Answered step by step

Verified Expert Solution

Question

1 Approved Answer

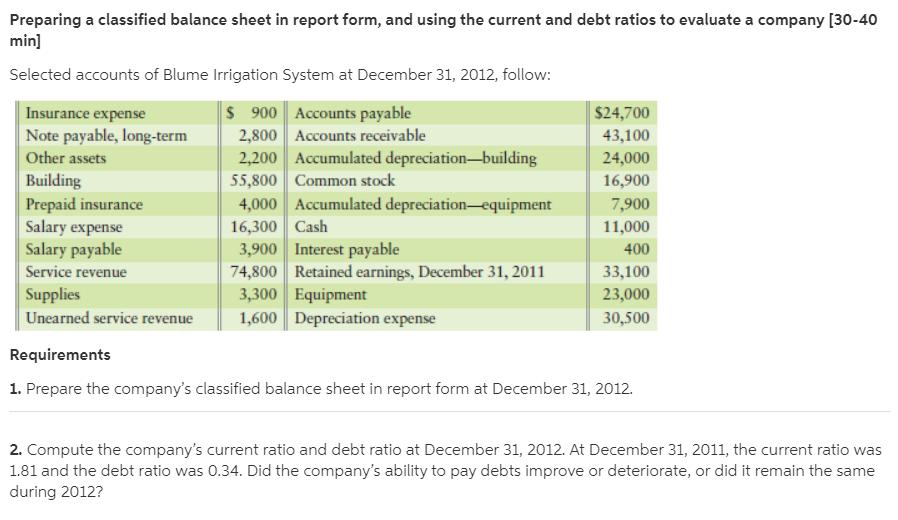

Preparing a classified balance sheet in report form, and using the current and debt ratios to evaluate a company [30-40 min] Selected accounts of

Preparing a classified balance sheet in report form, and using the current and debt ratios to evaluate a company [30-40 min] Selected accounts of Blume Irrigation System at December 31, 2012, follow: $ 900 Accounts payable 2,800 Accounts receivable 2,200 Accumulated depreciation-building 55,800 Common stock 4,000 Accumulated depreciation-equipment 16,300 Cash 3,900 Interest payable 74,800 Retained earnings, December 31, 2011 3,300 Equipment 1,600 Depreciation expense Insurance expense $24,700 Note payable, long-term Other assets 43,100 24,000 Building Prepaid insurance Salary expense Salary payable 16,900 7,900 11,000 400 Service revenue 33,100 Supplies 23,000 Unearned service revenue 30,500 Requirements 1. Prepare the company's classified balance sheet in report form at December 31, 2012. 2. Compute the company's current ratio and debt ratio at December 31, 2012. At December 31, 2011, the current ratio was 1.81 and the debt ratio was 0.34. Did the company's ability to pay debts improve or deteriorate, or did it remain the same during 2012?

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started