Present and justify absolute valuation method(DCF, DDM) and give recommendation on stock(Nordecon).

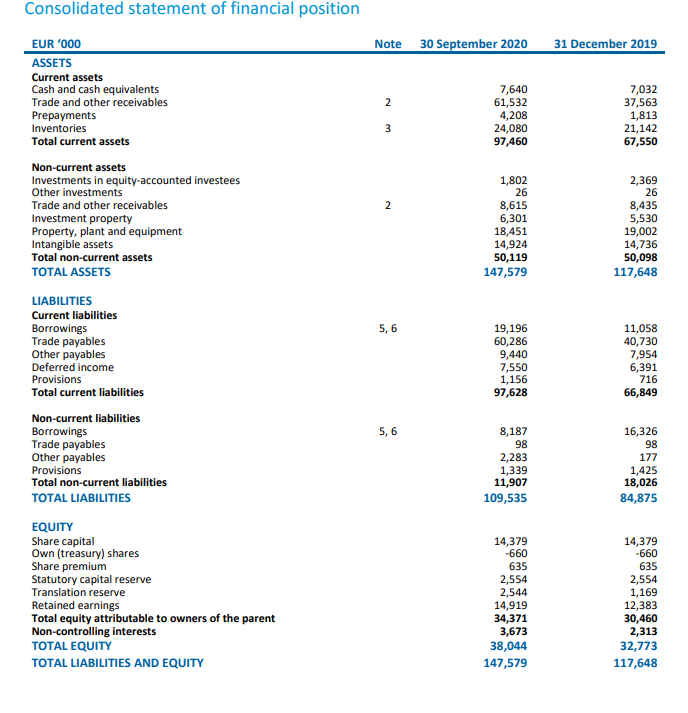

