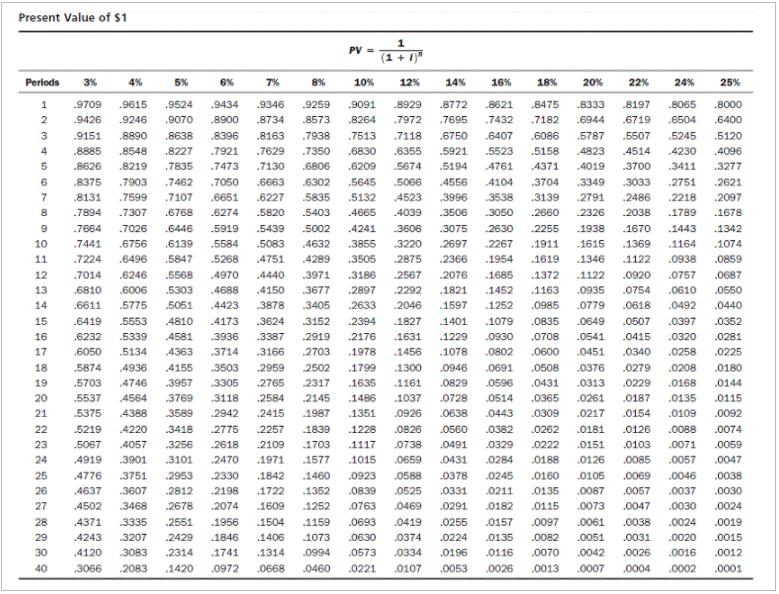

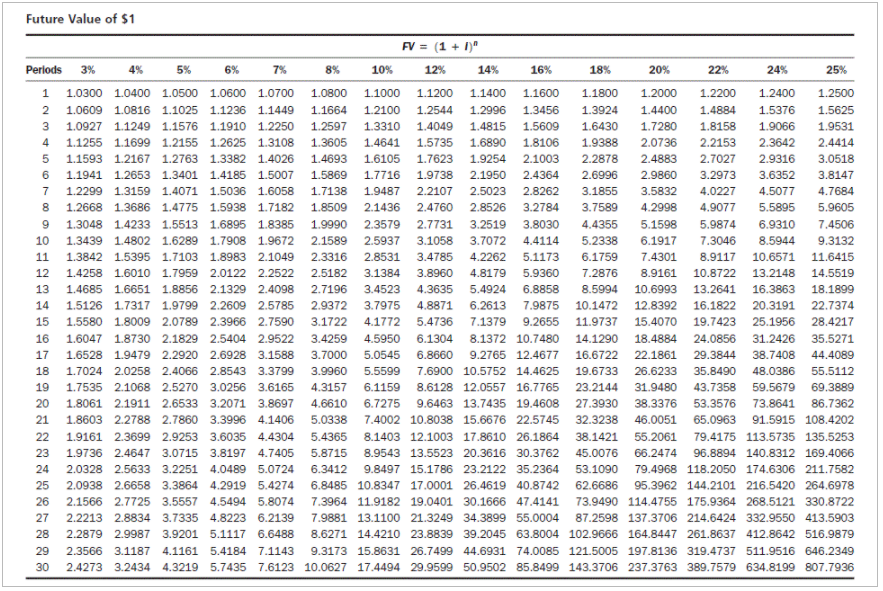

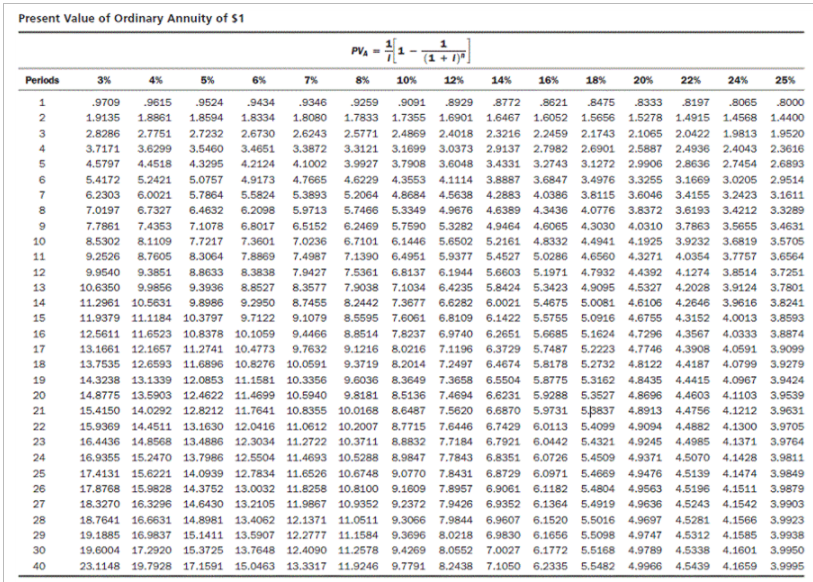

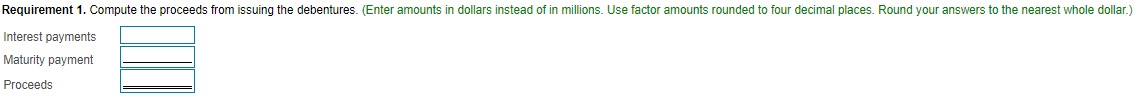

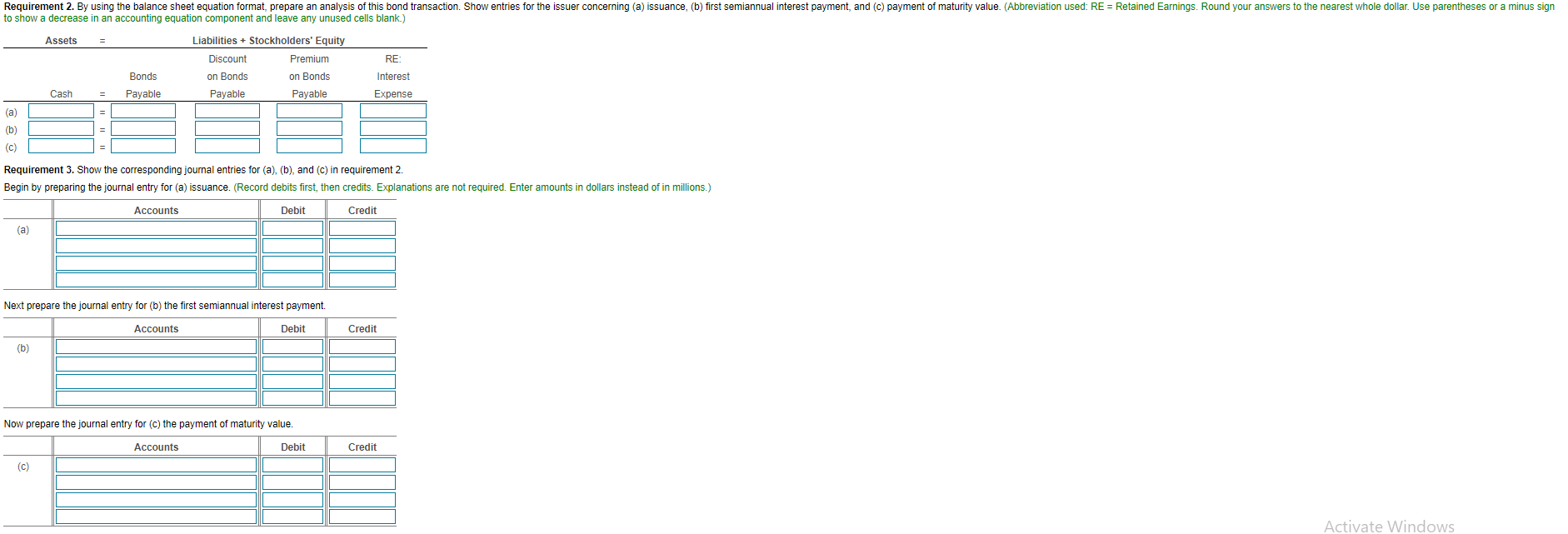

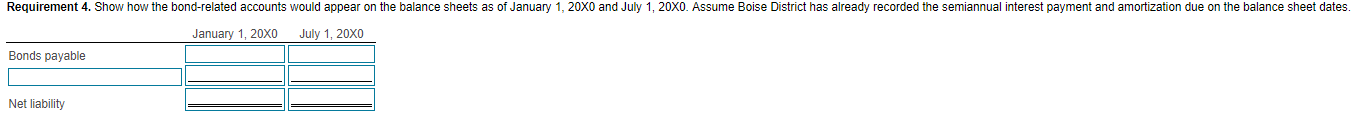

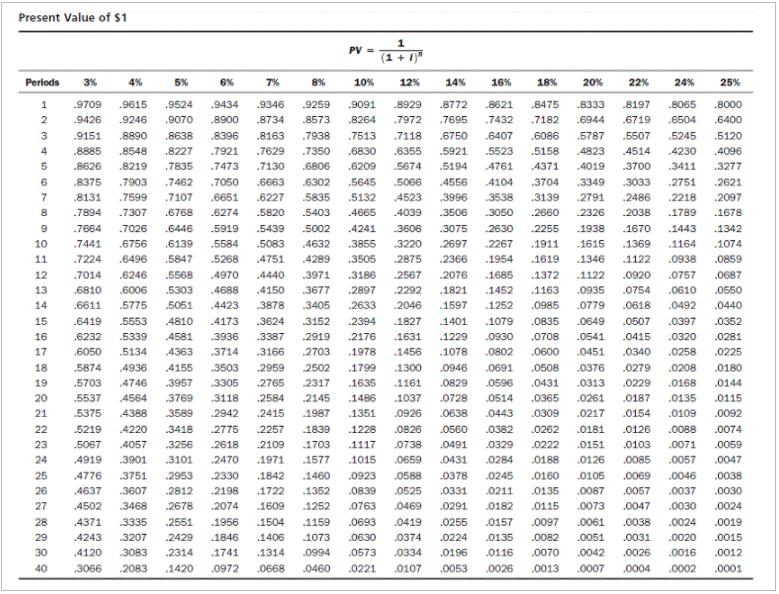

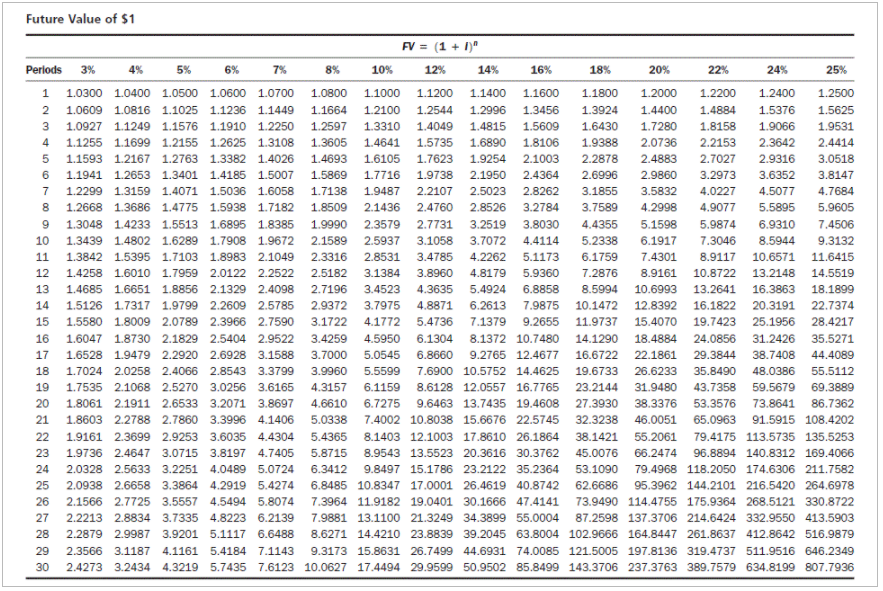

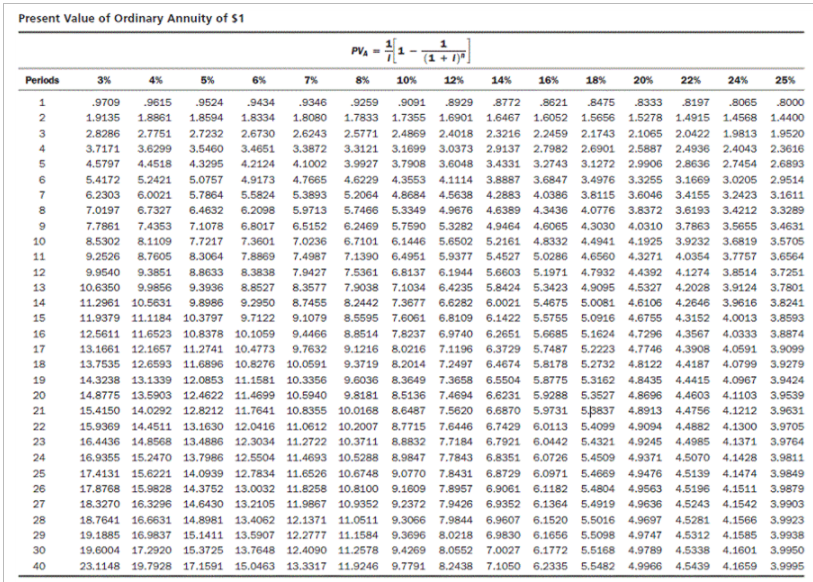

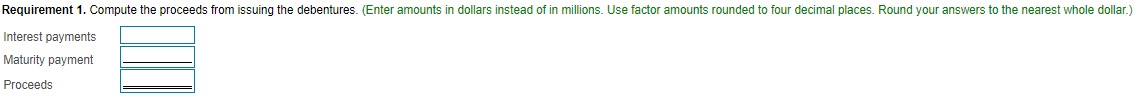

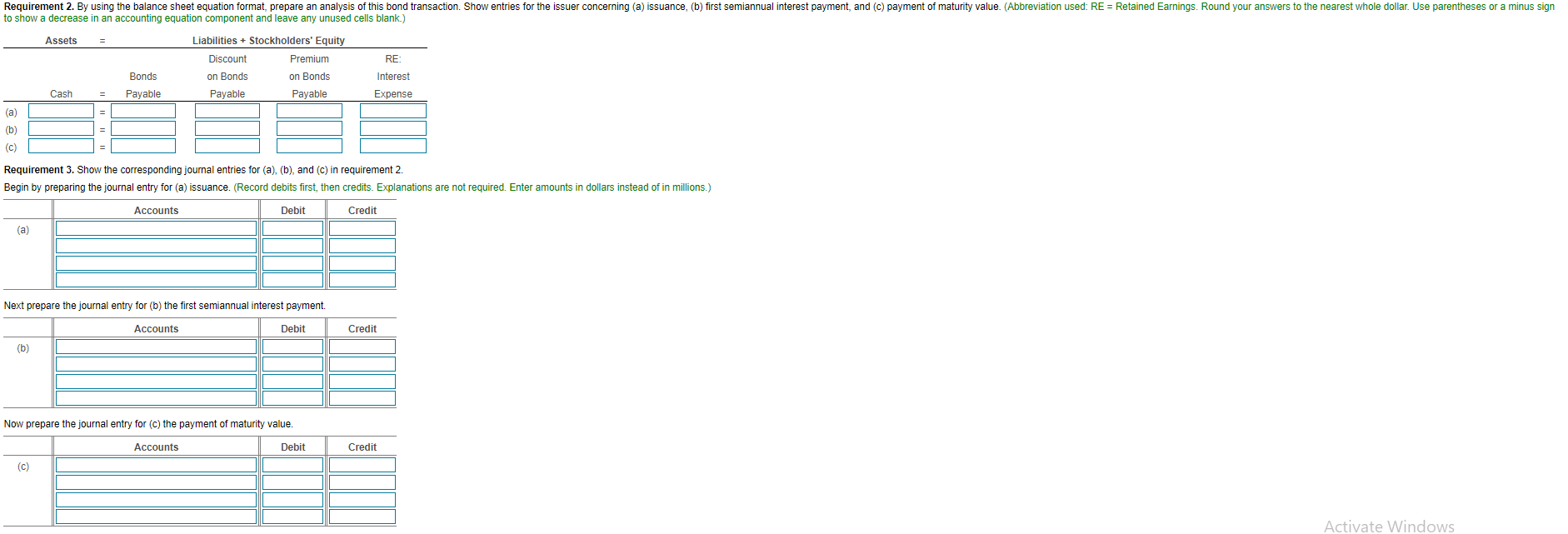

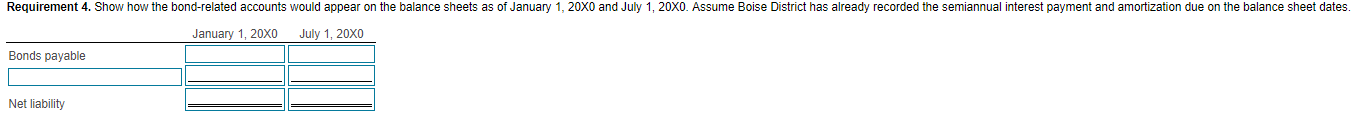

Present Value of $1 PV = 1 (1 + 1)" 3% 4% 5% 6% 7% 8% 10% 12% 14% 16% 18% 20% 22% 24% 25% Periods 1 2 3 4 5 6 7 8 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 40 .9709 .9426 .9151 .8885 .8626 .8375 .8131 .7894 .7664 .7441 .7224 .7014 .6810 .6611 .6419 .6232 .6050 .5874 .5703 .5537 .5375 .5219 .5067 ,4919 .4776 .4637 .4502 4371 .4243 .4120 .3066 .9615 .9246 .8890 .8548 .8219 .7903 .7599 .7307 .7026 .6756 .6496 .6246 .6006 .5775 .5553 .5339 .5134 .4936 .4746 .4564 4388 .4220 .4057 .3901 .3751 .3607 3468 .3335 3207 3083 2083 .9524 .9070 .8638 .8227 .7835 .7462 .7107 .6768 .6446 .6139 .5847 .5568 .5303 .5051 4810 .4581 .4363 .4155 .3957 .3769 3589 .3418 3256 .3101 .2953 .2812 .2678 .2551 .2429 .2314 1420 .9434 .8900 .8396 .7921 .7473 .7050 .6651 .6274 .5919 .5584 .5268 .4970 .4688 .4423 .4173 .3936 .3714 .3503 3305 .3118 .2942 .2775 .2618 .2470 .2330 2198 2074 .1956 .1846 . 1741 .0972 .9346 .8734 .8163 .7629 .7130 .6663 .6227 .5820 .5439 .5083 .4751 .4440 .4150 .3878 .3624 .3387 .3166 .2959 .2765 .2584 .2415 .2257 .2109 .1971 .1842 .1722 1609 .1504 .1406 .1314 .0668 .9259 .8573 .7938 .7350 .6806 .6302 5835 .5403 .5002 .4632 4289 .3971 .3677 .3405 3152 .2919 2703 2502 2317 2145 .1987 .1839 1703 .1577 .1460 .1352 .1252 .1159 .1073 .0994 .0460 .9091 .8264 .7513 .6830 .6209 .5645 .5132 .4665 .4241 .3855 .3505 .3186 2897 .2633 .2394 .2176 .1978 .1799 .1635 .1486 1351 .1228 1117 1015 .0923 .0839 .0763 .0693 .0630 .0573 .0221 .8929 .7972 .7118 .6355 5674 .5066 .4523 4039 3606 3220 .2875 2567 .2292 2046 .1827 1631 .1456 1300 .1161 .1037 .0926 .0826 .0738 .0659 .0588 .0525 .0469 .0419 .0374 .0334 .0107 .8772 .7695 .6750 .5921 .5194 .4556 .3996 .3506 .3075 2697 .2366 .2076 .1821 .1597 .1401 .1229 .1078 .0946 .0829 .0728 .0638 .0560 .0491 .0431 .0378 .0331 .0291 .0255 .0224 .0196 .0053 .8621 .7432 .6407 .5523 4761 .4104 .3538 3050 2630 .2267 . 1954 . 1685 .1452 .1252 .1079 .0930 0802 .0691 0596 .0514 .0443 .0382 .0329 .0284 .0245 .0211 .0182 .0157 .0135 .0116 .0026 .8475 .7182 .6086 .5158 .4371 .3704 .3139 .2660 .2255 .1911 .1619 .1372 .1163 .0985 .0835 .0708 .0600 .0508 .0431 .0365 .0309 .0262 .0222 .0188 .0160 .0135 .0115 .0097 .0082 .0070 .0013 .8333 .6944 .5787 .4823 .4019 .3349 2791 .2326 .1938 .1615 1346 .1122 .0935 .0779 .0649 .0541 .0451 .0376 .0313 .0261 .0217 .0181 .0151 .0126 .0105 .0087 .0073 .0061 .0051 .0042 .0007 .8197 .6719 .5507 .4514 .3700 .3033 .2486 .2038 . 