Answered step by step

Verified Expert Solution

Question

1 Approved Answer

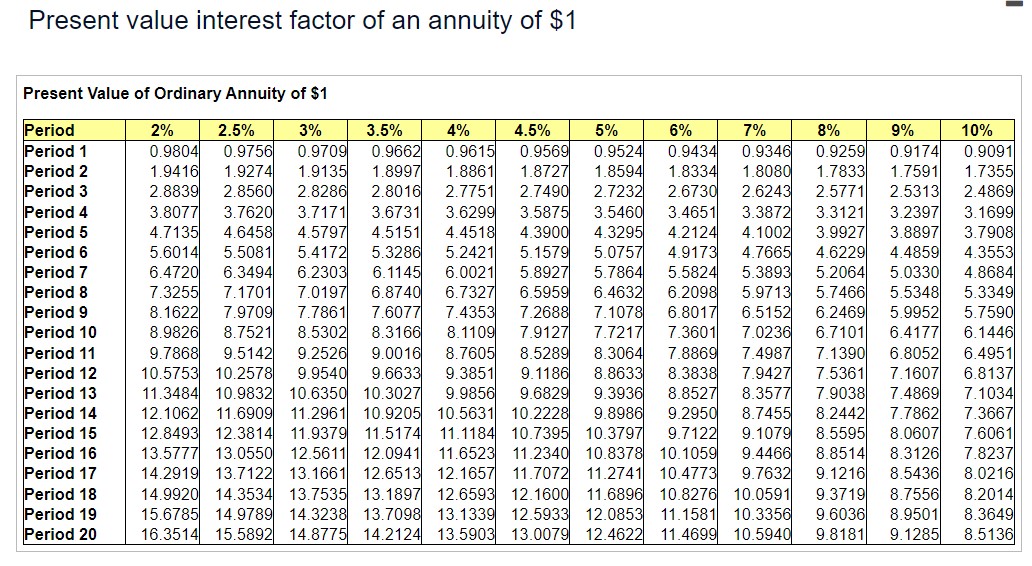

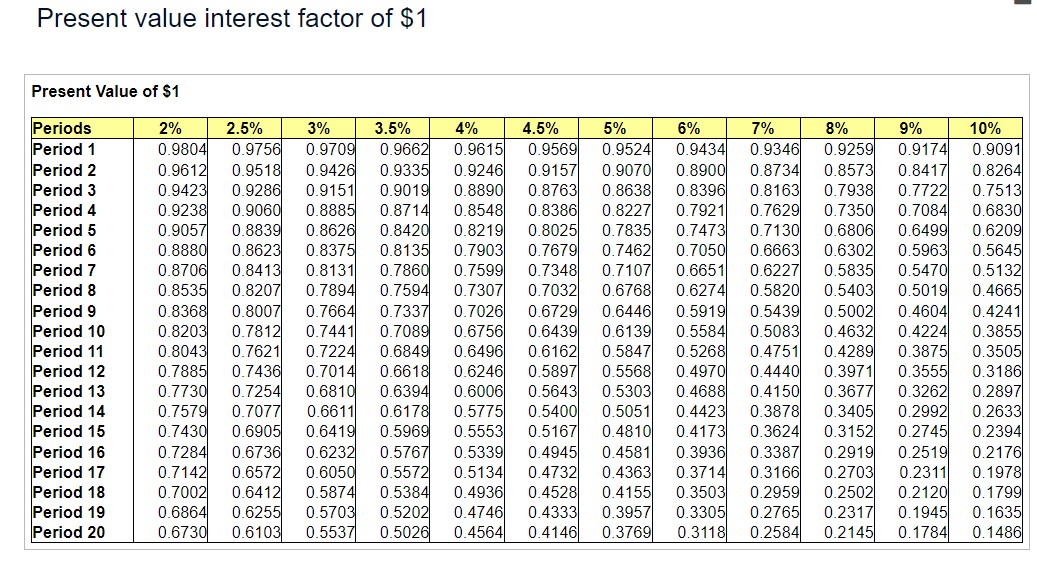

Present value interest factor of an annuity of $1 Present Value of Ordinary Annuity of $1 Present value interest factor of $1 Present Value of

