Answered step by step

Verified Expert Solution

Question

1 Approved Answer

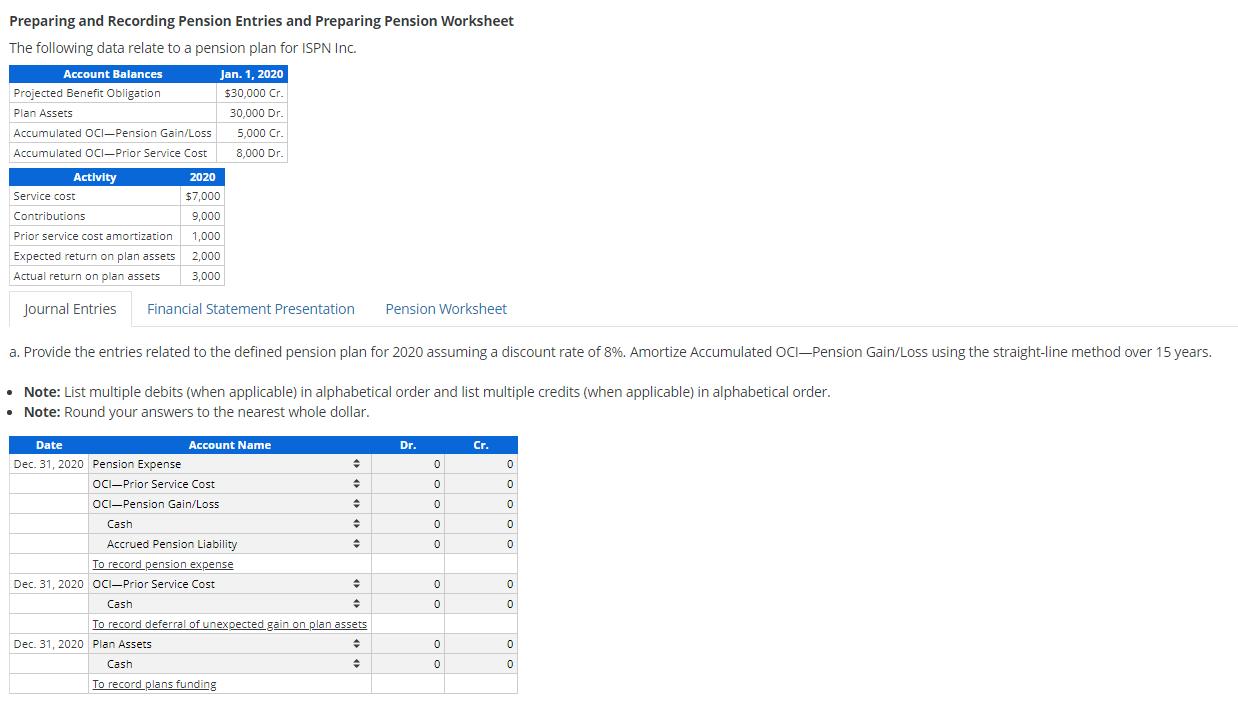

Preparing and Recording Pension Entries and Preparing Pension Worksheet The following data relate to a pension plan for ISPN Inc. Account Balances Projected Benefit

