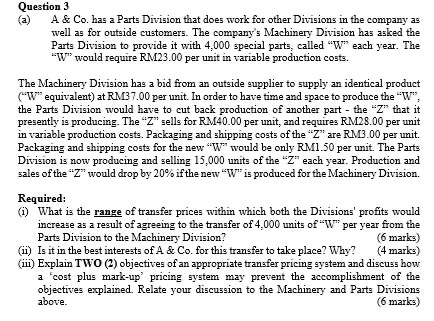

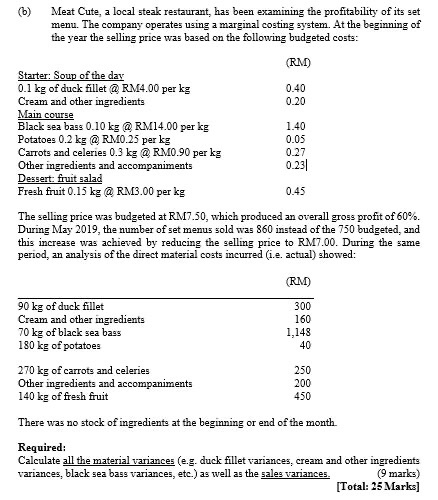

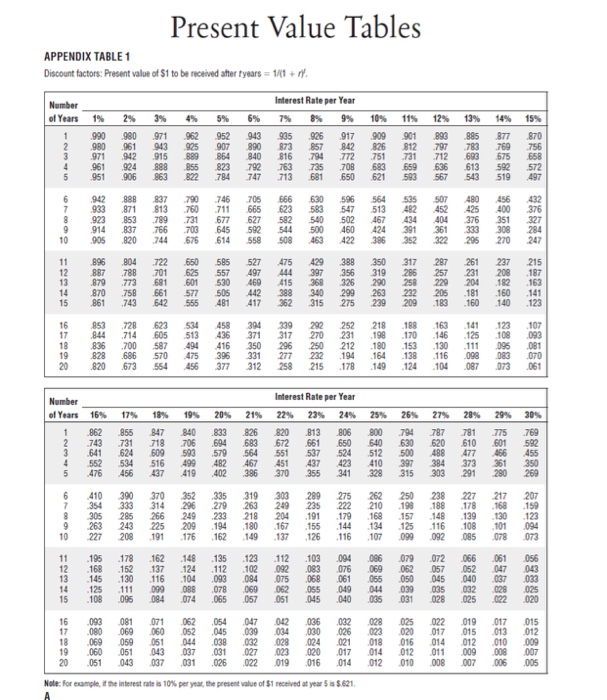

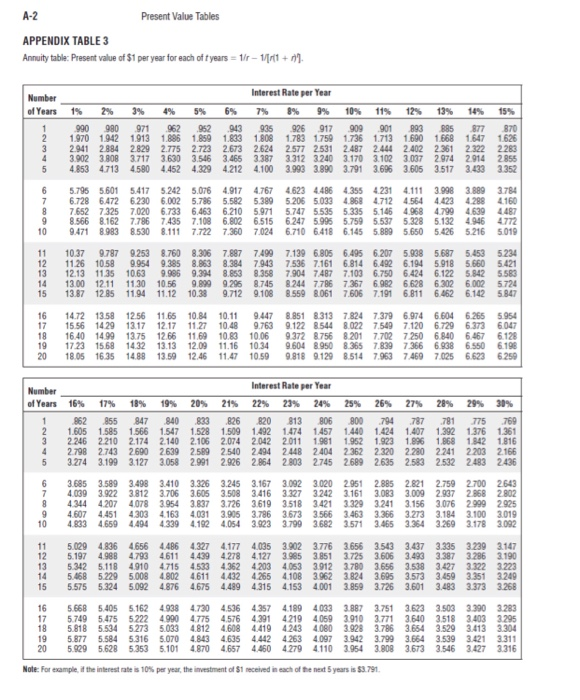

Question 3 (a) A & Co. has a Parts Division that does work for other Divisions in the company as well as for outside customers. The company's Machinery Division has asked the Parts Division to provide it with 4,000 special parts, called "W" each year. The "W" would require RM23.00 per unit in variable production costs. The Machinery Division has a bid from an outside supplier to supply an identical product "W" equivalent) at RM37.00 per unit. In order to have time and space to produce the "W", the Parts Division would have to cut back production of another part - the "Z" that it presently is producing. The "Z" sells for RM40.00 per unit, and requires RM28.00 per unit in variable production costs. Packaging and shipping costs of the "Z" are RM3.00 per unit. Packaging and shipping costs for the new "W" would be only RM1.50 per unit. The Parts Division is now producing and selling 15,000 units of the "Z" each year. Production and sales of the "Z" would drop by 20% if the new "W" is produced for the Machinery Division. Required: 1) What is the range of transfer prices within which both the Divisions' profits would increase as a result of agreeing to the transfer of 4,000 units of "W" per year from the Parts Division to the Machinery Division? (6 marks) (1) Is it in the best interests of A & Co. for this transfer to take place? Why? (4 marks) (ii) Explain TWO (2) objectives of an appropriate transfer pricing system and discuss how a 'cost plus mark-up pricing system may prevent the accomplishment of the objectives explained. Relate your discussion to the Machinery and Parts Divisions above. (6 marks) (6) Meat Cute, a local steak restaurant, has been examining the profitability of its set menu. The company operates using a marginal costing system. At the beginning of the year the selling price was based on the following budgeted costs: (RM) Starter: Soup of the day 0.1 kg of duck fillet @ RM4.00 per kg 0.40 Cream and other ingredients 0.20 Main course Black sea bass 0.10 kg @ RM14.00 per kg 1.40 Potatoes 0.2 kg @ RM0.25 per kg 0.05 Carrots and celeries 0.3 kg @ RM0.90 per kg 0.27 Other ingredients and accompaniments 0.23 Dessert: fruit salad Fresh fruit 0.15 kg @ RM3.00 per kg 0.45 The selling price was budgeted at RM7.50, which produced an overall gross profit of 60%. During May 2019, the number of set menus sold was 860 instead