Question

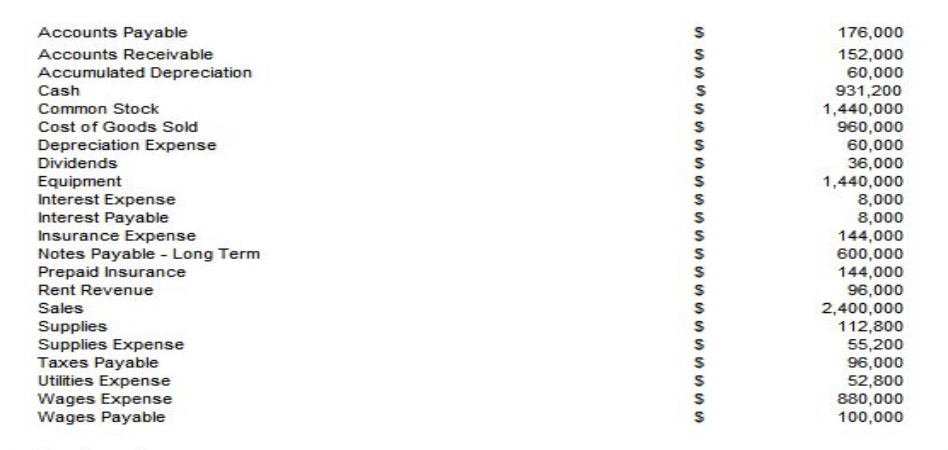

Presented below are of assets and liabilities of Glasses, Inc. as of December 31, 2016, and revenues and expenses of the company for the year

Presented below are of assets and liabilities of Glasses, Inc. as of December 31, 2016, and revenues and expenses of the company for the year ended on that date. These items are listed in alphabetical order.

Prepare the companys income statement for the year ended December 31, 2016.

Prepare the company statement of retained earnings for the year ended December 31, 2016.

Prepare the companys balance sheet at December 31, 2016.

The Gross Profit reported on the Income Statement for 2016 is?

The Total Selling & General Administrative Expenses reported on the Income Statement for 2016 is?

The Total Operating Income reported on the Income Statement for 2016 is?

The Net Income reported on the Income Statement for 2016 is?

The Ending Retained Earnings Balance reported on the Statement of Retained Earnings for 2016 is?

The Total Current Assets reported on the Balance Sheet on December 31, 2016 is?

The Total Long Term Assets reported on the Balance Sheet on December 31, 2016 is?

The Total Current Liabilities reported on the Balance Sheet on December 31, 2016 is?

The Total Long Term Liabilities reported on the Balance Sheet on December 31, 2016 is?

The Total Stockholders' Equity reported on the Balance Sheet on December 31, 2016 is?

The Total Liabilities & Stockholders' Equity reported on the Balance Sheet on December 31, 2016 is?

Accounts Payable Accounts Receivable Accumulated Depreciation Cash Common Stock Cost of Goods Sold Depreciation Expense Dividends Equipment Interest Expense Interest Payable Insurance Expense Notes Payable Long Term Prepaid Insurance Rent Revenue Sales Supplies Supplies Expense Taxes Payable Utilities Expense Wages Expense Wages Payable 176,000 152,000 60,000 931,200 1,440,000 960,000 60,000 36,000 1,440,000 8,000 8,000 144,000 600,000 144,000 96,000 2,400,000 112,800 55,200 96,000 52,800 880,000 100,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started