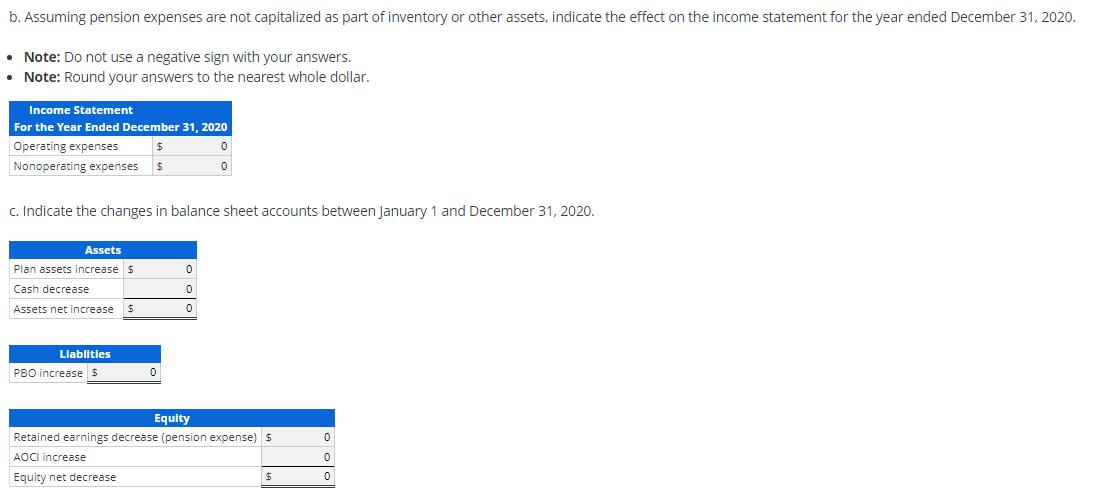

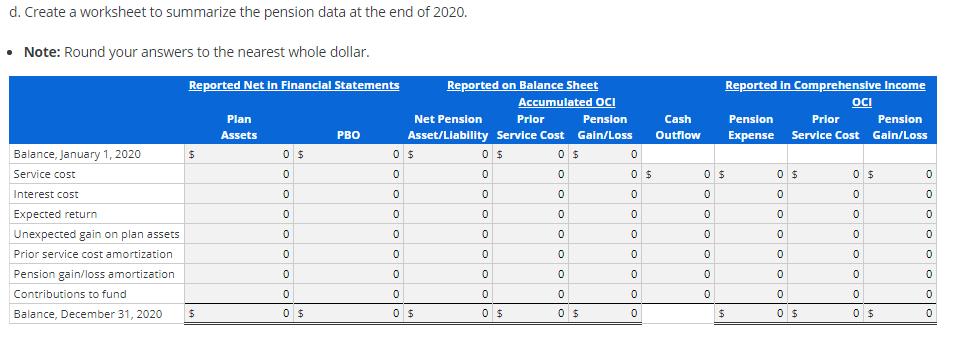

Preparing and Recording Pension Entries and Preparing Pension Worksheet The following data relate to a pension plan for ISPN Inc. Account Balances Projected Benefit Obligation Plan Assets Accumulated OCI-Pension Gain/Loss Accumulated OCI-Prior Service Cost Activity Service cost Contributions Prior service cost amortization. Expected return on plan assets Actual return on plan assets Date Dec. 31, 2020 Pension Expense Jan. 1, 2020 $30,000 Cr. 2020 $7,000 9,000 1,000 2,000 3,000 Journal Entries Financial Statement Presentation Pension Worksheet a. Provide the entries related to the defined pension plan for 2020 assuming a discount rate of 8%. Amortize Accumulated OCI-Pension Gain/Loss using the straight-line method over 15 years. Note: List multiple debits (when applicable) in alphabetical order and list multiple credits (when applicable) in alphabetical order. Note: Round your answers to the nearest whole dollar. Dec. 31, 2020 Plan Assets 30,000 Dr. 5,000 Cr 8,000 Dr. Account Name OCI-Prior Service Cost OCI-Pension Gain/Loss Cash Accrued Pension Liability To record pension expense Dec. 31, 2020 OCI-Prior Service Cost Cash Cashi To record plans funding + To record deferral of unexpected gain on plan assets + + Dr. 0 0 0 0 0 0 0 0 0 Cr. 0 0 0 0 0 0 0 0 0 b. Assuming pension expenses are not capitalized as part of inventory or other assets, indicate the effect on the income statement for the year ended December 31, 2020. . Note: Do not use a negative sign with your answers. Note: Round your answers to the nearest whole dollar. Income Statement For the Year Ended December 31, 2020 Operating expenses $ Nonoperating expenses $ c. Indicate the changes in balance sheet accounts between January 1 and December 31, 2020. Assets Plan assets increase $ Cash decrease Assets net increase $ Liablities PBO increase $ 0 0 0 0 0 0 Equity Retained earnings decrease (pension expense) $ AOCI increase Equity net decrease $ 0 0 0 d. Create a worksheet to summarize the pension data at the end of 2020. Note: Round your answers to the nearest whole dollar. Reported Net In Financial Statements Balance, January 1, 2020 Service cost Interest cost Expected return Unexpected gain on plan assets Prior service cost amortization Pension gain/loss amortization Contributions to fund Balance, December 31, 2020 $ $ Plan Assets 0 $ 0 0 0 0 0 0 0 0 $ PBO 0 0 0 0 0 0 Reported on Balance Sheet Accumulated OCI Net Pension Prior Pension Asset/Liability Service Cost Gain/Loss 0 $ 0 0 $ 0 0 0 $ 0 $ 0 0 0 0 0 0 0 0 $ 0 0 0 0 0 0 $ 0 0 $ 0 0 0 0 0 0 0 Cash Outflow 0 $ 0 0 0 0 0 Reported in Comprehensive Income 0 $ Pension Expense Pension Prior Service Cost Gain/Loss 0 $ 0 0 OCI 0 0 0 0 0 $ 0 $ 0 0 0 0 0 0 0 $ 0 0 0 0 0 0 0 0

Step by Step Solution

★★★★★

3.53 Rating (174 Votes )

There are 3 Steps involved in it

Step: 1

a Journal Entries Date Account Name Debit Credit December 31 2020 Pension Expense 7000 0 OCIPrior Se...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started