of the 750 budgeted, and this increase was achieved by reducing the selling price to RM7.00. During the same period, an analysis of the direct material costs incurred (1.e. actual) showed: (RM) 90 kg of duck fillet 300 Cream and other ingredients 160 70 kg of black sea bass 1,148 180 kg of potatoes 40 270 kg of carrots and celeries 250 Other ingredients and accompaniments 200 140 kg of fresh fruit 450 There was no stock of ingredients at the beginning or end of the month Required: Calculate all the material variances (e.g. duck fillet variances, cream and other ingredients variances, black sea bass variances, etc.) as well as the sales variances. (9 marks) [Total: 25 Marks] SOC 15 14 21 E- | 9 Present Value Tables Interest Rate per Year Interest Rate per Year 9 Note: For comple, if the interest rate is 10% per year, the present value of $1 received at year 5 is 5.621. Discount factors: Present value of $1 to be received after years = 1/(1+rf. APPENDIX TABLE 1 1 16 Number of Years 1% Number of Years 1 - -- 12 18 19 A-2 Present Value Tables APPENDIX TABLE 3 Annuity table: Present value of $1 per year for each of tyears = 1/r-177711 + n). Number of Years 943 901 2 3 4 5 Interest Rate per Year 1% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 990 980 971 962 952 935 926 917 909 893 885 877 870 1.970 1.942 1913 1.886 1.859 1.833 1.808 1.783 1759 1736 1.713 1.690 1668 1647 1626 2.941 2.884 2.829 2.775 2.723 2.673 2.624 2577 2531 2.487 2.444 2.402 2.361 2322 2283 3.902 3.808 3.717 3.630 3.546 3.466 3.387 3.312 3.240 3.170 3.102 3.037 2.974 2914 2855 4.853 4713 4.580 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.696 3.605 3.517 3.433 3.352 5.795 5.501 5.417 5.242 5.076 4.917 4.767 4.623 4.4864.355 4.231 4.111 3.998 3.889 3.784 6.728 6.472 6230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.712 4.564 4.423 4.288 4160 7.6527325 7,020 6.733 6.463 6.210 5.971 57475.535 5.335 5.146 4.968 4.799 4.639 4487 8.566 8.162 7.786 7.435 7.108 6.802 6.515 6.247 5.9955.759 5.537 5.328 5.132 4.946 4772 9.471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 6.418 6.145 5.88 5.650 5.426 5.216 5019 6 7 8 9 10 11 12 13 14 15 10.37 9.787 9.253 8.760 8.306 7.887 7.499 11.26 10.58 9.954 9.385 8.863 8.384 7.943 12.13 11.35 10.63 9.986 9.394 8.853 8.358 13.00 12.11 11.30 10.56 9.999 9.296 8.745 13.87 1285 11.94 11.12 10.38 9.712 9.108 7.139 6.805 6.495 6.207 5.938 5.687 5.453 5234 7.536 7.1616.814 6.492 6.1945.918 5.660 5.421 7.904 7.487 7.103 6.750 6.424 6.122 5.842 5.580 8244 7.786 7.367 6.982 