Answered step by step

Verified Expert Solution

Question

1 Approved Answer

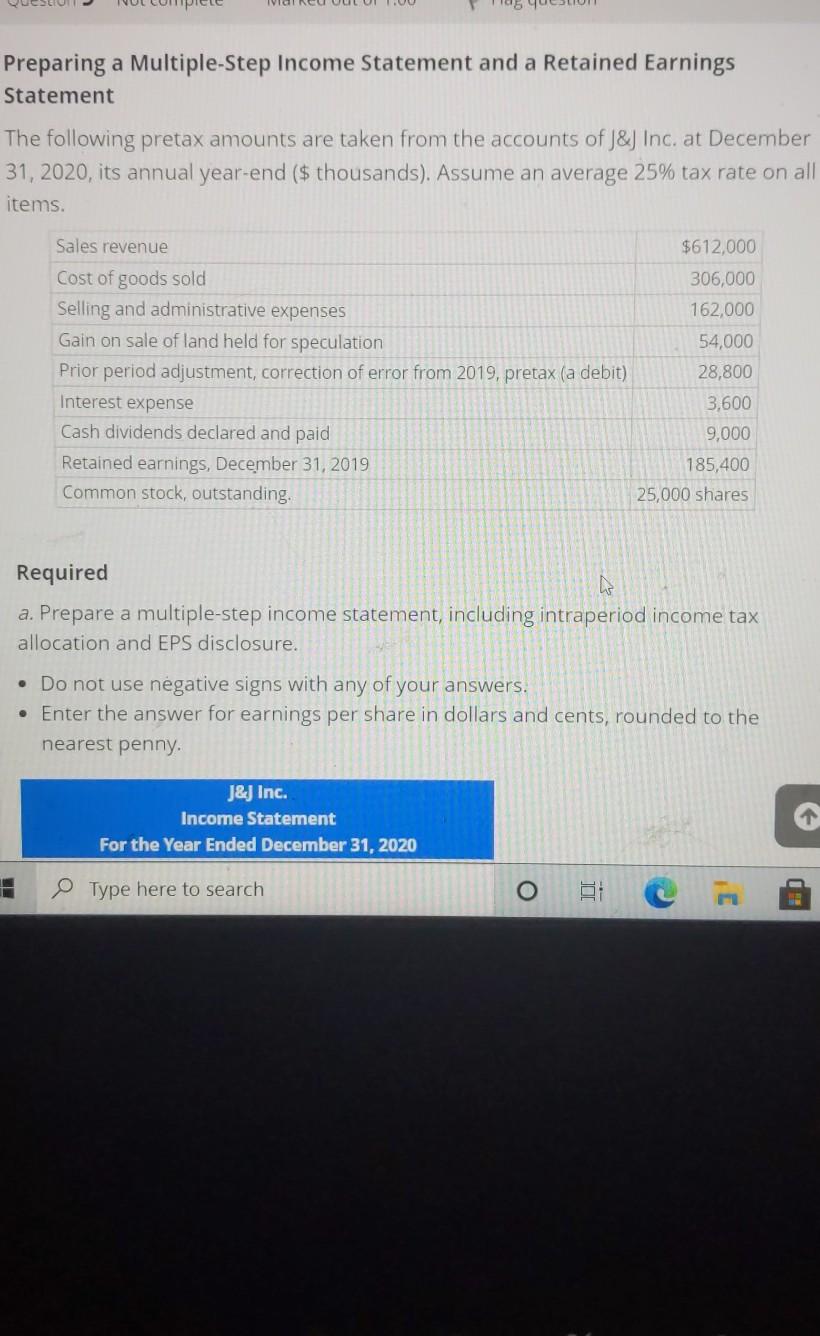

Preparing a Multiple-Step Income Statement and a Retained Earnings Statement The following pretax amounts are taken from the accounts of J&J Inc. at December 31,

