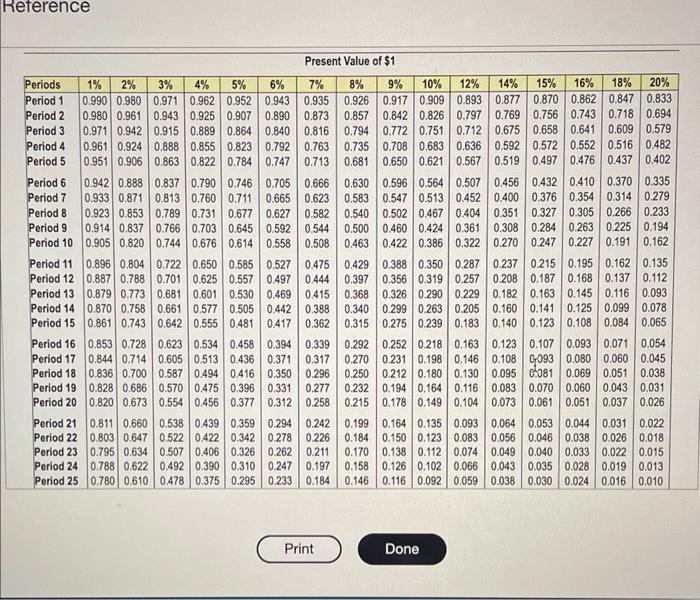

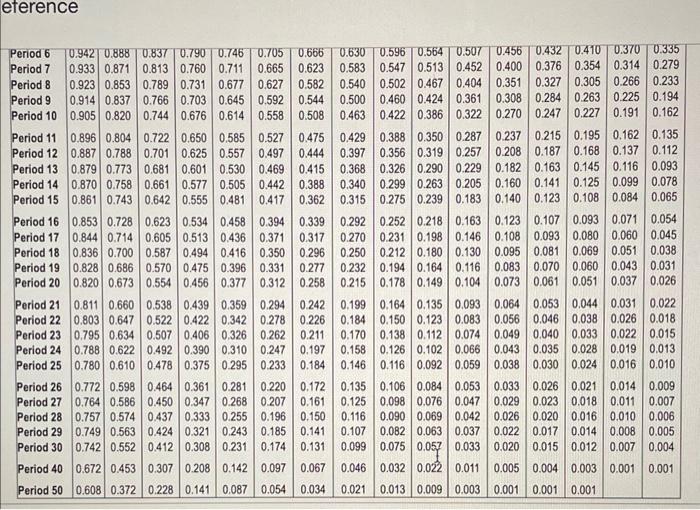

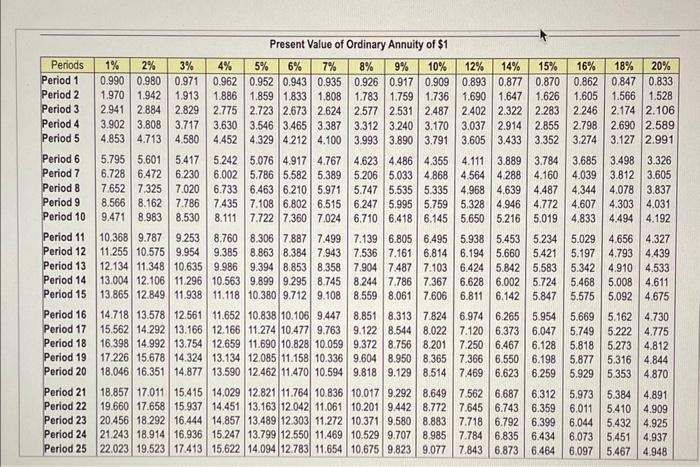

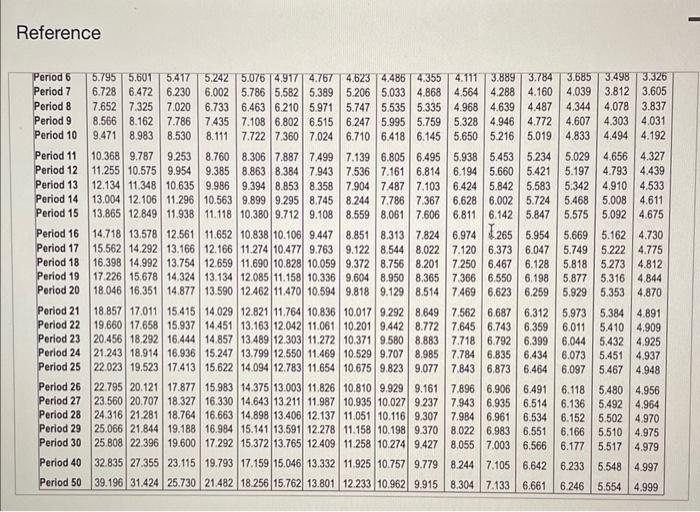

present 1 comtinued

present continued

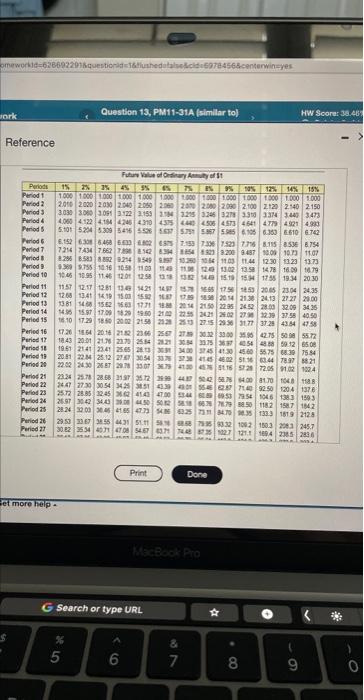

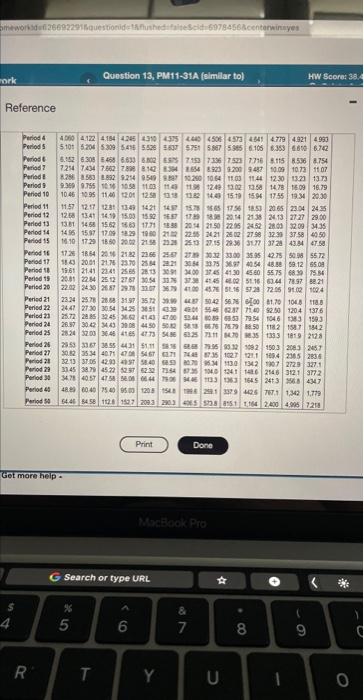

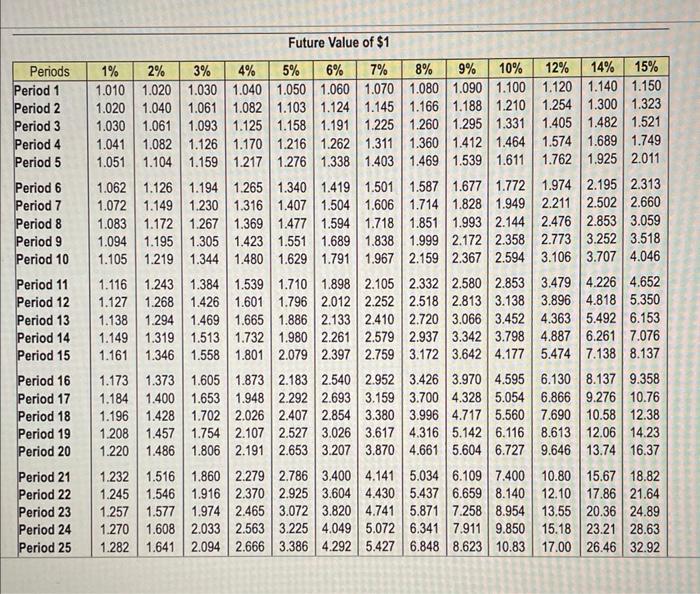

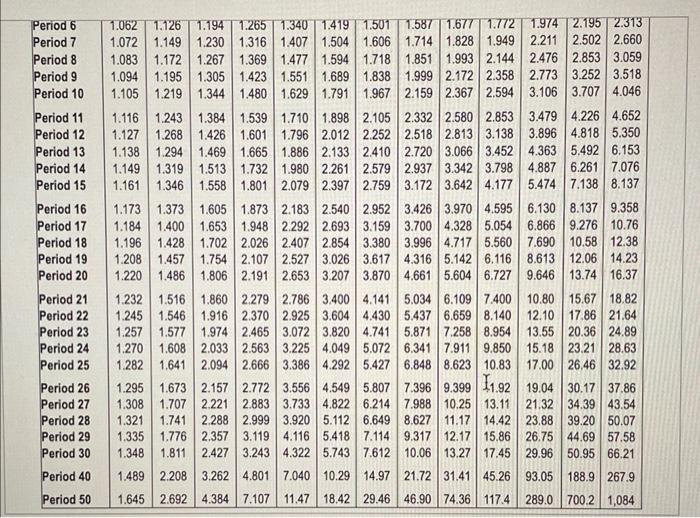

future continued

future conitnued

present

present

present 2

present 2

future

future

future 2

future 2

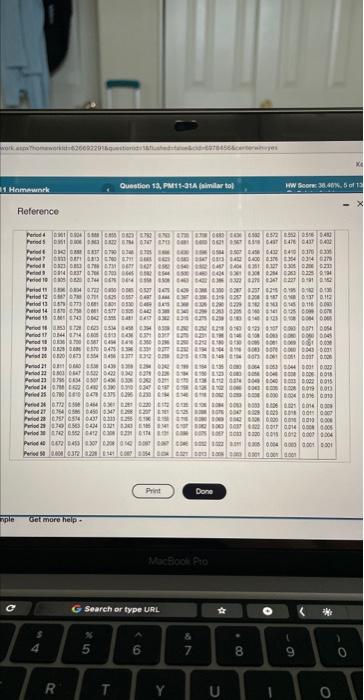

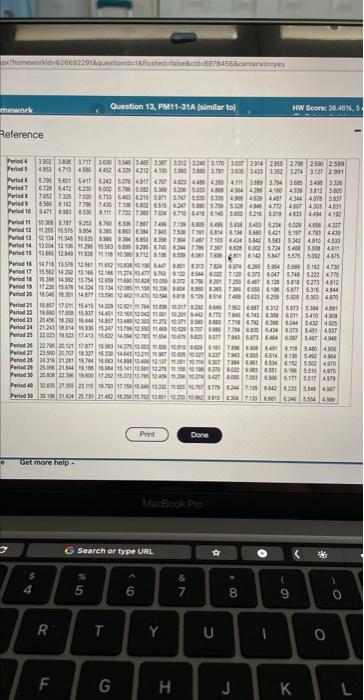

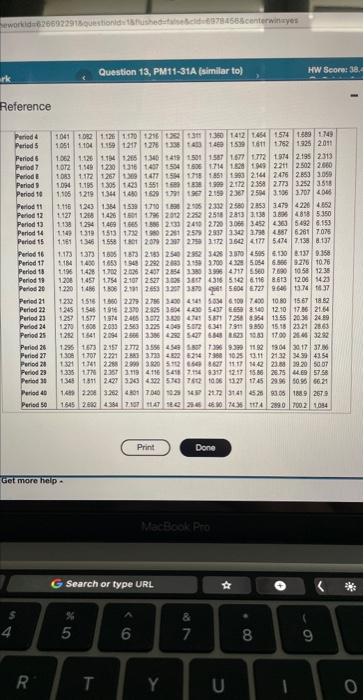