6.628 6.302 6.002 5724 8.559 8.061 7.606 7.1916.811 6.462 6.142 5.847 16 17 18 19 20 14.72 13.58 12.56 11.65 10.84 15.56 1429 13.17 12.17 11.27 16.40 14.99 13.75 12.66 1.69 17.23 15.68 1432 13.13 12.09 18.05 16:35 14.88 13.59 12.46 10.11 9.447 10.48 9.763 10.83 10.06 11.16 10.34 11.47 10.59 8.851 8.313 7.824 7.379 6.974 6.604 6.265 5954 9.122 8.544 8.022 7.5497.120 6.729 6.373 6047 9.372 8.756 8201 7.702 7250 6.840 6.467 6.128 9.604 8.950 8.365 7.839 7.366 6.938 6.550 6.198 9.818 9.129 8.514 7.963 7.469 7025 6.623 6259 1 Number Interest Rate per Year of Years 16% 17% 18% 19% 20% 21% 22% 23% 24% 25% 26% 27% 28% 29% 30% 862 855 847 840 833 .826 820 813 806 800 .794 .787 .781 775 769 2 1.605 1.585 1.566 1.547 1.528 1.509 1.492 1.474 1457 1.440 1.424 1.407 1.392 1.376 1361 3 2.246 2.210 2.174 2.140 2.106 2.074 2.042 2011 1.981 1952 1923 1.896 1.868 1.842 1.816 4 2.798 2.743 2690 2639 2.589 2540 2494 2448 2404 2362 2320 2.280 2241 2 203 2166 5 3.274 3.1993.127 3.058 2.991 2.926 2.864 2.803 2.745 2.689 2.635 2.583 2.532 24832436 6 7 8 9 10 3.685 3.589 3.498 3.410 3.326 3.245 3.167 3.092 3.020 2.951 2.885 2.821 2.759 2.700 2.643 4.039 3.922 3.812 3.706 3.605 3.508 3.416 3327 3.242 3.161 3.083 3.009 2.937 2.868 2802 4.344 4.207 4.078 3.954 3.837 3.726 3.619 3.518 3421 3.329 3.241 3.156 3.076 2.999 2.925 4.607 4.451 4303 4.163 4.031 3.905 3.786 3.673 3.566 3.463 3.366 3.273 3.184 3.100 3.019 4.833 4.659 4.494 43394.192 4.054 3.923 3.799 3.682 3.571 3.465 3.364 3.269 3.178 3.092 11 12 13 14 15 5.0294.836 4.656 4.486 4.327 4.177 4.035 3.902 3.776 3.656 3.543 3.437 3.335 3.239 3.147 5.197 4.988 4.793 4.611 4.439 4.278 4.127 3.985 3,851 3.725 3.606 3.493 3.387 3286 3.190 5.342 5.118 4910 4715 4.533 4.362 4203 4.053 3.912 3.780 3.656 3.538 3.427 3.322 3223 5.468 5229 5.008 4.802 4.611 4432 4.265 4.108 3.962 3.824 3.695 3.573 3.459 3.351 3249 5.575 5.324 5.092 4.876 4.675 4.489 4.315 4.153 4.001 3.859 3.726 3.601 3.483 3.373 3.268 16 17 18 19 20 5.668 5.405 5.1624.938 4.730 4.536 4.357 4.189 4.033 3.887 3.751 3.623 3.503 3.390 3.283 5.749 5.475 5.222 4.990 4.775 4.576 4.391 4219 4.0693.910 3.771 3.640 3.518 3.403 3.295 5.818 5.534 5.273 5.033 4.812 4.608 4.419 4243 4.080 3.928 3.786 3.654 3.529 3.413 3.304 5.877 5.584 5.316 5.070 4.843 4.635 4.442 4.263 4.097 3.942 3.799 3.664 3.539 3.421 3.311 5.929 5.628 5.353 5.101 4.870 4.657 4.460 4.279 4.110 3.954 3.808 3.673 3.546 3.427 3.316 Note: For example, if the interest rate is 10% per year, the investment of $1 received in each of the next 5 years is $3.791