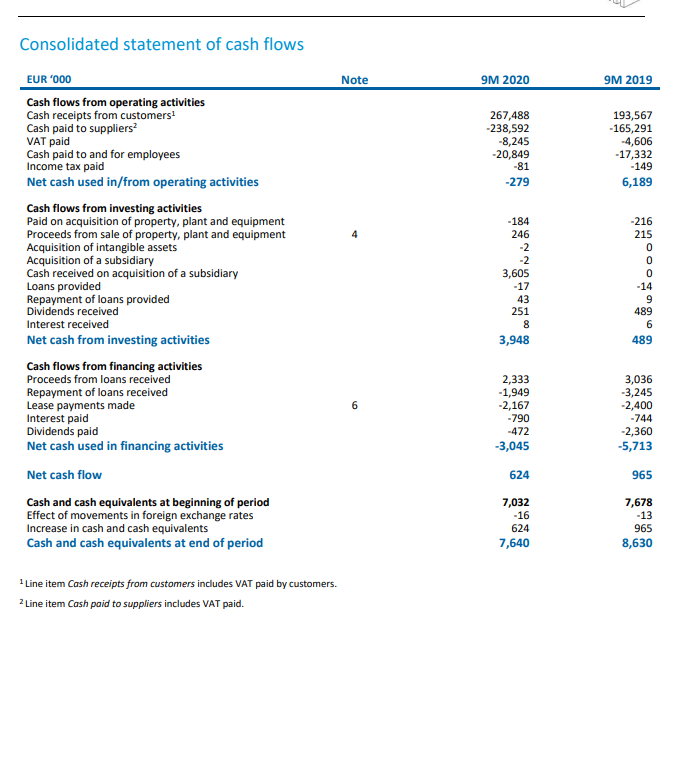

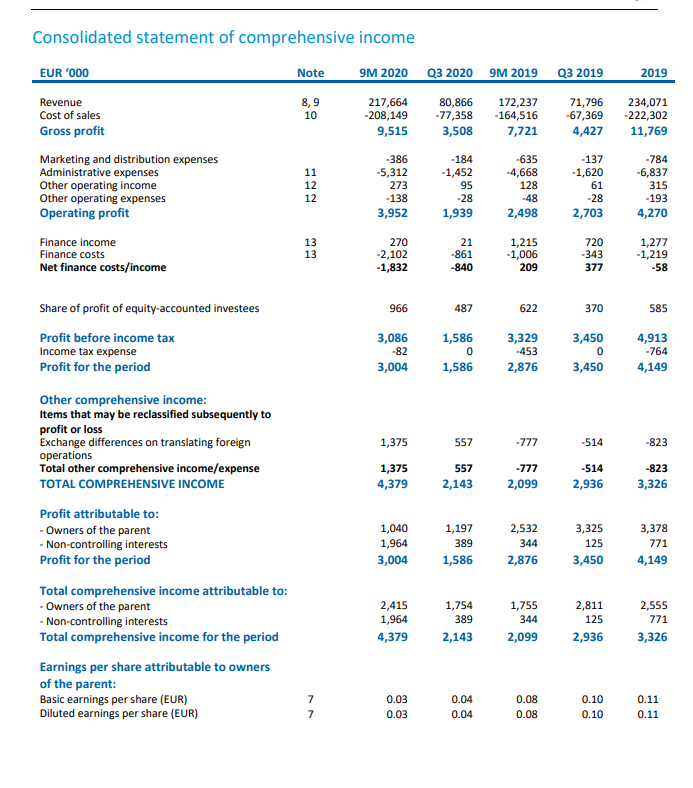

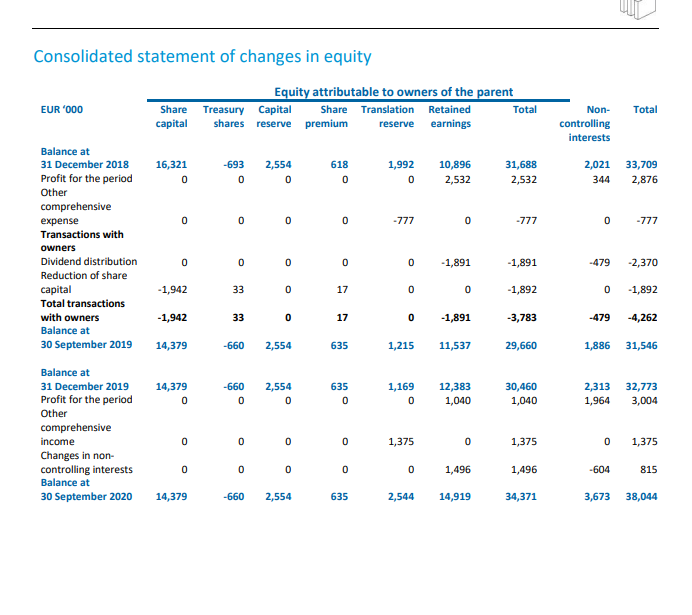

