 2,409 (32) $ 2.377 (113) 90 3,197 1,109 2,088 (30) $ 2,058 COSTCO WHOLESALE CORPORATION Consolidated Balance Sheets Aug. 28, 2016 Aug. 30, 2015 S millions, except par value and share data Assets Current assets Cash and cash equivalents.. Short-term investments Receivables, net. Merchandise inventories. Other current assets Total current assets. Property and equipment $ 3,379 1,350 1,252 8,969 268 15,218 $ 4,801 1,618 1,224 8,908 228 16,779 Land ... 4,961 Buildings and improvements Equipment and fixtures. Construction in progress Gross property and equipment. Less accumulated depreciation and amortization Net property and equipment Other assets. Total assets. 5,395 13,994 6,077 701 26,167 (9,124) 17,043 902 $33,163 12,618 5,274 811 23,664 (8,263) 15,401 837 $33,017 continued $ millions, except par value and share data Aug. 28, Aug. 30, 2016 2015 Liabilities and equity Current liabilities Accounts payable.. $ 7,612 9.011 Current portion long-term debt. 1,100 1,283 Accrued salaries and benefits 2,629 2.468 Accrued member rewards 869 813 Deferred membership fees. 1,362 1,289 Other current liabilities 2,003 1.695 Total current liabilities. 15,575 16,539 Long-term debt, excluding current portion 4,061 4,852 Other liabilities 1,195 783 Total liabilities 20,831 22,174 Equity Preferred stock, $0.005 par value: 100,000,000 shares authorized; no shares issued and outstanding... Common stock, $0.005 par value: 900,000,000 shares authorized; 437,524,000 and 437,952,000 shares issued and outstanding 2 2 Additional paid-in-capital. 5,490 5,218 Accumulated other comprehensive loss (1,099) (1.121) Retained earnings. 7,686 6,518 Total Costco stockholders' equity 12,079 10,617 Noncontrolling interests 253 226 Total equity... 12,332 10,843 Total liabilities and equity. $33,163 $33,017

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started