Question

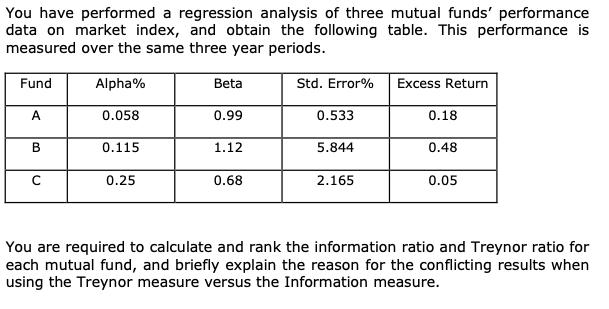

You have performed a regression analysis of three mutual funds' performance data on market index, and obtain the following table. This performance is measured

You have performed a regression analysis of three mutual funds' performance data on market index, and obtain the following table. This performance is measured over the same three year periods. Fund A B Alpha% 0.058 0.115 0.25 Beta 0.99 1.12 0.68 Std. Error% 0.533 5.844 2.165 Excess Return 0.18 0.48 0.05 You are required to calculate and rank the information ratio and Treynor ratio for each mutual fund, and briefly explain the reason for the conflicting results when using the Treynor measure versus the Information measure.

Step by Step Solution

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Information Ratio Treynor Ratio Fund ABC Fund A B Alpha 0058 0115 025 Excess ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting The Impact On Decision Makers

Authors: Gary A. Porter, Curtis L. Norton

10th Edition

1305793196, 978-1305793194

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App