Answered step by step

Verified Expert Solution

Question

1 Approved Answer

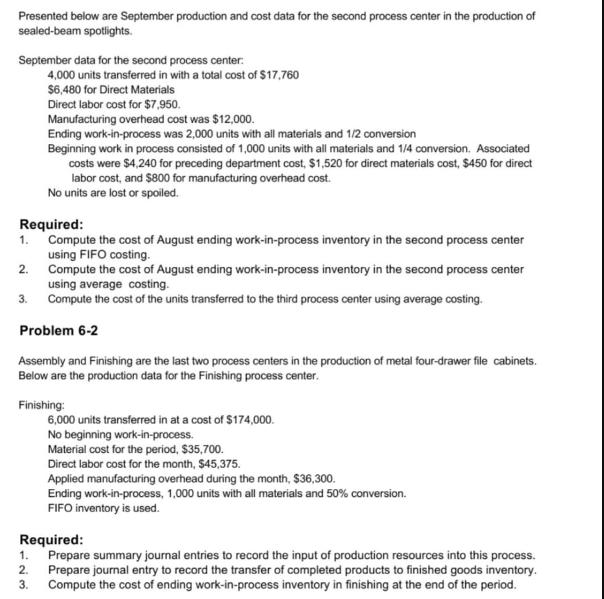

Presented below are September production and cost data for the second process center in the production of sealed-beam spotlights. September data for the second

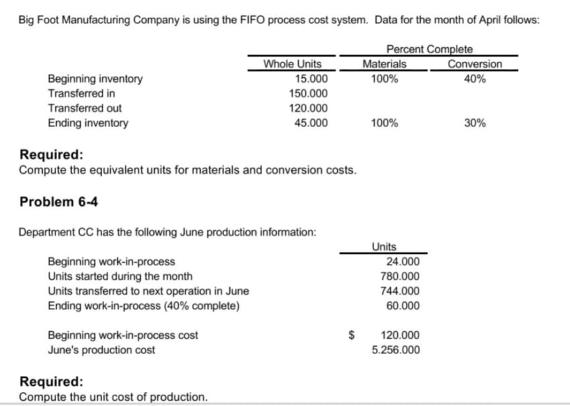

Presented below are September production and cost data for the second process center in the production of sealed-beam spotlights. September data for the second process center: Required: Compute the cost of August ending work-in-process inventory in the second process center using FIFO costing. Compute the cost of August ending work-in-process inventory in the second process center using average costing. Compute the cost of the units transferred to the third process center using average costing. Problem 6-2 Assembly and Finishing are the last two process centers in the production of metal four-drawer file cabinets. Below are the production data for the Finishing process center. 1. 2. 4,000 units transferred in with a total cost of $17,760 $6,480 for Direct Materials Direct labor cost for $7,950. Manufacturing overhead cost was $12,000. Ending work-in-process was 2,000 units with all materials and 1/2 conversion Beginning work in process consisted of 1,000 units with all materials and 1/4 conversion. Associated costs were $4,240 for preceding department cost, $1,520 for direct materials cost, $450 for direct labor cost, and $800 for manufacturing overhead cost. No units are lost or spoiled. 3. Finishing: 6,000 units transferred in at a cost of $174,000. No beginning work-in-process. Material cost for the period, $35,700. Direct labor cost for the month, $45,375. Applied manufacturing overhead during the month, $36,300. Ending work-in-process, 1,000 units with all materials and 50% conversion. FIFO inventory is used. Required: 1. Prepare summary journal entries to record the input of production resources into this process. 2. Prepare journal entry to record the transfer of completed products to finished goods inventory. 3. Compute the cost of ending work-in-process inventory in finishing at the end of the period. Big Foot Manufacturing Company is using the FIFO process cost system. Data for the month of April follows: Percent Complete Beginning inventory Transferred in Transferred out Ending inventory Required: Compute the equivalent units for materials and conversion costs. Problem 6-4 Department CC has the following June production information: Beginning work-in-process Units started during the month Units transferred to next operation in June Ending work-in-process (40% complete) Beginning work-in-process cost June's production cost Whole Units 15.000 150.000 120.000 45.000 Required: Compute the unit cost of production. $ Materials 100% 100% Units 24.000 780.000 744.000 60.000 120.000 5.256.000 Conversion 40% 30%

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To solve the problems presented lets start by addressing the first set of questions related to the sealedbeam spotlights production 1 Compute the cost of August ending workinprocess inventory in the s...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started