Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Preparing the Discontinued Operations Section of the Income Statement At its September 1 , Year 1 meeting; the board of directors of Jolie Inc. approved

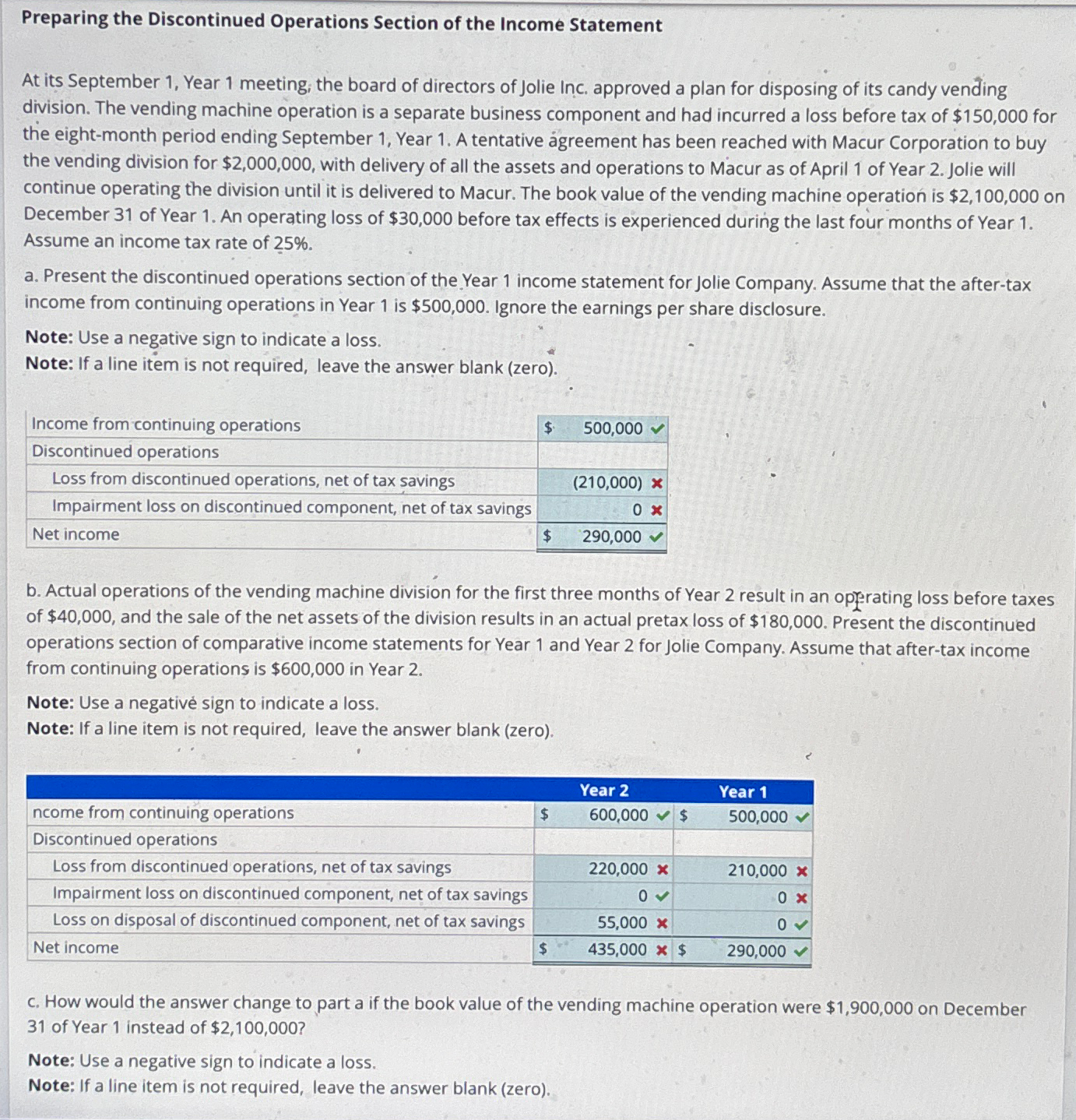

Preparing the Discontinued Operations Section of the Income Statement

At its September Year meeting; the board of directors of Jolie Inc. approved a plan for disposing of its candy vending division. The vending machine operation is a separate business component and had incurred a loss before tax of $ for the eightmonth period ending September Year A tentative greement has been reached with Macur Corporation to buy the vending division for $ with delivery of all the assets and operations to Macur as of April of Year Jolie will continue operating the division until it is delivered to Macur. The book value of the vending machine operation is $ on December of Year An operating loss of $ before tax effects is experienced during the last four months of Year Assume an income tax rate of

a Present the discontinued operations section of the Year income statement for Jolie Company. Assume that the aftertax income from continuing operations in Year is $ Ignore the earnings per share disclosure.

Note: Use a negative sign to indicate a loss.

Note: If a line item is not required, leave the answer blank zero

tableIncome from continuing operations,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started