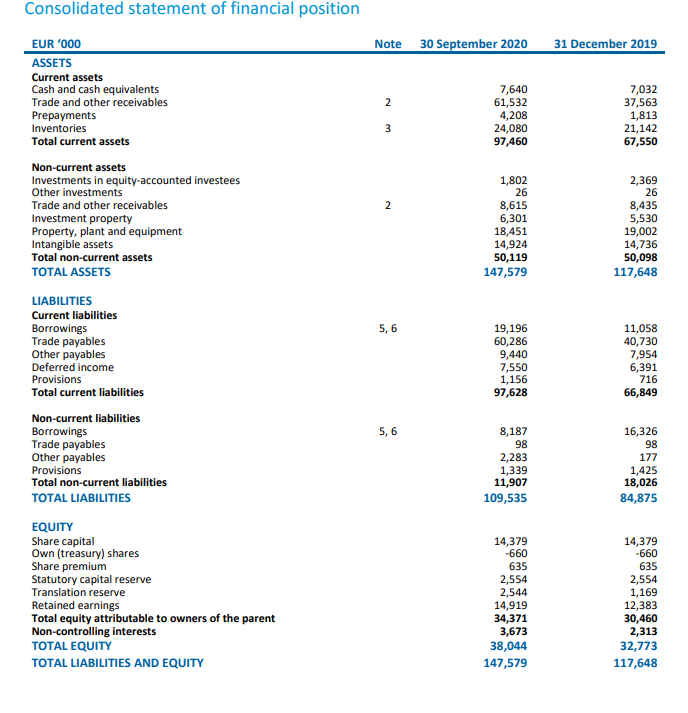

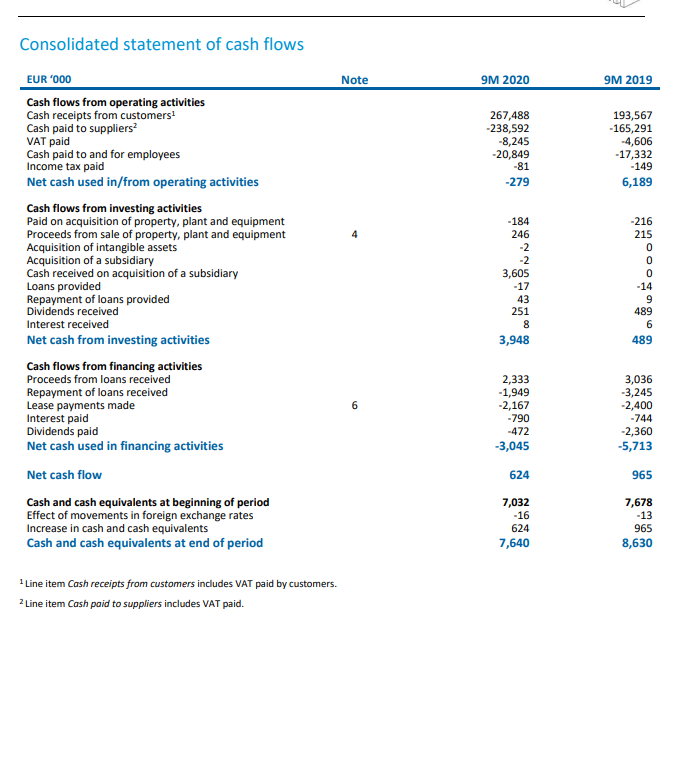

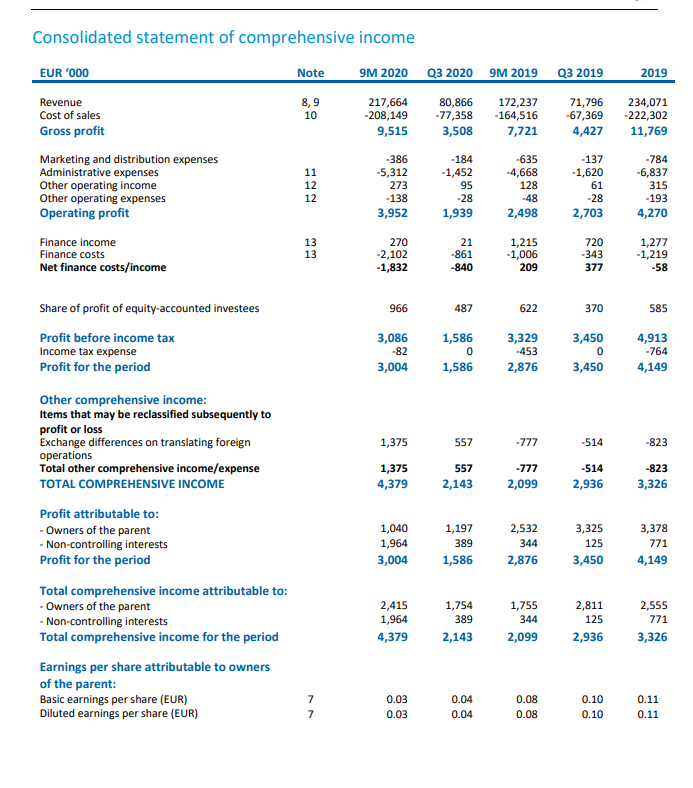

Show all the calculations.