1670 .1369 .1122 .0920 .0754 .0618 .0507 .0415 .0340 .0279 .0229 .0187 .0154 .0126 .0103 .0085 .0069 .0057 .0047 .0038 .0031 .0026 .0004 .8065 .6504 5245 .4230 .3411 .2751 .2218 .1789 .1443 .1164 .0938 .0757 .0610 0492 .0397 .0320 .0258 .0208 .0168 .0135 .0109 .0088 .0071 .0057 .0046 .0037 .0030 .0024 .0020 .0016 .0002 .8000 .6400 .5120 4096 .3277 .2621 2097 .1678 .1342 .1074 .0859 .0687 .0550 .0440 .0352 .0281 .0225 .0180 .0144 .0115 .0092 .0074 .0059 .0047 .0038 .0030 .0024 .0019 .0015 .0012 .0001 Future Value of $1 FV = (1 + 1)" Periods 3% 4% 5% 6% 7% 8% 10% 12% 14% 16% 18% 20% 22% 24% 25% 1 1.0300 1.0400 1.0500 1.0600 1.0700 1.0800 1.1000 1.1200 1.1400 1.1600 1.1800 1.2000 1.2200 1.2400 1.2500 1.0609 1.0816 1.1025 1.1236 1.1449 1.1664 1.2100 1.2544 1.2996 1.3456 1.3924 1.4400 1.4884 1.5376 1.5625 1.0927 1.1249 1.1576 1.1910 1.2250 1.2597 1.3310 1.4049 1.4815 1.5609 1.6430 1.7280 1.8158 1.9066 1.9531 1.1255 1.1699 1.2155 1.2625 1.3108 1.3605 1.4641 1.5735 1.6890 1.8106 1.9388 2.0736 2.2153 2.3642 2.4414 1.1593 1.2167 1.2763 1.3382 1.4026 1.4693 1.6105 1.7623 1.9254 2.1003 2.2878 2.4883 2.7027 2.9316 3.0518 1.1941 1.2653 1.3401 1.4185 1.5007 1.5869 1.7716 1.9738 2.1950 2.4364 2.6996 2.9860 3.2973 3.6352 3.8147 7 1.2299 1.3159 1.4071 1.5036 1.6058 1.7138 1.9487 2.2107 2.5023 2.8262 3.1855 3.5832 4.0227 4.5077 4.7684 8 1.2668 1.3686 1.4775 1.5938 1.7182 1.8509 2.1436 2.4760 2.8526 3.2784 3.7589 4.2998 4.9077 5.5895 5.9605 9 1.3048 1.4233 1.5513 1.6895 1.8385 1.9990 2.3579 2.7731 3.2519 3.8030 4.4355 5.1598 5.9874 6.9310 7.4506 10 1.3439 1.4802 1.6289 1.7908 1.9672 2.1589 2.5937 3.1058 3.7072 4.4114 5.2338 6.1917 7.3046 8.5944 9.3132 11 1.3842 1.5395 1.7103 1.8983 2.1049 2.3316 2.8531 3.4785 4.2262 5.1173 6.1759 7.4301 8.9117 10.6571 11.6415 12 1.4258 1.6010 1.7959 2.0122 2.2522 2.5182 3.1384 3.8960 4.8179 5.9360 7.2876 8.9161 10.8722 13.2148 14.5519 13 1.4685 1.6651 1.8856 2.1329 2.4098 2.7196 3.4523 4.3635 5.4924 6.8858 8.5994 10.6993 13.2641 16.3863 18.1899 14 1.5126 1.7317 1.9799 2.2609 2.5785 2.9372 3.7975 4.8871 6.2613 7.9875 10.1472 12.8392 16.1822 20.3191 22.7374 15 1.5580 1.8009 2.0789 2.3966 2.7590 3.1722 4.1772 5.4736 7.1379 9.2655 11.9737 15.4070 19.7423 25.1956 28.4217 16 1.6047 1.8730 2.1829 2.5404 2.9522 3.4259 4.5950 6.1304 8.1372 10.7480 14.1290 18.4884 24.0856 31.2426 35.5271 17 1.6528 1.9479 2.2920 2.6928 3.1588 3.7000 5.0545 6.8660 9.2765 12.4677 16.6722 22.1861 29.3844 38.7408 44.4089 18 1.7024 2.0258 2.4066 2.8543 3.3799 3.9960 5.5599 7.6900 10.5752 14.4625 19.6733 26.6233 35.8490 48.0386 55.5112 19 1.7535 2.1068 2.5270 3.0256 3.6165 4.3157 6.1159 8.6128 12.0557 16.7765 23.2144 31.9480 43.7358 59.5679 69.3889 20 1.8061 2.1911 2.6533 3.2071 3.8697 4.6610 6.7275 9.6463 13.7435 19.4608 27.3930 38.3376 53.3576 73.8641 86.7362 21 1.8603 2.2788 2.7860 3.3996 4.1406 5.0338 7.4002 10.8038 15.6676 22.5745 32.3238 46.0051 65.0963 91.5915 108.4202 22 1.9161 2.3699 2.9253 3.6035 4.4304 5.4365 8.1403 12.1003 17.8610 26.1864 38.1421 55.2061 79.4175 