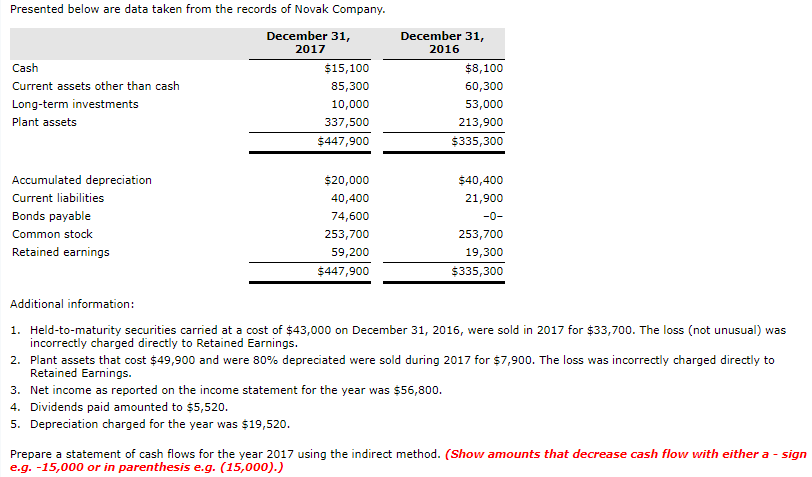

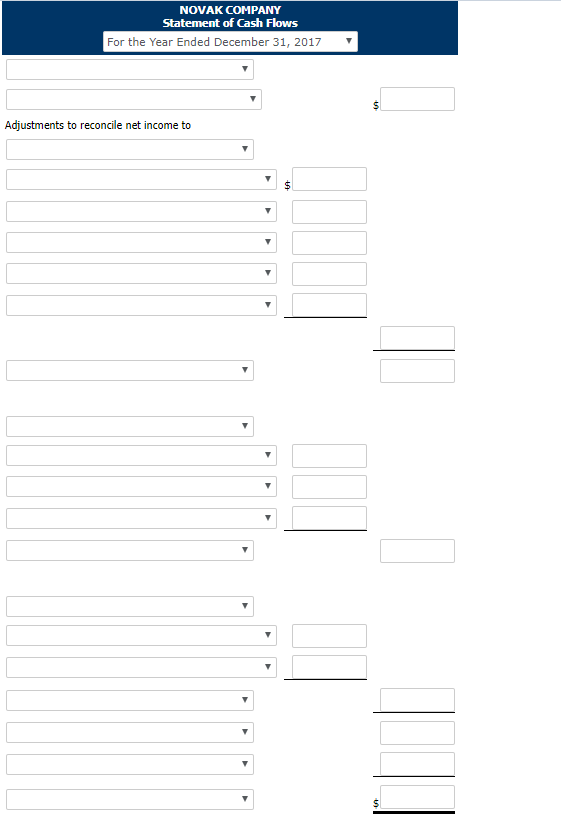

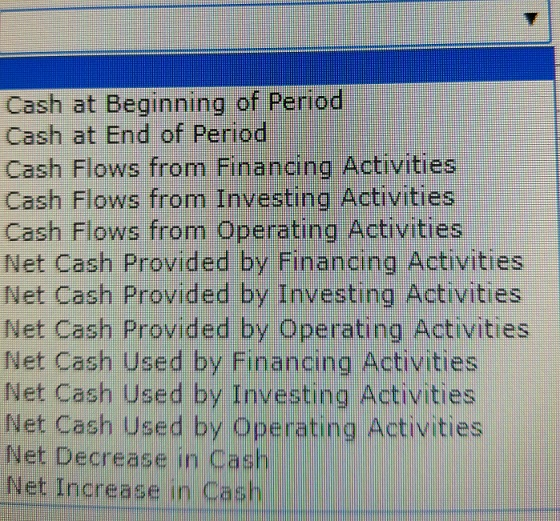

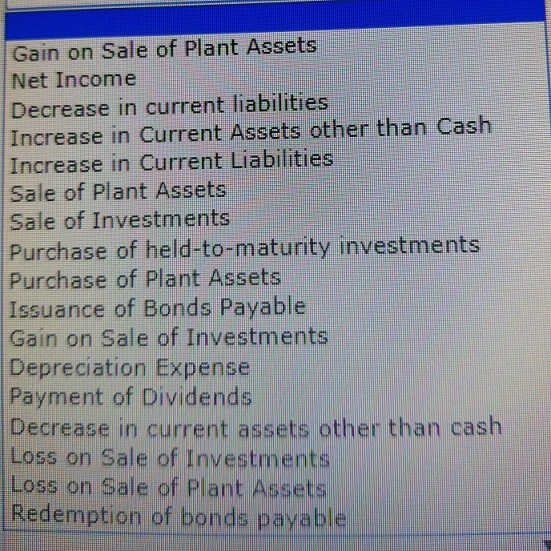

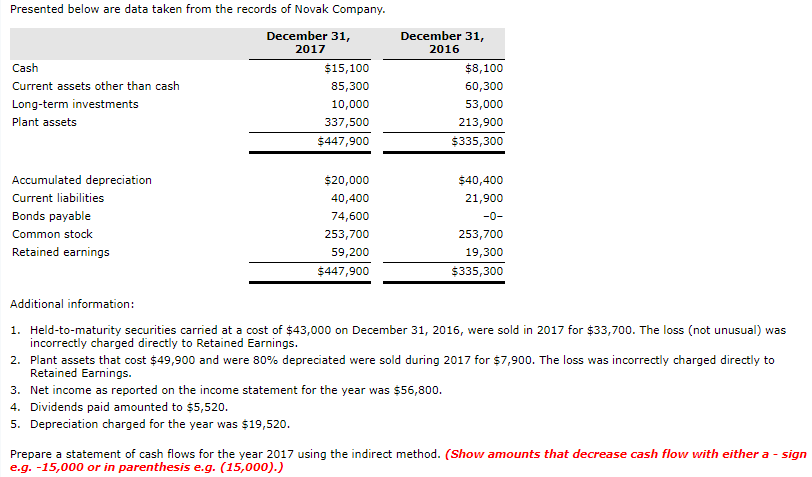

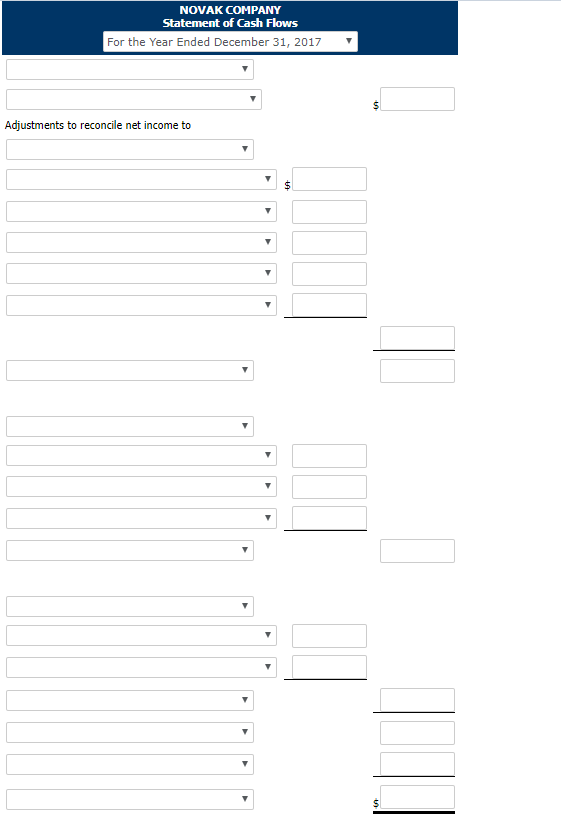

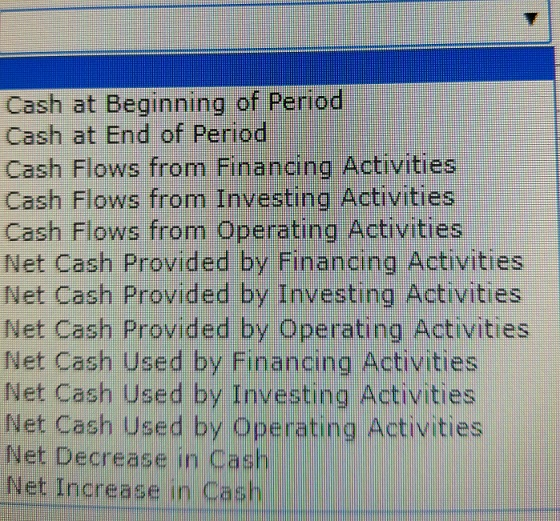

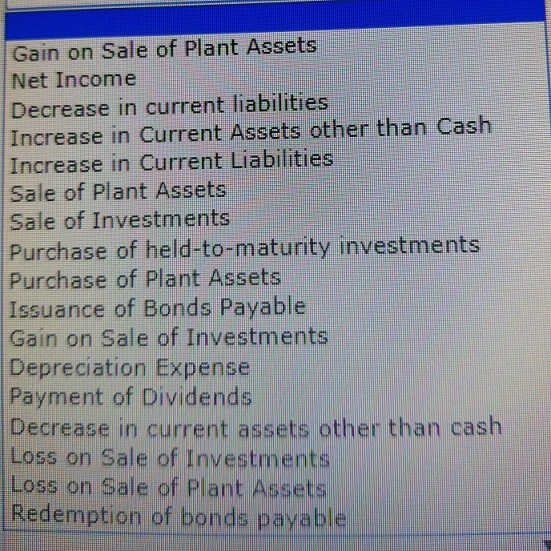

Presented below are data taken from the records of Novak Company, December 31, 2017 December 31, 2016 Cash Current assets other than cash Long-term investments Plant assets $15,100 85,300 10,000 337,500 $447,900 $8,100 60,300 53,000 213,900 $335,300 Accumulated depreciation Current liabilities Bonds payable Common stock Retained earnings $20,000 40,400 74,600 253,700 59,200 $447,900 $40,400 21,900 253,700 19,300 $335,300 Additional information: 1. Held-to-maturity securities carried at a cost of $43,000 on December 31, 2016, were sold in 2017 for $33,700. The loss (not unusual) was incorrectly charged directly to Retained Earnings 2. Plant assets that cost $49,900 and were 80% depreciated were sold during 2017 for $7,900. The loss was incorrectly charged directly to Retained Earnings. 3. Net income as reported on the income statement for the year was $56,800. 4. Dividends paid amounted to $5,520 5. Depreciation charged for the year was $19,520 Prepare a statement of cash flows for the year 2017 using the indirect method. (Show amounts that decrease cash flow with either a sign e.g. -15,000 or in parenthesis e.g. (15,000).) NOVAK COMPANY Statement of Cash Flows For the Year Ended December 31, 2017 Adjustments to reconcile net income to Cash at Beginning of Period Cash at End of Period Cash Flows from Financing Activities Cash Flows from Investing Activities Cash Flows from Operating Activities Net Cash Provided by Financing Activities Net Cash Provided by Investing Activities Net Cash Provided by Operating Activities Net Cash Used by Financing Activities Net Cash Used by Investing Activities Net Cash Used by Operating Activities Net Decrease in Cash Net Increase in Cash Gain on Sale of Plant Assets Net Income Decrease in current liabilities Increase in Current Assets other than Cash Increase in Current Liabilities Sale of Plant Assets Sale of Investments Purchase of held-to-maturity investments Purchase of Plant Assets Issuance of Bonds Payable Gain on Sale of Investments Depreciation Expense Payment of Dividends Decrease in current assets other than cash Loss on Sale of Investments Loss on Sale of Plant Assets Redemption of bonds payable