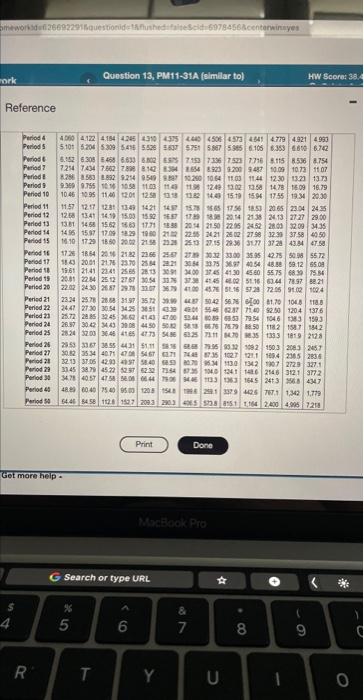

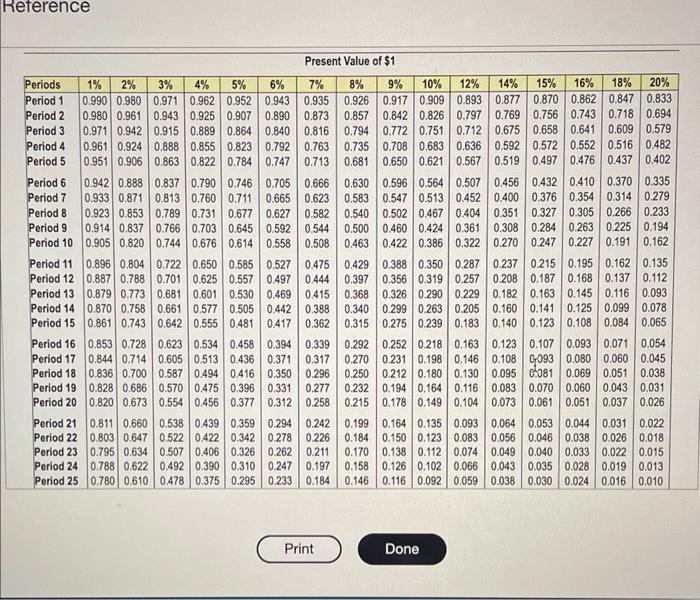

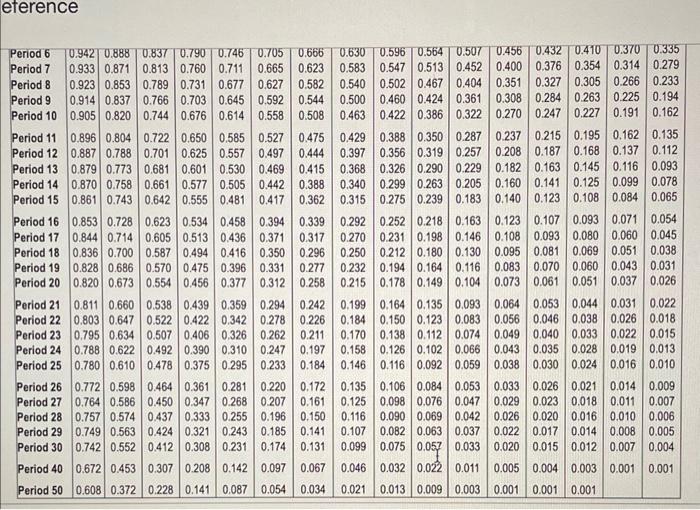

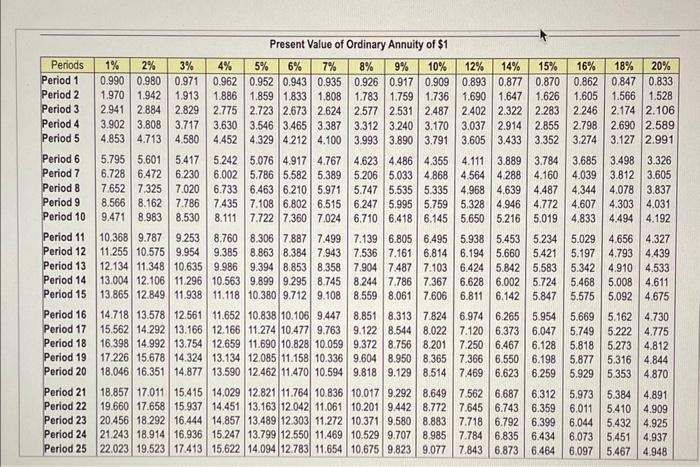

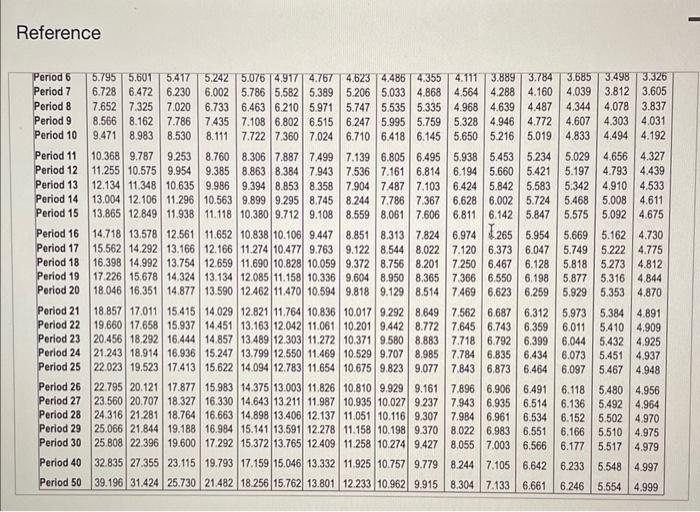

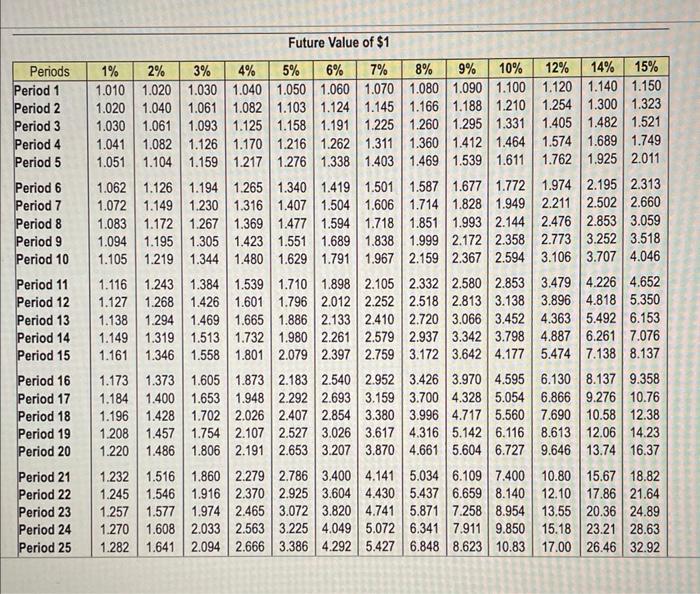

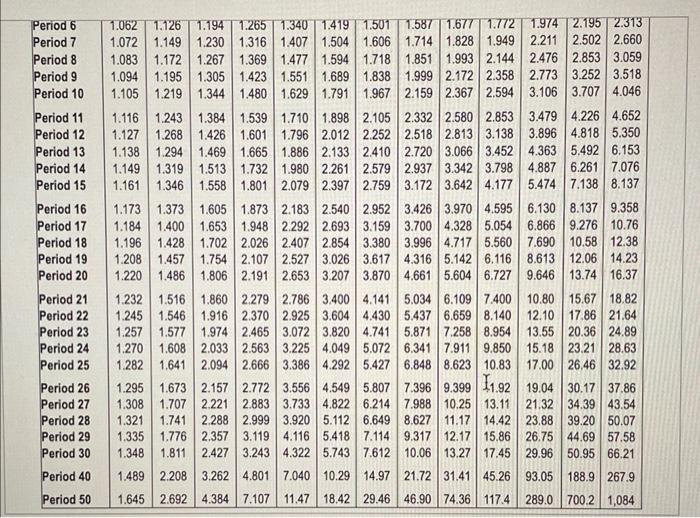

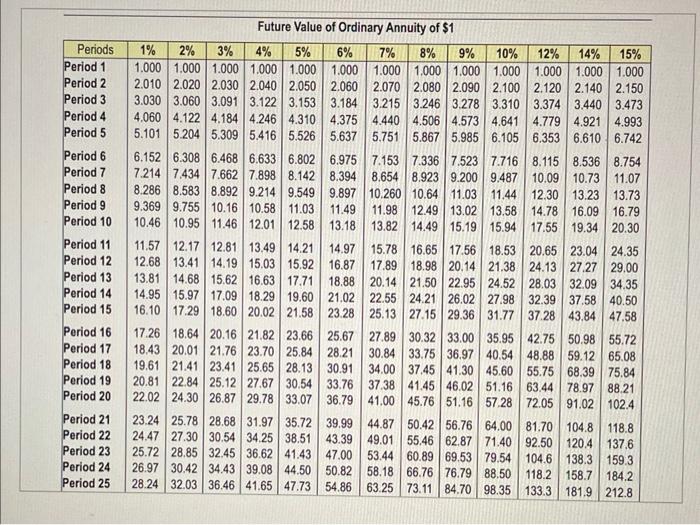

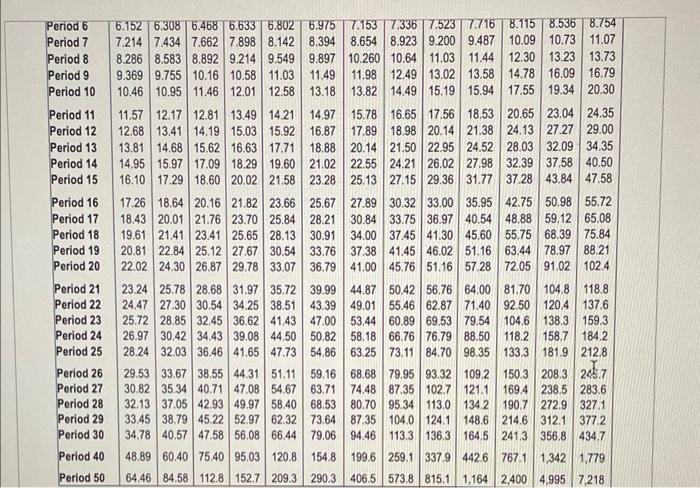

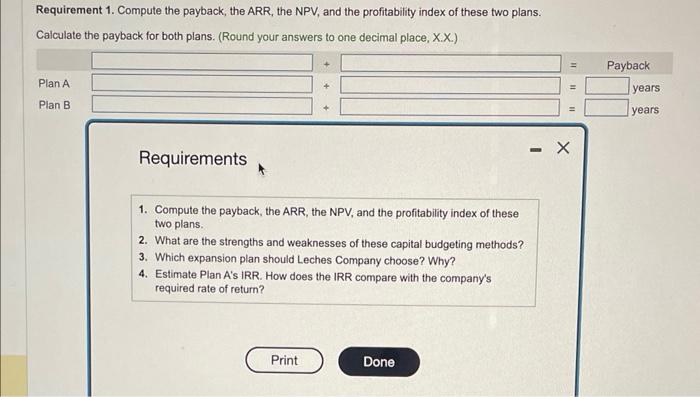

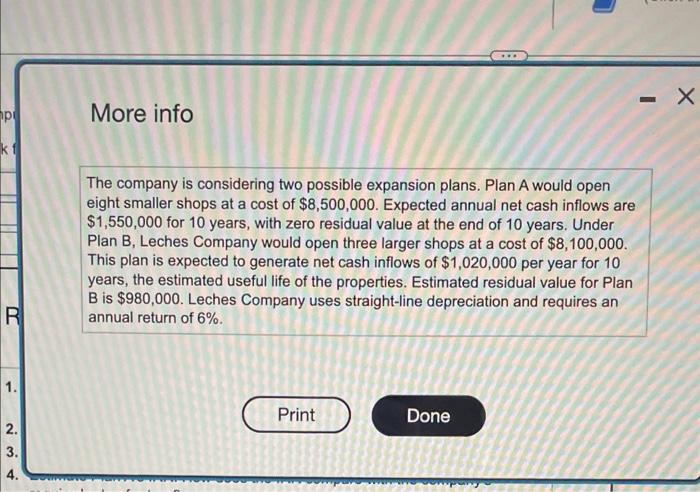

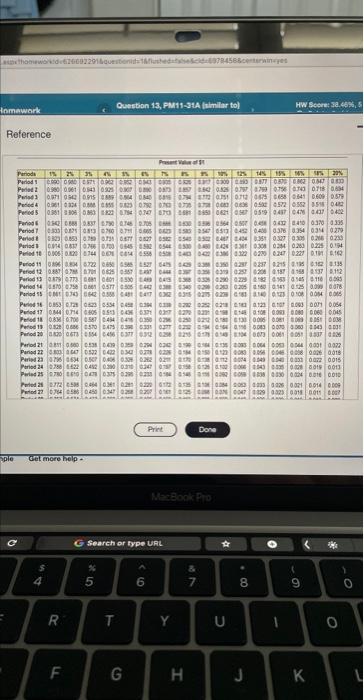

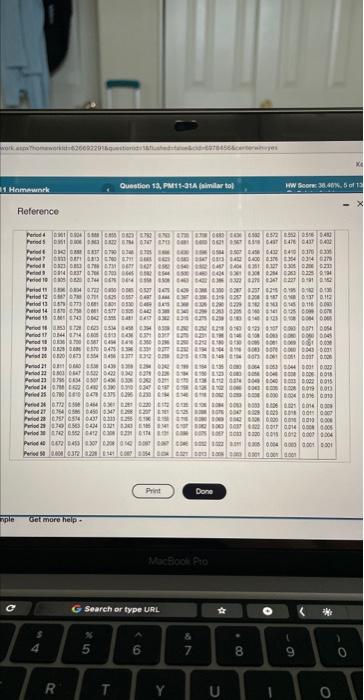

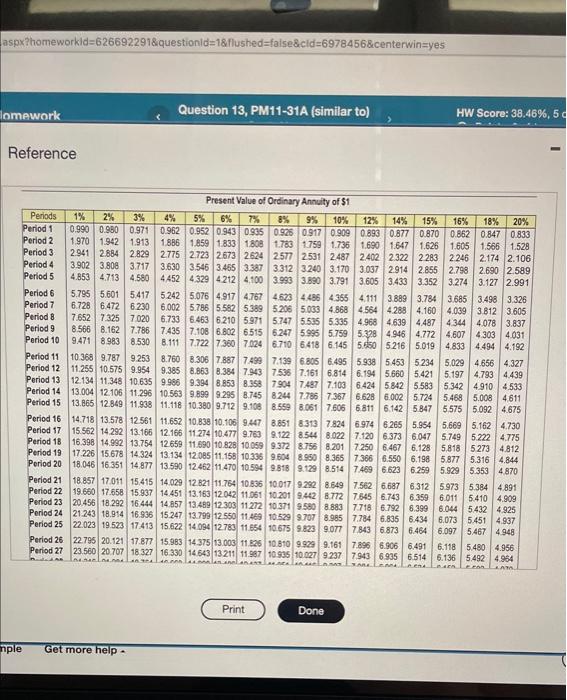

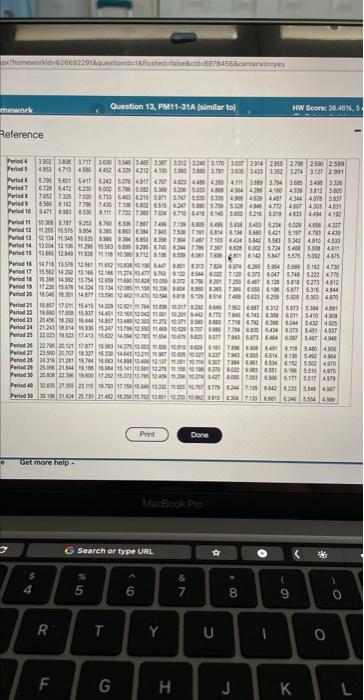