113.5735 135.5253 23 1.9736 2.4647 3.0715 3.8197 4.7405 5.8715 8.9543 13.5523 20.3616 30.3762 45.0076 66.2474 96.8894 140.8312 169.4066 24 2.0328 2.5633 3.2251 4.0489 5.0724 6.3412 9.8497 15.1786 23.2122 35.2364 53.1090 79.4968 118.2050 174.6306 211.7582 25 2.0938 2.6658 3.3864 4.2919 5.4274 6.8485 10.8347 17.0001 26.4619 40.8742 62.6686 95.3962 144.2101 216.5420 264.6978 26 2.1566 2.7725 3.5557 4.5494 5.8074 7.3964 11.9182 19.0401 30.1666 47.4141 73.9490 114.4755 175.9364 268.5121 330.8722 27 2.2213 2.8834 3.7335 4.8223 6.2139 7.9881 13.1100 21.3249 34.3899 55.0004 87.2598 137.3706 214.6424 332.9550 413.5903 28 2.2879 2.9987 3.9201 5.1117 6.6488 8.6271 14.4210 23.8839 39.2045 63.8004 102.9666 164.8447 261.8637 412.8642 516.9879 29 2.3566 3.1187 4.1161 5.4184 7.1143 9.3173 15.8631 26.7499 44.6931 74.0085 121.5005 197.8136 319.4737 511.9516 646.2349 30 2.4273 3.2434 4.3219 5.7435 7.6123 10.0627 17.4494 29.9599 50.9502 85.8499 143.3706 237.3763 389.7579 634.8199 807.7936 Present Value of Ordinary Annuity of 51 Periods 5% 1 2 3 4 5 6 7 8 9 10 11 12 13 PVA 1- (1 + 1)" 3% 4% 7% 8% 10% 12% 14% 16% 18% 20% 22% 24% 25% .9709 .9615 .9524 .9434 .9346 .9259 .9091 .8929 .8772 .8621 .8475 .8333 .8197 .8065 .8000 1.9135 1.8861 1.8594 1.8334 1.8080 1.7833 1.7355 1.6901 1.6467 1.6052 1.5656 1.5278 1.4915 1.4568 1.4400 2.8286 2.7751 2.7232 2.6730 2.6243 2.5771 2.4869 2.4018 2.3216 2.2459 2.1743 2.1065 2.0422 1.9813 1.9520 3.7171 3.6299 3.5460 3.4651 3.3872 3.3121 3.1699 3.0373 2.9137 2.7982 2.6901 2.5887 2.4936 2.4043 2.3616 4.5797 4.4518 4.3295 4.2124 4.1002 3.9927 3.7908 3.6048 3.4331 3.2743 3.1272 2.9906 2.8636 2.7454 2.6893 5.4172 5.2421 5.0757 4.9173 4.7665 4.6229 4.3553 4.1114 3.8887 3.6847 3.4976 3.3255 3.1669 3.0205 2.9514 6.2303 6.0021 5.7864 5.5824 5.3893 5.2064 4.8684 4.5638 4.2883 4.0386 3.8115 3.6046 3.4155 3.2423 3.1611 7.0197 6.7327 6.4632 6.2098 5.9713 5.7466 5.3349 4.9676 4.6389 4.3436 4.0776 3.8372 3.6193 3.4212 3.3289 7.7861 7.4353 7.1078 6.8017 6.5152 6.2469 5.7590 5.3282 4.9464 4.6065 4.3030 4.0310 3.7863 3.5655 3.4631 8.5302 8.1109 7.7217 7.3601 7.0236 6.7101 6.1446 5.6502 5.2161 4.8332 4,4941 4.1925 3.9232 3.6819 3.5705 9.2526 8.7605 8.3064 7.8869 7.4987 7.1390 6.4951 5.9377 5.4527 5.0286 4.6560 4.3271 4.0354 3.7757 3.6564 9.9540 9.3851 8.8633 8.3838 7.9427 7.5361 6.8137 6.1944 5.6603 5.1971 4.7932 4.4392 4.1274 3.8514 3.7251 10.6350 9.9856 9.3936 8.8527 8.3577 7.9038 7.1034 6.4235 5.8424 5.3423 4.9095 4.5327 4.2028 3.9124 3.7801 11.2961 10.5631 9.8986 9.2950 8.7455 8.2442 7.3677 6.6282 6.0021 5.4675 5.0081 4.6106 4.2646 3.9616 3.8241 11.9379 11.1184 10.3797 9.7122 9.1079 8.5595 7.6061 6.8109 6.1422 5.5755 5.0916 4.6755 4.3152 4.0013 3.8593 12.5611 11.6523 10.8378 10.1059 9.4466 8.8514 7.8237 6.9740 6.2651 5.6685 5.1624 4.7296 4.3567 4.0333 3.8874 13.1661 12.1657 11.2741 10.4773 9.7632 9.1216 8.0216 7.1196 6.3729 5.7487 5.2223 4.7746 4.3908 4.0591 3.9099 13.7535 12.6593 11.6896 10.8276 10.0591 9.3719 8.2014 