Question

Present a summary journal entry (amounts in thousands) on October 30, 2020, in Teladocs books to record its acquisition of Livongo. Assume that the par

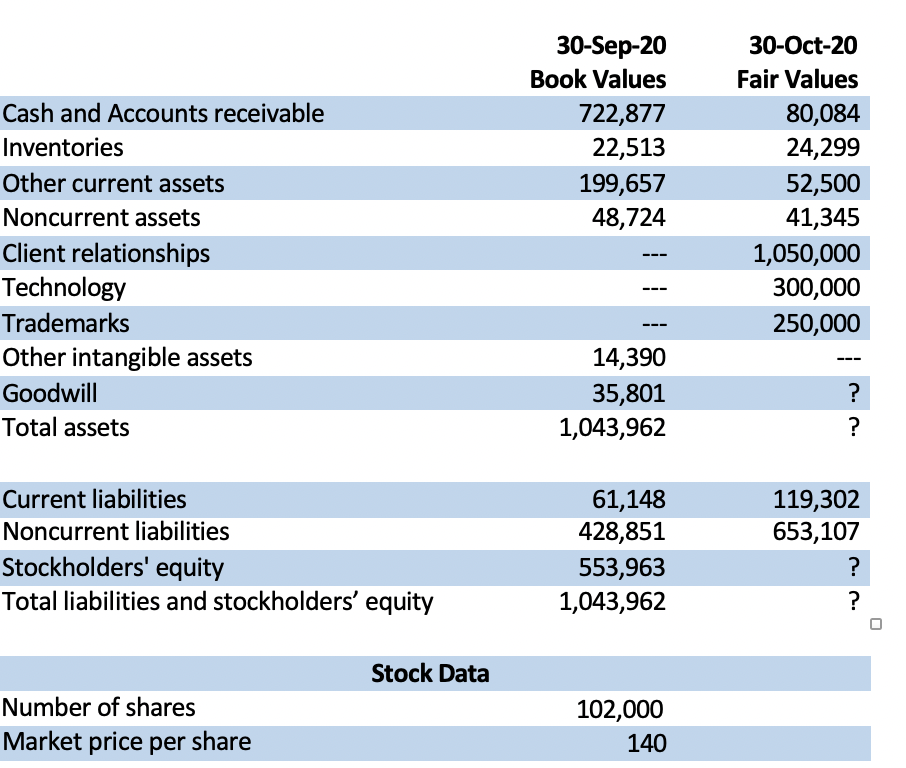

Present a summary journal entry (amounts in thousands) on October 30, 2020, in Teladocs books to record its acquisition of Livongo. Assume that the par value of Teladocs shares was $0.001 per share. The acquisition price paid by Teladoc was $13,938 million, consisting of $401 million of cash, assumption of notes payable of $555.4 million, and issuance of 60.4 million shares of Teladoc's common stock valued at $12,981.6 million. Table 2 presents the summarized balance sheet of Livongo immediately before the acquisition and the fair value of its assets and liabilities on the date of acquisition (October 30, 2020).

Present a summary journal entry (amounts in thousands) on October 30, 2020, in Teladocs books to record its acquisition of Livongo. Assume that the par value of Teladocs shares was $0.001 per share. The acquisition price paid by Teladoc was $13,938 million, consisting of $401 million of cash, assumption of notes payable of $555.4 million, and issuance of 60.4 million shares of Teladoc's common stock valued at $12,981.6 million. Table 2 presents the summarized balance sheet of Livongo immediately before the acquisition and the fair value of its assets and liabilities on the date of acquisition (October 30, 2020).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started