Question: Presented below are annual coupon rates, yield rates, and expected duration for a series of debentures. Calculate the issuance price for each debenture assuming

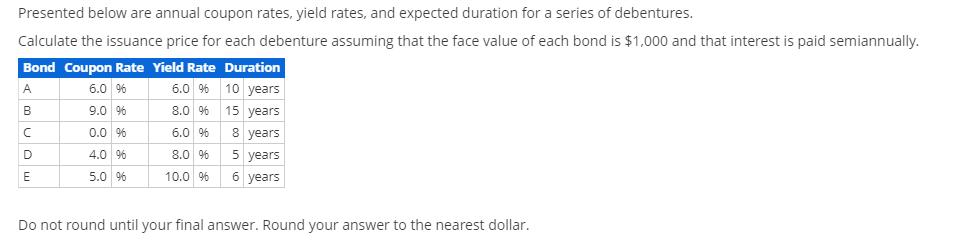

Presented below are annual coupon rates, yield rates, and expected duration for a series of debentures. Calculate the issuance price for each debenture assuming that the face value of each bond is $1,000 and that interest is paid semiannually. Bond Coupon Rate Yield Rate Duration A 6.0 % 6.0 % 10 years B 9.0 % 8.0 % 15 years C 0.0 % 6.0 % 8 years D 4.0 96 8.0 % E 5.0 % 10.0 % 5 years 6 years Do not round until your final answer. Round your answer to the nearest dollar.

Step by Step Solution

3.45 Rating (168 Votes )

There are 3 Steps involved in it

To calculate the issuance price for each debenture we need to use the formula for present value of a ... View full answer

Get step-by-step solutions from verified subject matter experts