7.2497 6.4674 5.8178 5.2732 4.8122 4.4187 4.0799 3.9279 14.3238 13.1339 12.0853 11.1581 10.3356 9.6036 8.3649 7.3658 6.5504 5.8775 5.3162 4.8435 4.4415 4.0967 3.9424 14.8775 13.5903 12.4622 11.4699 10.5940 9.8181 8.5136 7.4694 6.6231 5.9288 5.3527 4.8696 4.4603 4.1103 3.9539 15.4150 14.0292 12.8212 11.7641 10.8355 10.0168 8.6487 7.5620 6.6870 5.9731 5.3837 4.8913 4.4756 4.1212 3.9631 15.9369 14.4511 13.1630 12.0416 11.0612 10.2007 8.7715 7.6446 6.7429 6.01.13 5.4099 4.9094 4.4882 4.1300 3.9705 16.4436 14.8568 13.4886 12.3034 11.2722 10.3711 8.8832 7.7184 6.7921 6.0442 5.4321 4.9245 4.4985 4.1371 3.9764 16.9355 15.2470 13.7986 12.5504 11.4693 10.5288 8.9847 7.7843 6.8351 6.0726 5.4509 4.9371 4.5070 4.1428 3.9811 17.4131 15.6221 14.0939 12.7834 11.6526 10.6748 9.0770 7.8431 6.8729 6.0971 5.4669 4.9476 4.5139 4.1474 3.9849 17.8768 15.9828 14.3752 13.0032 11.8258 10.8100 9.1609 7.8957 6.9061 6.1182 5.4804 4.9563 4.5196 4.1511 3.9879 18.3270 16.3296 14.6430 13.2105 11.9867 10.9352 9.2372 7.9426 6.9352 6.1364 5.4919 4.9636 4.5243 4.1542 3.9903 18.7641 16.6631 14.8981 13.4062 12.1371 11.0511 9.3066 7.9844 6.9607 6.1520 5.5016 4.9697 4.5281 4.1566 3.9923 19.1885 16.9837 15.1411 13.5907 12.2777 11.1584 9.3696 8.0218 6.9830 6.1656 5.5098 4.9747 4.5312 4.1585 3.9938 19.6004 17.2920 15.3725 13.7648 12.4090 11.2578 9.4269 8.0552 7.0027 6.1772 5.5168 4.9789 4.5338 4.1601 3.9950 23.1148 19.7928 17.1591 15.0463 13.3317 11.9246 9.7791 8.2438 7.1050 6.2335 5.5482 4.9966 4.5439 4.1659 3.9995 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 40 Requirement 1. Compute the proceeds from issuing the debentures. (Enter amounts in dollars instead of in millions. Use factor amounts rounded to four decimal places. Round your answers to the nearest whole dollar.) Interest payments Maturity payment Proceeds Requirement 2. By using the balance sheet equation format, prepare an analysis of this bond transaction. Show entries for the issuer concerning (a) issuance, (b) first semiannual interest payment, and (c) payment of maturity value. (Abbreviation used: RE = Retained Earnings. Round your answers to the nearest whole dollar. Use parentheses or a minus sign to show a decrease in an accounting equation component and leave any unused cells blank.) Assets Liabilities + Stockholders' Equity Discount Premium RE: Bonds on Bonds on Bonds Interest Cash Payable Payable Payable Expense (a) = (b) Requirement 3. Show the corresponding journal entries for (a), (b), and (c) in requirement 2. Begin by preparing the journal entry for (a) issuance. (Record debits first, then credits. Explanations are not required. Enter amounts in dollars instead of in millions.) Accounts Debit Credit (a) Next prepare the journal entry for (b) the first semiannual interest payment. Accounts Debit Credit (b) Now prepare the journal entry for (C) the payment of maturity value. Accounts Debit Credit (c) Activate Windows Requirement 4. Show how the bond-related accounts would