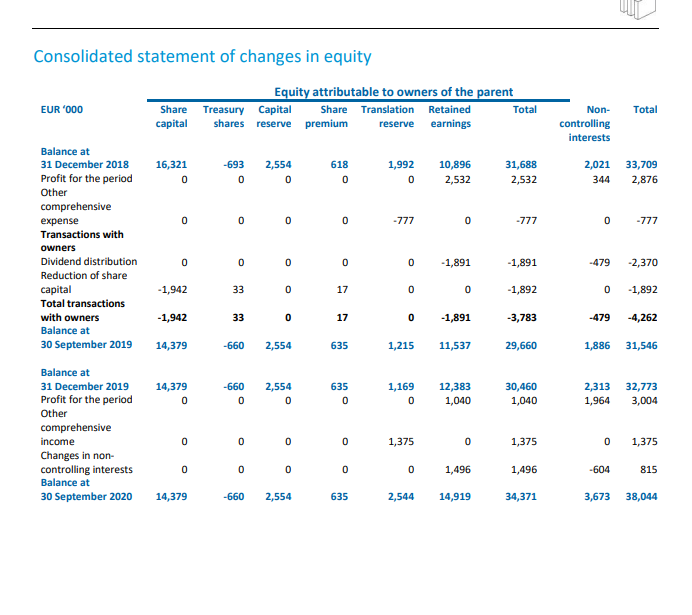

Consolidated statement of financial position Note 30 September 2020 31 December 2019 2 7,640 61,532 4,208 24,080 97,460 7,032 37,563 1,813 21,142 67,550 3 2 EUR '000 ASSETS Current assets Cash and cash equivalents Trade and other receivables Prepayments Inventories Total current assets Non-current assets Investments in equity-accounted investees Other investments Trade and other receivables Investment property Property, plant and equipment Intangible assets Total non-current assets TOTAL ASSETS LIABILITIES Current liabilities Borrowings Trade payables Other payables Deferred income Provisions Total current liabilities Non-current liabilities Borrowings Trade payables Other payables Provisions Total non-current liabilities TOTAL LIABILITIES 1,802 26 8,615 6,301 18,451 14,924 50,119 147,579 2,369 26 8,435 5,530 19,002 14,736 50,098 117,648 5,6 19,196 60,286 9,440 7,550 1,156 97,628 11,058 40,730 7,954 6,391 716 66,849 5, 6 8,187 98 2,283 1,339 11,907 109,535 16,326 98 177 1,425 18,026 84,875 EQUITY Share capital Own (treasury) shares Share premium Statutory capital reserve Translation reserve Retained earnings Total equity attributable to owners of the parent Non-controlling interests TOTAL EQUITY TOTAL LIABILITIES AND EQUITY 14,379 -660 635 2,554 2,544 14,919 34,371 3,673 38,044 147,579 14,379 -660 635 2,554 1,169 12,383 30,460 2,313 32,773 117,648 Consolidated statement of cash flows EUR '000 Note 9M 2020 9M 2019 267,488 -238,592 -8,245 -20,849 -81 -279 193,567 -165,291 -4,606 -17,332 -149 6,189 -184 246 -2 -2 3,605 Cash flows from operating activities Cash receipts from customers Cash paid to suppliers VAT paid Cash paid to and for employees Income tax paid Net cash used in/from operating activities Cash flows from investing activities Paid on acquisition of property, plant and equipment Proceeds from sale of property, plant and equipment Acquisition of intangible assets Acquisition of a subsidiary Cash received on acquisition of a subsidiary Loans provided Repayment of loans provided Dividends received Interest received Net cash from investing activities Cash flows from financing activities Proceeds from loans received Repayment of loans received Lease payments made Interest paid Dividends paid Net cash used in financing activities Net cash flow -216 215 0 0 0 -14 9 489 6 489 -17 43 251 8 3,948 6 2,333 -1,949 -2,167 -790 -472 -3,045 3,036 -3,245 -2,400 -744 -2,360 -5,713 624 965 Cash and cash equivalents at beginning of period Effect of movements in foreign exchange rates Increase in cash and cash equivalents Cash and cash equivalents at end of period 7,032 -16 624 7,640 7,678 -13 965 8,630 1 Line item Cash receipts from customers includes VAT paid by customers. 2 Line item Cash paid to suppliers includes VAT paid. Consolidated statement of comprehensive income EUR '000 Note 9M 2020 Q3 2020 9M 2019 Q3 2019 2019 8,9 10 217,664 -208,149 9,515 80,866 -77,358 3,508 172,237 - 164,516 7,721 71,796 -67,369 4,427 234,071 -222,302 11,769 Revenue Cost of sales Gross profit Marketing and distribution expenses Administrative expenses Other operating income Other operating expenses Operating profit 11 12 12 -386 -5,312 273 -138 3,952 -184 -1,452 95 -28 1,939 -635 -4,668 128 -48 2,498 -137 -1,620 61 -28 2,703 -784 -6,837 315 -193 4,270 Finance income Finance costs Net finance costs/income 13 13 270 -2,102 -1,832 21 -861 -840 1,215 -1,006 209 720 -343 377 1,277 -1,219 -58 Share of profit of equity-accounted investees 966 487 622 370 585 Profit before income tax Income tax expense Profit for the period 3,086 -82 3,004 1,586 0 1,586 3,329 -453 2,876 3,450 0 4,913 -764 4,149 3,450 1,375 557 -777 -514 -823 Other comprehensive income: Items