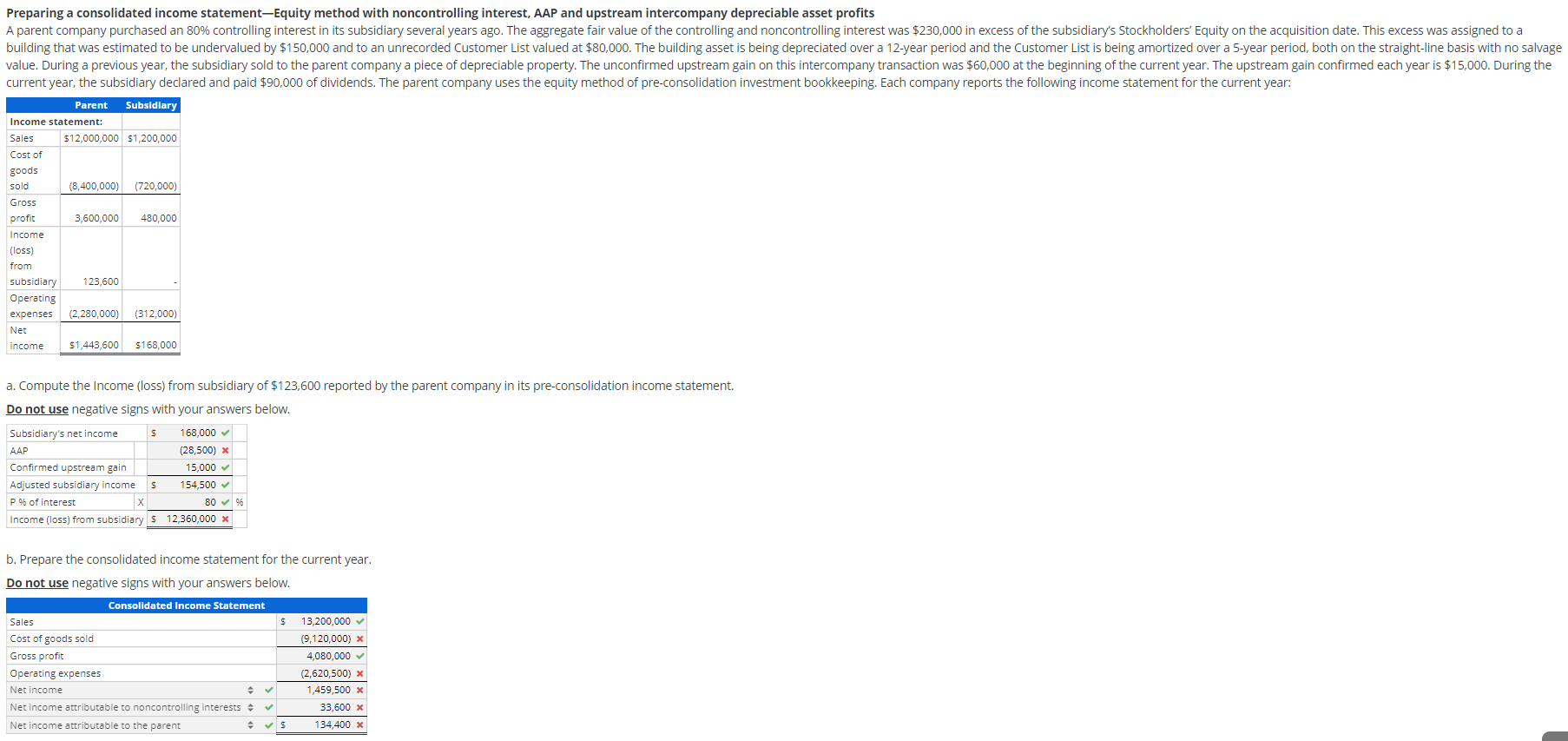

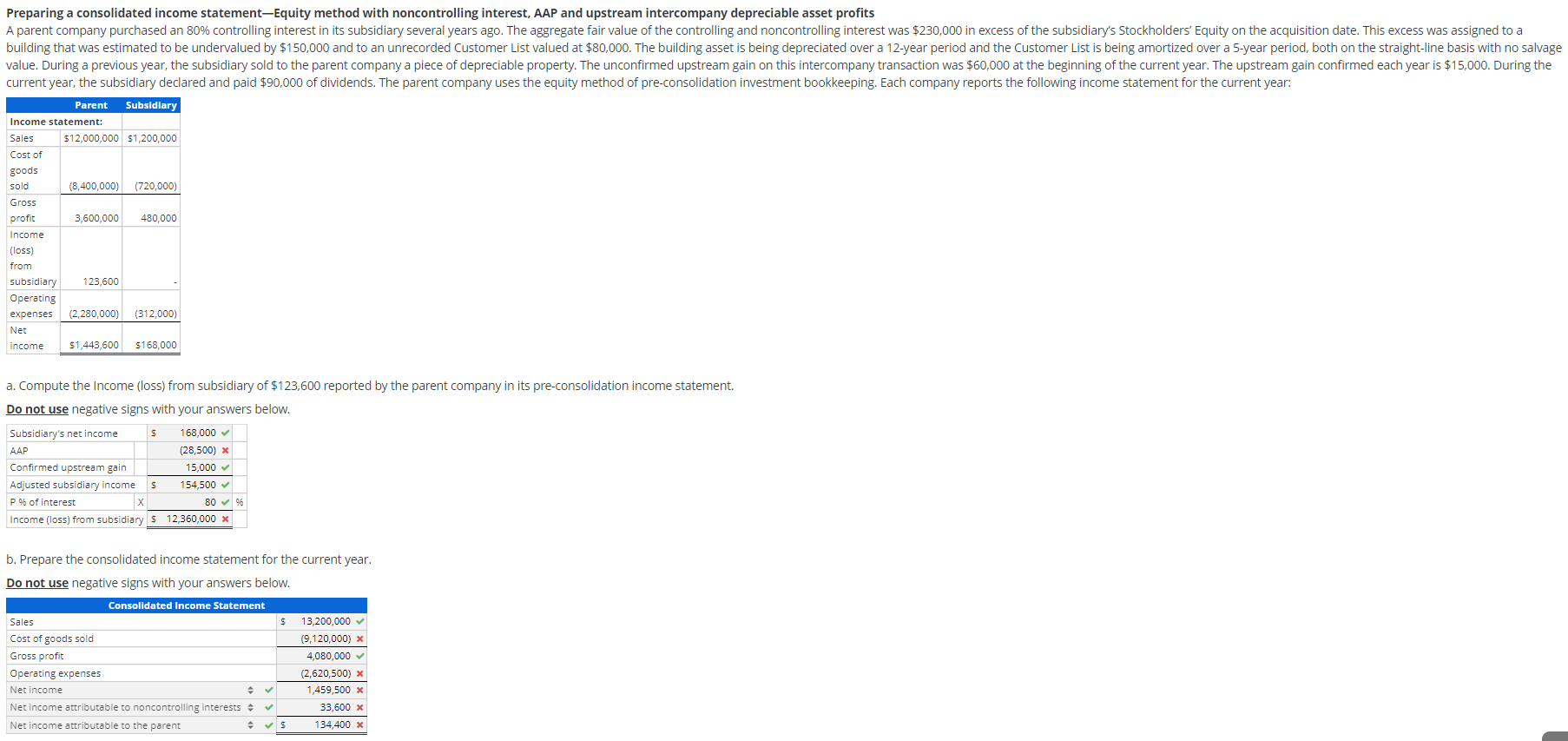

Preparing a consolidated income statement-Equity method with noncontrolling interest, AAP and upstream intercompany depreciable asset profits A parent company purchased an 80% controlling interest in its subsidiary several years ago. The aggregate fair value of the controlling and noncontrolling interest was $230,000 in excess of the subsidiary's Stockholders' Equity on the acquisition date. This excess was assigned to a building that was estimated to be undervalued by $150,000 and to an unrecorded Customer List valued at $80,000. The building asset is being depreciated over a 12-year period and the Customer List is being amortized over a 5-year period, both on the straight-line basis with no salvage value. During a previous year, the subsidiary sold to the parent company a piece of depreciable property. The unconfirmed upstream gain on this intercompany transaction was $60,000 at the beginning of the current year. The upstream gain confirmed each year is $15,000. During the current year, the subsidiary declared and paid $90,000 of dividends. The parent company uses the equity method of pre-consolidation investment bookkeeping. Each company reports the following income statement for the current year: Parent Subsidiary Income statement: Sales $12,000,000 $1,200,000 Cost of goods sold (8,400,000) (720,000) Gross profit 3,600,000 480,000 Income (loss) from subsidiary 123,600 Operating expenses (2,280,000) (312,000) Net income $1,443,600 $168,000 a. Compute the Income (loss) from subsidiary of $123,600 reported by the parent company in its pre-consolidation income statement. Do not use negative signs with your answers below. Subsidiary's net income $ 168,000 AAP (28,500) Confirmed upstream gain 15,000 Adjusted subsidiary income $ 154,500 P % of interest 80 % Income (loss) from subsidiary 12,360,000 x b. Prepare the consolidated income statement for the current year. Do not use negative signs with your answers below. Consolidated Income Statement Sales Cost of goods sold Gross profit Operating expenses Net income Net income attributable to noncontrolling interests Net income attributable to the parent s 13,200,000 (9,120,000) X 4,080,000 (2,620,500) X 1,459,500 X 33,600 x 134,400 x