Answered step by step

Verified Expert Solution

Question

1 Approved Answer

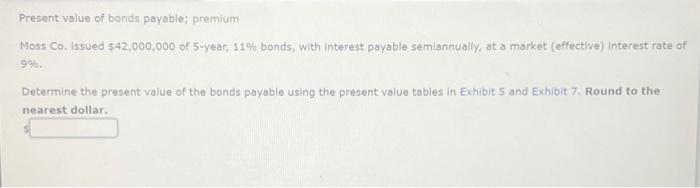

Present value of bonds payable; premium Moss Co. issued $42,000,000 of 5-year, 11% bonds, with interest payable semiannually, at a market (effective) interest rate

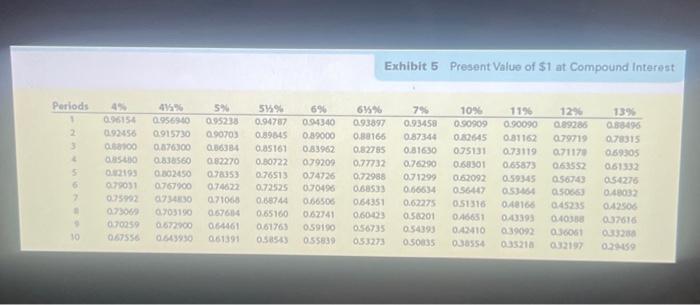

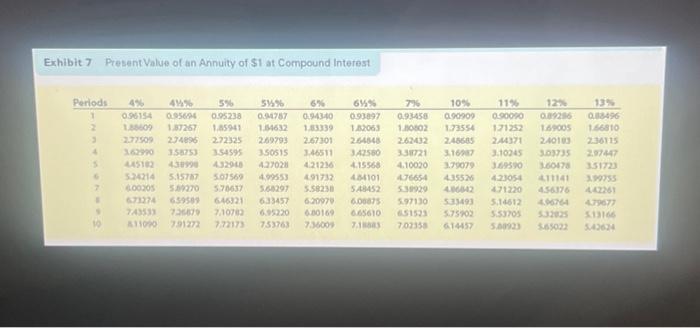

Present value of bonds payable; premium Moss Co. issued $42,000,000 of 5-year, 11% bonds, with interest payable semiannually, at a market (effective) interest rate of 9%. Determine the present value of the bonds payable using the present value tables in Exhibit 5 and Exhibit 7. Round to the nearest dollar. Exhibit 5 Present Value of $1 at Compound Interest Periods 4% 0.96154 2 092456 3 4 0.85400 0.838560 5 0.82195 415% 5% 0.956940 0.95238 0.915730 090703 0.88100 0876300 0.86384 082270 0.802450 078353 6 0.79031 0767900 074622 0.72525 2 075992 0734830 071068 073069 9 10 070259 067556 0.672900 0.643930 0.66506 0703190 067684 0.65160 0.62741 064461 0.61763 059190 061391 0.58543 0.55839 0.68744 515% 6% 615% 7% 10% 11% 12% 13% 0.94787 094340 0.93897 0.93458 0.90909 0.90090 089286 0.88496 0.89845 0.39000 0.88166 0.87344 0.82645 0.81162 079719 0.78315 0.85161 0.83962 0.82785 0.81630 075131 0.73119 0.71179 0.69305 0.80722 079209 0.77732 0.76290 0.68301 0.65873 063552 061332 0.76513 074726 0.72988 0.71299 0.62092 0.59345 056743 054276 070496 0.68533 0.66634 0.56447 0.53464 050663 0.48032 0.64351 0.62275 0.51316 0.48166 045235 0.42506 0.60423 0.58201 0466511 0.43395 0.40388 037616 0.56735 0.54393 0.42410 0.39092 036061 033288 053273 050835 038554 035218 032197 0.29459 Exhibit 7 Present Value of an Annuity of $1 at Compound Interest Periods 4% 2 . 0.96154 186609 2.77509 4 414% 0.95694 0.95238 1.87267 1.859411 2.74896 2.72325 3.62990 358753 354595 5% S 6 9 10 515% 6% 6%% 7% 10% 11% 12% 13% 0.94787 094340 0.93897 0.93458 0.90909 0.90090 0.89296 0.88496 154632 1.83339 1.82063 1.80802 1.73554 171252 1.69005 1.66810 2.69793 2.67301 264848 262432 2.48685 244371 240183 2.36115 350515 3.46511 342560 338721 3.16987 3.10245 3.03735 2.97447 445182 438990 4.32948 427028 4.21236 4.15568 4.10020 3.79079 3.69590 3.60478 351723 5.24214 5.15787 507569 4.99553 491732 434101 476654 435526 4.23054 411141 3.99755 6.00205 539270 5.70637 5.68297 5.58230 548452 538929 486842 471220 4.56376 442261 673274 659589 646321 633457 620979 6.06875 5.97130 533493 5.14612 4.96764 4.79677 743533 736879 7,10783 6.95220 600169 6.65610 651523 5.75902 5.53705 532025 513166 A11090 7.91272 7.72173 753763 736009 7.188 7.02358 614457 500923 5.65022 5.43624

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To solve this problem we need to determine the present value of the bond issued by Moss Co using the present value tables provided in Exhibit 5 and Exhibit 7 StepbyStep Process Step 1 Key Information ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started