appear on the balance sheets as of January 1, 20X0 and July 1, 20X0. Assume Boise District has already recorded the semiannual interest payment and amortization due on the balance sheet dates. January 1, 20X0 July 1, 20X0 Bonds payable Net liability Present Value of $1 PV = 1 (1 + 1)" 3% 4% 5% 6% 7% 8% 10% 12% 14% 16% 18% 20% 22% 24% 25% Periods 1 2 3 4 5 6 7 8 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 40 .9709 .9426 .9151 .8885 .8626 .8375 .8131 .7894 .7664 .7441 .7224 .7014 .6810 .6611 .6419 .6232 .6050 .5874 .5703 .5537 .5375 .5219 .5067 ,4919 .4776 .4637 .4502 4371 .4243 .4120 .3066 .9615 .9246 .8890 .8548 .8219 .7903 .7599 .7307 .7026 .6756 .6496 .6246 .6006 .5775 .5553 .5339 .5134 .4936 .4746 .4564 4388 .4220 .4057 .3901 .3751 .3607 3468 .3335 3207 3083 2083 .9524 .9070 .8638 .8227 .7835 .7462 .7107 .6768 .6446 .6139 .5847 .5568 .5303 .5051 4810 .4581 .4363 .4155 .3957 .3769 3589 .3418 3256 .3101 .2953 .2812 .2678 .2551 .2429 .2314 1420 .9434 .8900 .8396 .7921 .7473 .7050 .6651 .6274 .5919 .5584 .5268 .4970 .4688 .4423 .4173 .3936 .3714 .3503 3305 .3118 .2942 .2775 .2618 .2470 .2330 2198 2074 .1956 .1846 . 1741 .0972 .9346 .8734 .8163 .7629 .7130 .6663 .6227 .5820 .5439 .5083 .4751 .4440 .4150 .3878 .3624 .3387 .3166 .2959 .2765 .2584 .2415 .2257 .2109 .1971 .1842 .1722 1609 .1504 .1406 .1314 .0668 .9259 .8573 .7938 .7350 .6806 .6302 5835 .5403 .5002 .4632 4289 .3971 .3677 .3405 3152 .2919 2703 2502 2317 2145 .1987 .1839 1703 .1577 .1460 .1352 .1252 .1159 .1073 .0994 .0460 .9091 .8264 .7513 .6830 .6209 .5645 .5132 .4665 .4241 .3855 .3505 .3186 2897 .2633 .2394 .2176 .1978 .1799 .1635 .1486 1351 .1228 1117 1015 .0923 .0839 .0763 .0693 .0630 .0573 .0221 .8929 .7972 .7118 .6355 5674 .5066 .4523 4039 3606 3220 .2875 2567 .2292 2046 .1827 1631 .1456 1300 .1161 .1037 .0926 .0826 .0738 .0659 .0588 .0525 .0469 .0419 .0374 .0334 .0107 .8772 .7695 .6750 .5921 .5194 .4556 .3996 .3506 .3075 2697 .2366 .2076 .1821 .1597 .1401 .1229 .1078 .0946 .0829 .0728 .0638 .0560 .0491 .0431 .0378 .0331 .0291 .0255 .0224 .0196 .0053 .8621 .7432 .6407 .5523 4761 .4104 .3538 3050 2630 .2267 . 1954 . 1685 .1452 .1252 .1079 .0930 0802 .0691 0596 .0514 .0443 .0382 .0329 .0284 .0245 .0211 .0182 .0157 .0135 .0116 .0026 .8475 .7182 .6086 .5158 .4371 .3704 .3139 .2660 .2255 .1911 .1619 .1372 .1163 .0985 .0835 .0708 .0600 .0508 .0431 .0365 .0309 .0262 .0222 .0188 .0160 .0135 .0115 .0097 .0082 .0070 .0013 .8333 .6944 .5787 .4823 .4019 .3349 2791 .2326 .1938 .1615 1346 .1122 .0935 .0779 .0649 .0541 .0451 .0376 .0313 .0261 .0217 .0181 .0151 .0126 .0105 .0087 .0073 .0061 .0051 .0042 .0007 .8197 .6719 .5507 .4514 .3700 .3033 .2486 .2038 . 