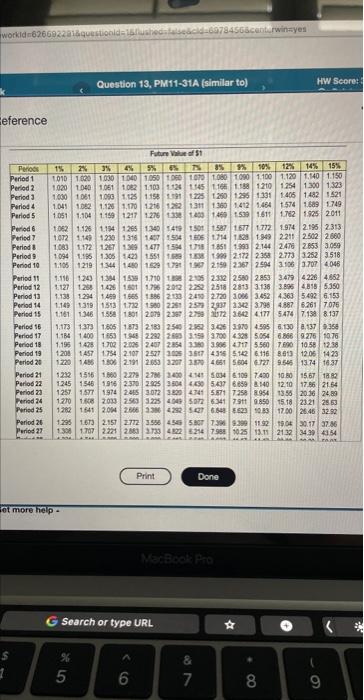

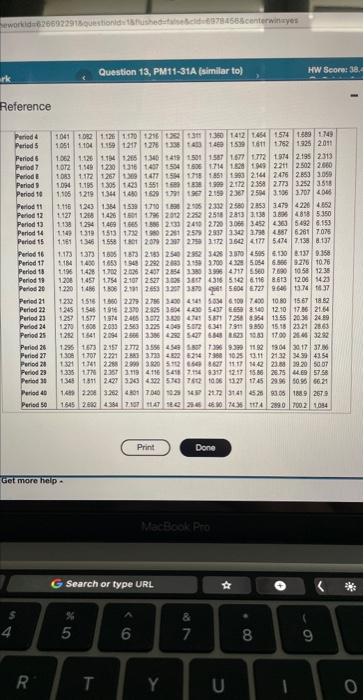

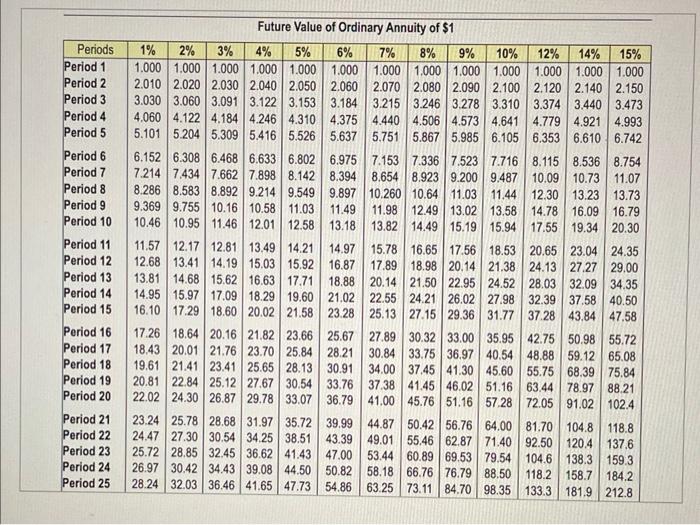

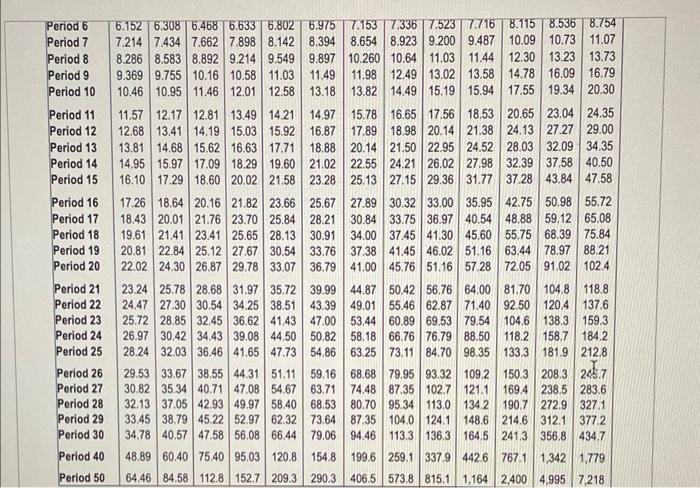

Requirement 1. Compute the payback, the ARR, the NPV, and the profitability index of these two plans. Calculate the payback for both plans. (Round your answers to one decimal place, X.X.) Requirements 1. Compute the payback, the ARR, the NPV, and the profitability index of these two plans. 2. What are the strengths and weaknesses of these capital budgeting methods? 