that may be reclassified subsequently to profit or loss Exchange differences on translating foreign operations Total other comprehensive income/expense TOTAL COMPREHENSIVE INCOME Profit attributable to: - Owners of the parent - Non-controlling interests Profit for the period 1,375 4,379 557 2,143 -777 2,099 -514 2,936 -823 3,326 1,040 1,964 3,004 1,197 389 1,586 2,532 344 2,876 3,325 125 3,450 3,378 771 4,149 2,415 1,964 4,379 1,754 389 2,143 1,755 344 2,099 2,811 125 2,555 771 3,326 2,936 Total comprehensive income attributable to: - Owners of the parent - Non-controlling interests Total comprehensive income for the period Earnings per share attributable to owners of the parent: Basic earnings per share (EUR) Diluted earnings per share (EUR) 7 7 0.03 0.03 0.04 0.04 0.08 0.08 0.10 0.10 0.11 0.11 Consolidated statement of changes in equity EUR '000 Equity attributable to owners of the parent Share Treasury Capital Share Translation Retained Total capital shares reserve premium reserve earnings Total Non- controlling interests 16,321 0 -693 0 2,554 0 618 0 1,992 0 10,896 2,532 31,688 2,532 2,021 344 33,709 2,876 0 0 0 0 -777 0 -777 0 -777 Balance at 31 December 2018 Profit for the period Other comprehensive expense Transactions with owners Dividend distribution Reduction of share capital Total transactions with owners Balance at 30 September 2019 0 0 0 0 0 -1,891 -1,891 -479 -2,370 -1,942 33 0 17 0 0 -1,892 0 -1,892 -1,942 33 0 17 0 -1,891 -3,783 -479 -4,262 14,379 -660 2,554 635 1,215 11,537 29,660 1,886 31,546 14,379 0 -660 0 2,554 0 635 0 1,169 0 12,383 1,040 30,460 1,040 2,313 1,964 32,773 3,004 Balance at 31 December 2019 Profit for the period Other comprehensive income Changes in non- controlling interests Balance at 30 September 2020 0 0 0 0 1,375 0 1,375 0 1,375 0 0 0 0 0 1,496 1,496 -604 815 14,379 -660 2,554 635 2,544 14,919 34,371 3,673 38,044 Consolidated statement of financial position Note 30 September 2020 31 December 2019 2 7,640 61,532 4,208 24,080 97,460 7,032 37,563 1,813 21,142 67,550 3 2 EUR '000 ASSETS Current assets Cash and cash equivalents Trade and other receivables Prepayments Inventories Total current assets Non-current assets Investments in equity-accounted investees Other investments Trade and other receivables Investment property Property, plant and equipment Intangible assets Total non-current assets TOTAL ASSETS LIABILITIES Current liabilities Borrowings Trade payables Other payables Deferred income Provisions Total current liabilities Non-current liabilities Borrowings Trade payables Other payables Provisions Total non-current liabilities TOTAL LIABILITIES 1,802 26 8,615 6,301 18,451 14,924 50,119 147,579 2,369 26 8,435 5,530 19,002 14,736 50,098 117,648 5,6 19,196 60,286 9,440 7,550 1,156 97,628 11,058 40,730 7,954 6,391 716 66,849 5, 6 8,187 98 2,283 1,339 11,907 109,535 16,326 98 177 1,425 18,026 84,875 EQUITY Share capital Own (treasury) shares Share premium Statutory capital reserve Translation reserve Retained earnings Total equity attributable to owners of the parent Non-controlling interests TOTAL EQUITY TOTAL LIABILITIES AND EQUITY 14,379 -660 635 2,554 2,544 14,919 34,371 3,673 38,044 147,579 14,379 -660 635 2,554 1,169 12,383 30,460 2,313 32,773 117,648 Consolidated statement of cash flows EUR '000 Note 9M 2020 9M 2019 267,488 -238,592 -8,245 -20,849 -81 -279 193,567 -165,291 -4,606 -17,332 -149 6,189 -184 246 -2 -2 3,605 Cash flows from operating activities Cash receipts from customers Cash paid to suppliers VAT paid Cash paid to and for employees Income tax paid Net cash used in/from operating activities Cash flows from investing activities Paid on acquisition of property, plant and equipment Proceeds from sale of