1670 .1369 .1122 .0920 .0754 .0618 .0507 .0415 .0340 .0279 .0229 .0187 .0154 .0126 .0103 .0085 .0069 .0057 .0047 .0038 .0031 .0026 .0004 .8065 .6504 5245 .4230 .3411 .2751 .2218 .1789 .1443 .1164 .0938 .0757 .0610 0492 .0397 .0320 .0258 .0208 .0168 .0135 .0109 .0088 .0071 .0057 .0046 .0037 .0030 .0024 .0020 .0016 .0002 .8000 .6400 .5120 4096 .3277 .2621 2097 .1678 .1342 .1074 .0859 .0687 .0550 .0440 .0352 .0281 .0225 .0180 .0144 .0115 .0092 .0074 .0059 .0047 .0038 .0030 .0024 .0019 .0015 .0012 .0001 Future Value of $1 FV = (1 + 1)" Periods 3% 4% 5% 6% 7% 8% 10% 12% 14% 16% 18% 20% 22% 24% 25% 1 1.0300 1.0400 1.0500 1.0600 1.0700 1.0800 1.1000 1.1200 1.1400 1.1600 1.1800 1.2000 1.2200 1.2400 1.2500 1.0609 1.0816 1.1025 1.1236 1.1449 1.1664 1.2100 1.2544 1.2996 1.3456 1.3924 1.4400 1.4884 1.5376 1.5625 1.0927 1.1249 1.1576 1.1910 1.2250 1.2597 1.3310 1.4049 1.4815 1.5609 1.6430 1.7280 1.8158 1.9066 1.9531 1.1255 1.1699 1.2155 1.2625 1.3108 1.3605 1.4641 1.5735 1.6890 1.8106 1.9388 2.0736 2.2153 2.3642 2.4414 1.1593 1.2167 1.2763 1.3382 1.4026 1.4693 1.6105 1.7623 1.9254 2.1003 2.2878 2.4883 2.7027 2.9316 3.0518 1.1941 1.2653 1.3401 1.4185 1.5007 1.5869 1.7716 1.9738 2.1950 2.4364 2.6996 2.9860 3.2973 3.6352 3.8147 7 1.2299 1.3159 1.4071 1.5036 1.6058 1.7138 1.9487 2.2107 2.5023 2.8262 3.1855 3.5832 4.0227 4.5077 4.7684 8 1.2668 1.3686 1.4775 1.5938 1.7182 1.8509 2.1436 2.4760 2.8526 3.2784 3.7589 4.2998 4.9077 5.5895 5.9605 9 1.3048 1.4233 1.5513 1.6895 1.8385 1.9990 2.3579 2.7731 3.2519 3.8030 4.4355 5.1598 5.9874 6.9310 7.4506 10 1.3439 1.4802 1.6289 1.7908 1.9672 2.1589 2.5937 3.1058 3.7072 4.4114 5.2338 6.1917 7.3046 8.5944 9.3132 11 1.3842 1.5395 1.7103 1.8983 2.1049 2.3316 2.8531 3.4785 4.2262 5.1173 6.1759 7.4301 8.9117 10.6571 11.6415 12 1.4258 1.6010 1.7959 2.0122 2.2522 2.5182 3.1384 3.8960 4.8179 5.9360 7.2876 8.9161 10.8722 13.2148 14.5519 13 1.4685 1.6651 1.8856 2.1329 2.4098 2.7196 3.4523 4.3635 5.4924 6.8858 8.5994 10.6993 13.2641 16.3863 18.1899 14 1.5126 1.7317 1.9799 2.2609 2.5785 2.9372 3.7975 4.8871 6.2613 7.9875 10.1472 12.8392 16.1822 20.3191 22.7374 15 1.5580 1.8009 2.0789 2.3966 2.7590 3.1722 4.1772 5.4736 7.1379 9.2655 11.9737 15.4070 19.7423 25.1956 28.4217 16 1.6047 1.8730 2.1829 2.5404 2.9522 3.4259 4.5950 6.1304 8.1372 10.7480 14.1290 18.4884 24.0856 31.2426 35.5271 17 1.6528 1.9479 2.2920 2.6928 3.1588 3.7000 5.0545 6.8660 9.2765 12.4677 16.6722 22.1861 29.3844 38.7408 44.4089 18 1.7024 2.0258 2.4066 2.8543 3.3799 3.9960 5.5599 7.6900 10.5752 14.4625 19.6733 26.6233 35.8490 48.0386 55.5112 19 1.7535 2.1068 2.5270 3.0256 3.6165 4.3157 6.1159 8.6128 12.0557 16.7765 23.2144 31.9480 43.7358 59.5679 69.3889 20 1.8061 2.1911 2.6533 3.2071 3.8697 4.6610 6.7275 9.6463 13.7435 19.4608 27.3930 38.3376 53.3576 73.8641 86.7362 21 1.8603 2.2788 2.7860 3.3996 4.1406 5.0338 7.4002 10.8038 15.6676 22.5745 32.3238 46.0051 65.0963 91.5915 108.4202 22 1.9161 2.3699 2.9253 3.6035 4.4304 5.4365 8.1403 12.1003 17.8610 26.1864 38.1421 55.2061 79.4175 113.5735 135.5253 23 1.9736 2.4647 3.0715 3.8197 4.7405 5.8715 8.9543 13.5523 20.3616 30.3762 45.0076 66.2474 96.8894 140.8312 169.4066 24 2.0328 2.5633 3.2251 4.0489 5.0724 6.3412 9.8497 15.1786 23.2122 35.2364 53.1090 79.4968 118.2050 174.6306 211.7582 