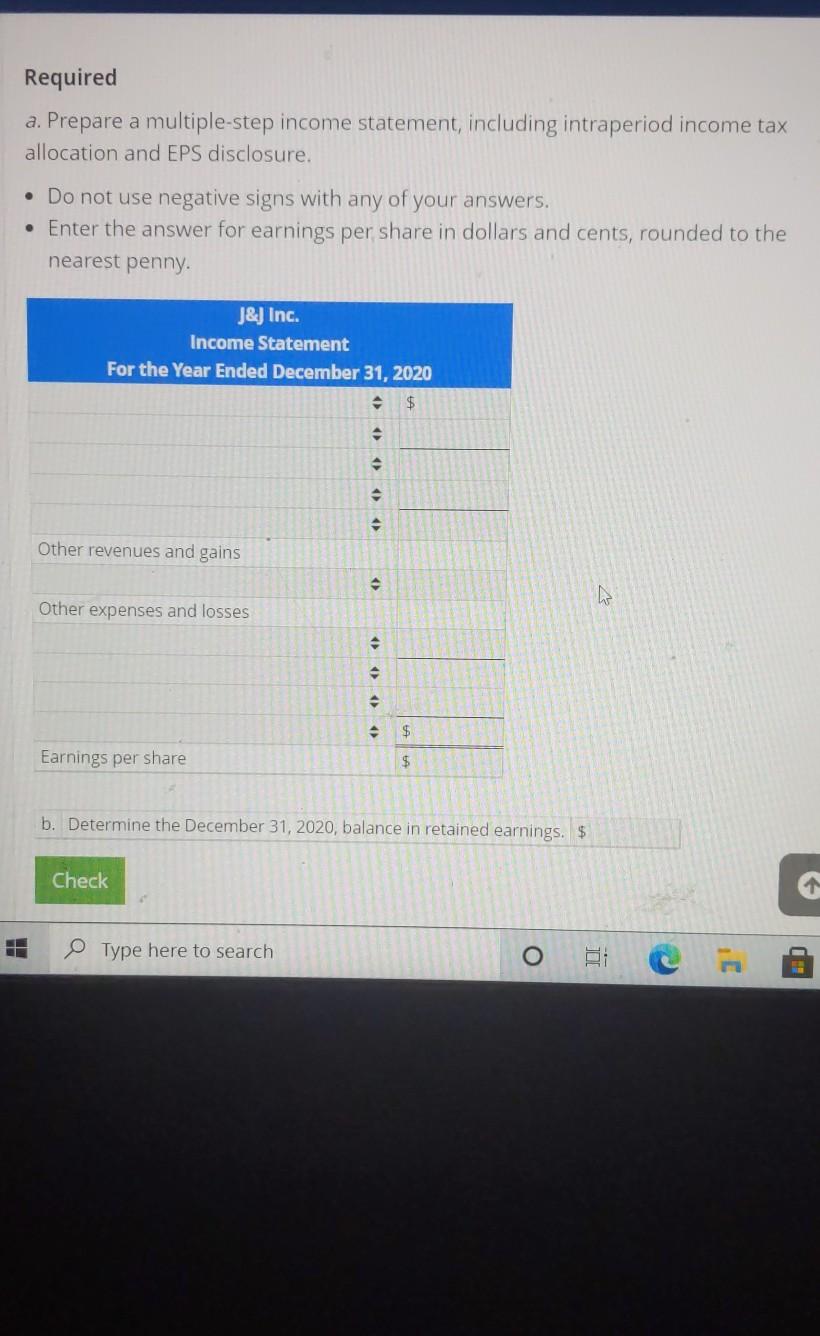

Preparing a Multiple-Step Income Statement and a Retained Earnings Statement The following pretax amounts are taken from the accounts of J&J Inc. at December 31, 2020, its annual year-end ($ thousands). Assume an average 25% tax rate on all items. Sales revenue Cost of goods sold Selling and administrative expenses Gain on sale of land held for speculation Prior period adjustment, correction of error from 2019, pretax (a debit) Interest expense Cash dividends declared and paid Retained earnings, December 31, 2019 Common stock, outstanding. $612,000 306,000 162,000 54,000 28,800 3,600 9,000 185,400 25,000 shares Required a. Prepare a multiple-step income statement, including intraperiod income tax allocation and EPS disclosure. Do not use negative signs with any of your answers. Enter the answer for earnings per share in dollars and cents, rounded to the nearest penny. J&J Inc. Income Statement For the Year Ended December 31, 2020 Type here to search O DI ED Required a. Prepare a multiple-step income statement, including intraperiod income tax allocation and EPS disclosure. Do not use negative signs with any of your answers. Enter the answer for earnings per share in dollars and cents, rounded to the nearest penny. J&J Inc. Income Statement For the Year Ended December 31, 2020 $ Other revenues and gains Other expenses and losses $ Earnings per share $ b. Determine the December 31, 2020, balance in retained earnings. $ Check 1 H Type here to search . O

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started