property, plant and equipment Acquisition of intangible assets Acquisition of a subsidiary Cash received on acquisition of a subsidiary Loans provided Repayment of loans provided Dividends received Interest received Net cash from investing activities Cash flows from financing activities Proceeds from loans received Repayment of loans received Lease payments made Interest paid Dividends paid Net cash used in financing activities Net cash flow -216 215 0 0 0 -14 9 489 6 489 -17 43 251 8 3,948 6 2,333 -1,949 -2,167 -790 -472 -3,045 3,036 -3,245 -2,400 -744 -2,360 -5,713 624 965 Cash and cash equivalents at beginning of period Effect of movements in foreign exchange rates Increase in cash and cash equivalents Cash and cash equivalents at end of period 7,032 -16 624 7,640 7,678 -13 965 8,630 1 Line item Cash receipts from customers includes VAT paid by customers. 2 Line item Cash paid to suppliers includes VAT paid. Consolidated statement of comprehensive income EUR '000 Note 9M 2020 Q3 2020 9M 2019 Q3 2019 2019 8,9 10 217,664 -208,149 9,515 80,866 -77,358 3,508 172,237 - 164,516 7,721 71,796 -67,369 4,427 234,071 -222,302 11,769 Revenue Cost of sales Gross profit Marketing and distribution expenses Administrative expenses Other operating income Other operating expenses Operating profit 11 12 12 -386 -5,312 273 -138 3,952 -184 -1,452 95 -28 1,939 -635 -4,668 128 -48 2,498 -137 -1,620 61 -28 2,703 -784 -6,837 315 -193 4,270 Finance income Finance costs Net finance costs/income 13 13 270 -2,102 -1,832 21 -861 -840 1,215 -1,006 209 720 -343 377 1,277 -1,219 -58 Share of profit of equity-accounted investees 966 487 622 370 585 Profit before income tax Income tax expense Profit for the period 3,086 -82 3,004 1,586 0 1,586 3,329 -453 2,876 3,450 0 4,913 -764 4,149 3,450 1,375 557 -777 -514 -823 Other comprehensive income: Items that may be reclassified subsequently to profit or loss Exchange differences on translating foreign operations Total other comprehensive income/expense TOTAL COMPREHENSIVE INCOME Profit attributable to: - Owners of the parent - Non-controlling interests Profit for the period 1,375 4,379 557 2,143 -777 2,099 -514 2,936 -823 3,326 1,040 1,964 3,004 1,197 389 1,586 2,532 344 2,876 3,325 125 3,450 3,378 771 4,149 2,415 1,964 4,379 1,754 389 2,143 1,755 344 2,099 2,811 125 2,555 771 3,326 2,936 Total comprehensive income attributable to: - Owners of the parent - Non-controlling interests Total comprehensive income for the period Earnings per share attributable to owners of the parent: Basic earnings per share (EUR) Diluted earnings per share (EUR) 7 7 0.03 0.03 0.04 0.04 0.08 0.08 0.10 0.10 0.11 0.11 Consolidated statement of changes in equity EUR '000 Equity attributable to owners of the parent Share Treasury Capital Share Translation Retained Total capital shares reserve premium reserve earnings Total Non- controlling interests 16,321 0 -693 0 2,554 0 618 0 1,992 0 10,896 2,532 31,688 2,532 2,021 344 33,709 2,876 0 0 0 0 -777 0 -777 0 -777 Balance at 31 December 2018 Profit for the period Other comprehensive expense Transactions with owners Dividend distribution Reduction of share capital Total transactions with owners Balance at 30 September 2019 0 0 0 0 0 -1,891 -1,891 -479 -2,370 -1,942 33 0 17 0 0 -1,892 0 -1,892 -1,942 33 0 17 0 -1,891 -3,783 -479 -4,262 14,379 -660 2,554 635 1,215 11,537 29,660 1,886 31,546 14,379 0 -660 0 2,554 0 635 0 1,169 0 12,383 1,040 30,460 1,040 2,313 1,964 32,773 3,004 Balance at 31 December 2019 Profit for the period Other comprehensive income Changes in non- controlling interests Balance at 30 September 2020 0 0 0 0 1,375 0 1,375 0 1,375 0 0 0 0 0 1,496 1,496 -604 815 14,379 -660 2,554 635 2,544 14,919 34,371 3,673 38,044