3. Which expansion plan should Leches Company choose? Why? 4. Estimate Plan A's IRR. How does the IRR compare with the company's required rate of return? More info The company is considering two possible expansion plans. Plan A would open eight smaller shops at a cost of $8,500,000. Expected annual net cash inflows are $1,550,000 for 10 years, with zero residual value at the end of 10 years. Under Plan B, Leches Company would open three larger shops at a cost of $8,100,000. This plan is expected to generate net cash inflows of $1,020,000 per year for 10 years, the estimated useful life of the properties. Estimated residual value for Plan B is $980,000. Leches Company uses straight-line depreciation and requires an annual return of 6%. Peference Reference Reference Reference Reference Reterence eference \begin{tabular}{|l|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline Periods & 1% & 2% & 3% & 4% & 5% & 6% & 7% & 8% & 9% & 10% & 12% & 14% & 15% & 16% & 18% & 20% \\ \hline Period 1 & 0.990 & 0.980 & 0.971 & 0.962 & 0.952 & 0.943 & 0.935 & 0.926 & 0.917 & 0.909 & 0.893 & 0.877 & 0.870 & 0.862 & 0.847 & 0.833 \\ Period 2 & 1.970 & 1.942 & 1.913 & 1.886 & 1.859 & 1.833 & 1.808 & 1.783 & 1.759 & 1.736 & 1.690 & 1.647 & 1.626 & 1.605 & 1.566 & 1.528 \\ Period 3 & 2.941 & 2.884 & 2.829 & 2.775 & 2.723 & 2.673 & 2.624 & 2.577 & 2.531 & 2.487 & 2.402 & 2.322 & 2.283 & 2.246 & 2.174 & 2.106 & \\ Period 4 & 3.902 & 3.808 & 3.717 & 3.630 & 3.546 & 3.465 & 3.387 & 3.312 & 3.240 & 3.170 & 3.037 & 2.914 & 2.855 & 2.798 & 2.690 & 2.589 & \\ Period 5 & 4.853 & 4.713 & 4.580 & 4.452 & 4.329 & 4.212 & 4.100 & 3.993 & 3.890 & 3.791 & 3.605 & 3.433 & 3.352 & 3.274 & 3.127 & 2.991 \\ Period 6 & 5.795 & 5.601 & 5.417 & 5.242 & 5.076 & 4.917 & 4.767 & 4.623 & 4.486 & 4.355 & 4.111 & 3.889 & 3.784 & 3.685 & 3.498 & 3.326 & \\ Period 7 & 6.728 & 6.472 & 6.230 & 6.002 & 5.786 & 5.582 & 5.389 & 5.206 & 5.033 & 4.868 & 4.564 & 4.288 & 4.160 & 4.039 & 3.812 & 3.605 & \\ Period 8 & 7.652 & 7.325 & 7.020 & 6.733 & 6.463 & 6.210 & 5.971 & 5.747 & 5.535 & 5.335 & 4.968 & 4.639 & 4.487 & 4.344 & 4.078 & 3.837 & \\ Period 9 & 8.566 & 8.162 & 7.786 & 7.435 & 7.108 & 6.802 & 6.515 & 6.247 & 5.995 & 5.759 & 5.328 & 4.946 & 4.772 & 4.607 & 4.303 & 4.031 & \\ Period 10 & 9.471 & 8.983 & 8.530 & 8.111 & 7.722 & 7.360 & 7.024 & 6.710 & 6.418 & 6.145 & 5.650 & 5.216 & 5.019 & 4.833 & 4.494 & 4.192 & \\ Period 11 & 10.368 & 9.787 & 9.253 & 8.760 & 8.306 & 7.887 & 7.499 & 7.139 & 6.805 & 6.495 & 5.938 & 5.453 & 5.234 & 5.029 & 4.656 & 4.327 & \\ Period 12 & 11.255 & 10.575 & 9.954 & 9.385 & 8.863 & 8.384 & 7.943 & 7.536 & 7.161 & 6.814 & 6.194 & 5.660 & 5.421 & 5.197 & 4.793 & 4.439 & \\ Period 13 & 12.134 & 11.348 & 10.635 & 9.986 & 9.394 & 8.853 & 8.358 & 7.904 & 7.487 & \end{tabular} Reference Future Value of $1 Future Value of Ordinary Annuity of $1

present 1 comtinued

present 1 comtinued

present continued

present continued

future continued

future continued

future conitnued

future conitnued present

present present

present present 2

present 2 present 2

present 2 future

future future

future future 2

future 2 future 2

future 2