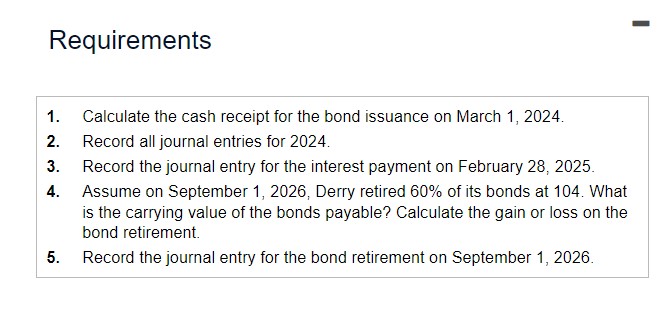

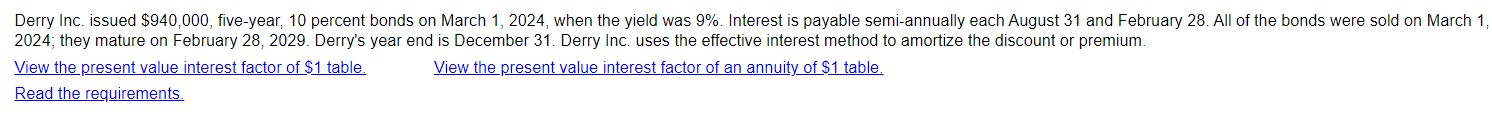

Present value interest factor of an annuity of $1 Present Value of Ordinary Annuity of $1 Present value interest factor of $1 Present Value of $1 Requirements 1. Calculate the cash receipt for the bond issuance on March 1, 2024. 2. Record all journal entries for 2024. 3. Record the journal entry for the interest payment on February 28, 2025. 4. Assume on September 1,2026, Derry retired 60% of its bonds at 104 . What is the carrying value of the bonds payable? Calculate the gain or loss on the bond retirement. 5. Record the journal entry for the bond retirement on September 1, 2026. Derry Inc. issued $940,000, five-year, 10 percent bonds on March 1,2024 , when the yield was 9%. Interest is payable semi-annually each August 31 and February 28 . All of the bonds were sold on March 1 , 2024; they mature on February 28, 2029. Derry's year end is December 31. Derry Inc. uses the effective interest method to amortize the discount or premium. View the present value interest factor of $1 table. View the present value interest factor of an annuity of $1 table. Read the requirements. Present value interest factor of an annuity of $1 Present Value of Ordinary Annuity of $1 Present value interest factor of $1 Present Value of $1 Requirements 1. Calculate the cash receipt for the bond issuance on March 1, 2024. 2. Record all journal entries for 2024. 3. Record the journal entry for the interest payment on February 28, 2025. 4. Assume on September 1,2026, Derry retired 60% of its bonds at 104 . What is the carrying value of the bonds payable? Calculate the gain or loss on the bond retirement. 5. Record the journal entry for the bond retirement on September 1, 2026. Derry Inc. issued $940,000, five-year, 10 percent bonds on March 1,2024 , when the yield was 9%. Interest is payable semi-annually each August 31 and February 28 . All of the bonds were sold on March 1 , 2024; they mature on February 28, 2029. Derry's year end is December 31. Derry Inc. uses the effective interest method to amortize the discount or premium. View the present value interest factor of $1 table. View the present value interest factor of an annuity of $1 table. Read the requirements

Present value interest factor of an annuity of $1 Present Value of Ordinary Annuity of $1 Present value interest factor of $1 Present Value of $1 Requirements 1. Calculate the cash receipt for the bond issuance on March 1, 2024. 2. Record all journal entries for 2024. 3. Record the journal entry for the interest payment on February 28, 2025. 4. Assume on September 1,2026, Derry retired 60% of its bonds at 104 . What is the carrying value of the bonds payable? Calculate the gain or loss on the bond retirement. 5. Record the journal entry for the bond retirement on September 1, 2026. Derry Inc. issued $940,000, five-year, 10 percent bonds on March 1,2024 , when the yield was 9%. Interest is payable semi-annually each August 31 and February 28 . All of the bonds were sold on March 1 , 2024; they mature on February 28, 2029. Derry's year end is December 31. Derry Inc. uses the effective interest method to amortize the discount or premium. View the present value interest factor of $1 table. View the present value interest factor of an annuity of $1 table. Read the requirements. Present value interest factor of an annuity of $1 Present Value of Ordinary Annuity of $1 Present value interest factor of $1 Present Value of $1 Requirements 1. Calculate the cash receipt for the bond issuance on March 1, 2024. 2. Record all journal entries for 2024. 3. Record the journal entry for the interest payment on February 28, 2025. 4. Assume on September 1,2026, Derry retired 60% of its bonds at 104 . What is the carrying value of the bonds payable? Calculate the gain or loss on the bond retirement. 5. Record the journal entry for the bond retirement on September 1, 2026. Derry Inc. issued $940,000, five-year, 10 percent bonds on March 1,2024 , when the yield was 9%. Interest is payable semi-annually each August 31 and February 28 . All of the bonds were sold on March 1 , 2024; they mature on February 28, 2029. Derry's year end is December 31. Derry Inc. uses the effective interest method to amortize the discount or premium. View the present value interest factor of $1 table. View the present value interest factor of an annuity of $1 table. Read the requirements Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started