25 2.0938 2.6658 3.3864 4.2919 5.4274 6.8485 10.8347 17.0001 26.4619 40.8742 62.6686 95.3962 144.2101 216.5420 264.6978 26 2.1566 2.7725 3.5557 4.5494 5.8074 7.3964 11.9182 19.0401 30.1666 47.4141 73.9490 114.4755 175.9364 268.5121 330.8722 27 2.2213 2.8834 3.7335 4.8223 6.2139 7.9881 13.1100 21.3249 34.3899 55.0004 87.2598 137.3706 214.6424 332.9550 413.5903 28 2.2879 2.9987 3.9201 5.1117 6.6488 8.6271 14.4210 23.8839 39.2045 63.8004 102.9666 164.8447 261.8637 412.8642 516.9879 29 2.3566 3.1187 4.1161 5.4184 7.1143 9.3173 15.8631 26.7499 44.6931 74.0085 121.5005 197.8136 319.4737 511.9516 646.2349 30 2.4273 3.2434 4.3219 5.7435 7.6123 10.0627 17.4494 29.9599 50.9502 85.8499 143.3706 237.3763 389.7579 634.8199 807.7936 Present Value of Ordinary Annuity of 51 Periods 5% 1 2 3 4 5 6 7 8 9 10 11 12 13 PVA 1- (1 + 1)" 3% 4% 7% 8% 10% 12% 14% 16% 18% 20% 22% 24% 25% .9709 .9615 .9524 .9434 .9346 .9259 .9091 .8929 .8772 .8621 .8475 .8333 .8197 .8065 .8000 1.9135 1.8861 1.8594 1.8334 1.8080 1.7833 1.7355 1.6901 1.6467 1.6052 1.5656 1.5278 1.4915 1.4568 1.4400 2.8286 2.7751 2.7232 2.6730 2.6243 2.5771 2.4869 2.4018 2.3216 2.2459 2.1743 2.1065 2.0422 1.9813 1.9520 3.7171 3.6299 3.5460 3.4651 3.3872 3.3121 3.1699 3.0373 2.9137 2.7982 2.6901 2.5887 2.4936 2.4043 2.3616 4.5797 4.4518 4.3295 4.2124 4.1002 3.9927 3.7908 3.6048 3.4331 3.2743 3.1272 2.9906 2.8636 2.7454 2.6893 5.4172 5.2421 5.0757 4.9173 4.7665 4.6229 4.3553 4.1114 3.8887 3.6847 3.4976 3.3255 3.1669 3.0205 2.9514 6.2303 6.0021 5.7864 5.5824 5.3893 5.2064 4.8684 4.5638 4.2883 4.0386 3.8115 3.6046 3.4155 3.2423 3.1611 7.0197 6.7327 6.4632 6.2098 5.9713 5.7466 5.3349 4.9676 4.6389 4.3436 4.0776 3.8372 3.6193 3.4212 3.3289 7.7861 7.4353 7.1078 6.8017 6.5152 6.2469 5.7590 5.3282 4.9464 4.6065 4.3030 4.0310 3.7863 3.5655 3.4631 8.5302 8.1109 7.7217 7.3601 7.0236 6.7101 6.1446 5.6502 5.2161 4.8332 4,4941 4.1925 3.9232 3.6819 3.5705 9.2526 8.7605 8.3064 7.8869 7.4987 7.1390 6.4951 5.9377 5.4527 5.0286 4.6560 4.3271 4.0354 3.7757 3.6564 9.9540 9.3851 8.8633 8.3838 7.9427 7.5361 6.8137 6.1944 5.6603 5.1971 4.7932 4.4392 4.1274 3.8514 3.7251 10.6350 9.9856 9.3936 8.8527 8.3577 7.9038 7.1034 6.4235 5.8424 5.3423 4.9095 4.5327 4.2028 3.9124 3.7801 11.2961 10.5631 9.8986 9.2950 8.7455 8.2442 7.3677 6.6282 6.0021 5.4675 5.0081 4.6106 4.2646 3.9616 3.8241 11.9379 11.1184 10.3797 9.7122 9.1079 8.5595 7.6061 6.8109 6.1422 5.5755 5.0916 4.6755 4.3152 4.0013 3.8593 12.5611 11.6523 10.8378 10.1059 9.4466 8.8514 7.8237 6.9740 6.2651 5.6685 5.1624 4.7296 4.3567 4.0333 3.8874 13.1661 12.1657 11.2741 10.4773 9.7632 9.1216 8.0216 7.1196 6.3729 5.7487 5.2223 4.7746 4.3908 4.0591 3.9099 13.7535 12.6593 11.6896 10.8276 10.0591 9.3719 8.2014 7.2497 6.4674 5.8178 5.2732 4.8122 4.4187 4.0799 3.9279 14.3238 13.1339 12.0853 11.1581 10.3356 9.6036 8.3649 7.3658 6.5504 5.8775 5.3162 4.8435 4.4415 4.0967 3.9424 14.8775 13.5903 12.4622 11.4699 10.5940 9.8181 8.5136 7.4694 6.6231 5.9288 5.3527 4.8696 4.4603 4.1103 3.9539 15.4150 14.0292 12.8212 11.7641 10.8355 10.0168 8.6487 7.5620 6.6870 5.9731 5.3837 4.8913 4.4756 4.1212 3.9631 15.9369 14.4511 13.1630 12.0416 11.0612 10.2007 8.7715 7.6446 6.7429 6.01.13 5.4099 4.9094 4.4882 4.1300 3.9705 16.4436 14.8568 13.4886 12.3034 11.2722 10.3711 8.8832 7.7184 6.7921 6.0442 5.4321 4.9245 4.4985 4.1371 3.9764 16.9355 15.2470 13.7986 12.5504 11.4693 10.5288 8.9847 7.7843 6.8351 6.0726 5.4509 4.9371 4.5070 4.1428 3.9811 17.4131 15.6221 14.0939 12.7834 11.6526 10.6748 9.0770 7.8431 6.8729 6.0971 5.4669 4.9476 4.5139 4.1474 3.9849 17.8768 15.9828 14.3752 13.0032 11.8258 10.8100 9.1609 7.8957 6.9061 6.1182 5.4804 4.9563 4.5196 4.1511 3.9879 18.3270 16.3296 14.6430 13.2105 11.9867 10.9352 9.2372 7.9426 6.9352 6.1364 5.4919 4.9636 4.5243 4.1542 3.9903 18.7641 16.6631 14.8981 13.4062 12.1371 11.0511 9.3066 7.9844 6.9607 6.1520 5.5016 4.9697 4.5281 4.1566 3.9923 19.1885 16.9837 15.1411 13.5907 12.2777 11.1584 9.3696 8.0218 6.9830 6.1656 5.5098 4.9747 4.5312 4.1585 3.9938 19.6004 17.2920 15.3725 13.7648 12.4090 11.2578 9.4269 8.0552 7.0027 6.1772 5.5168 4.9789 4.5338 4.1601 3.9950 23.1148 19.7928 17.1591 15.0463 13.3317 11.9246 9.7791 8.2438 7.1050 6.2335 5.5482 4.9966 4.5439 4.1659 3.9995 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 40 Requirement 1. Compute the proceeds from issuing the debentures. (Enter amounts in dollars instead of in millions. Use factor amounts rounded to four decimal places. Round your answers to the nearest whole dollar.) Interest payments Maturity payment Proceeds Requirement 2. By using the balance sheet equation format, prepare an analysis of this bond transaction. Show entries for the issuer concerning (a) issuance, (b) first semiannual interest payment, and (c) payment of maturity value. (Abbreviation used: RE = Retained Earnings. Round your answers to the nearest whole dollar. Use parentheses or a minus sign to show a decrease in an accounting equation component and leave any unused cells blank.) Assets Liabilities + Stockholders' Equity Discount Premium RE: Bonds on Bonds on Bonds Interest Cash Payable Payable Payable Expense (a) = (b) Requirement 3. Show the corresponding journal entries for (a), (b), and (c) in requirement 2. Begin by preparing the journal entry for (a) issuance. (Record debits first, then credits. Explanations are not required. Enter amounts in dollars instead of in millions.) Accounts Debit Credit (a) Next prepare the journal entry for (b) the first semiannual interest payment. Accounts Debit Credit (b) Now prepare the journal entry for (C) the payment of maturity value. Accounts Debit Credit (c) Activate Windows Requirement 4. Show how the bond-related accounts would appear on the balance sheets as of January 1, 20X0 and July 1, 20X0. Assume Boise District has already recorded the semiannual interest payment and amortization due on the balance sheet dates. January 1, 20X0 July 1, 20X0 Bonds payable Net liability