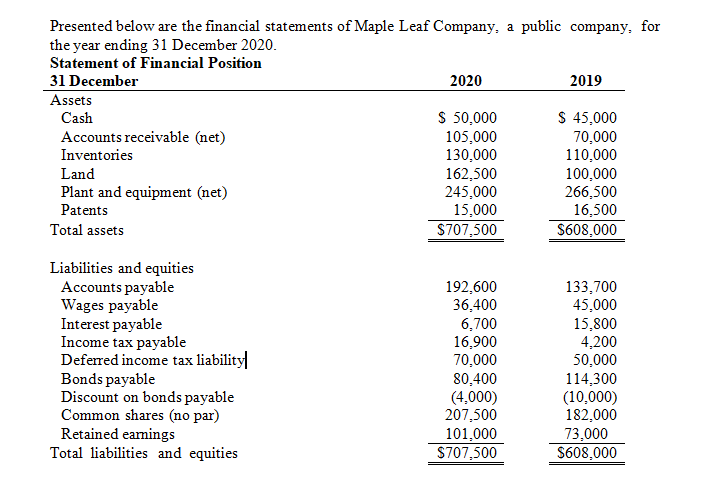

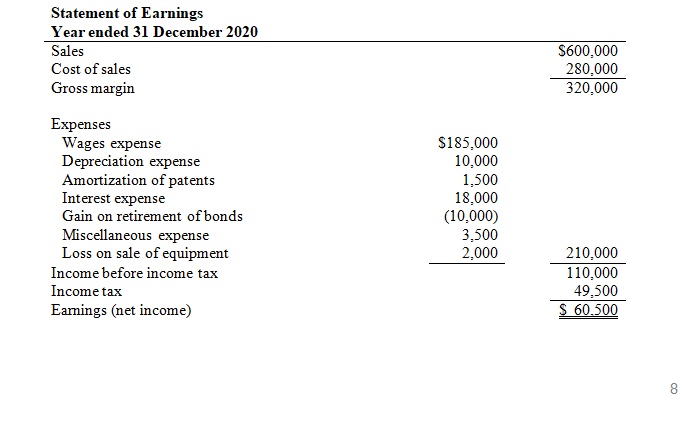

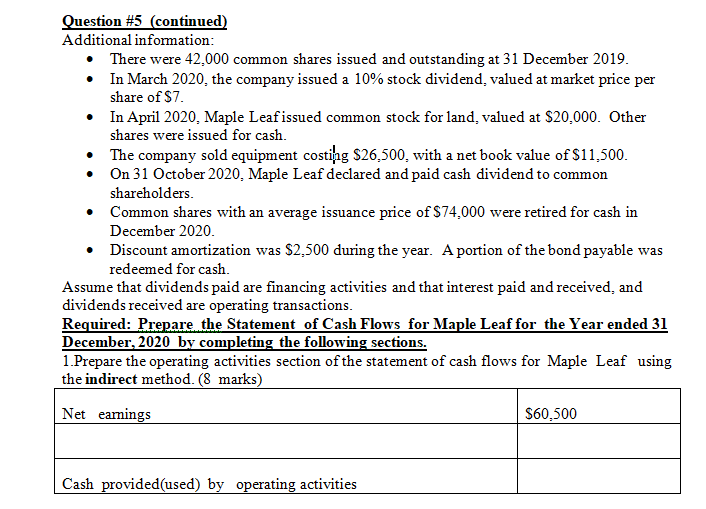

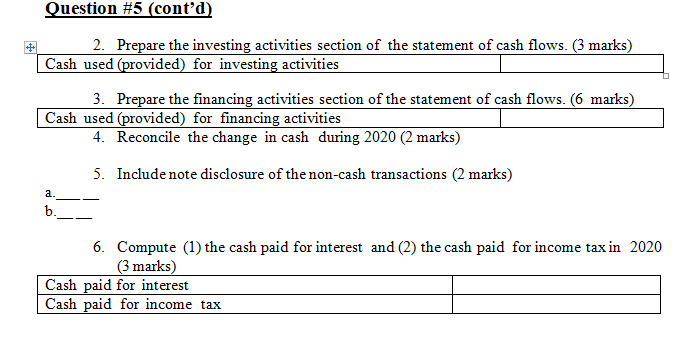

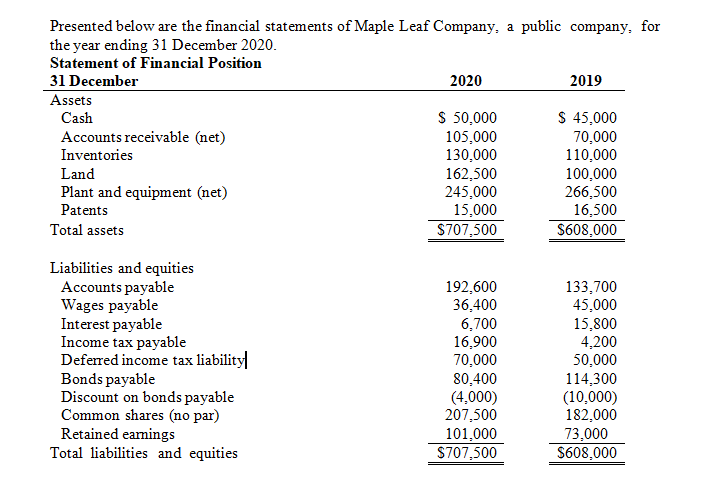

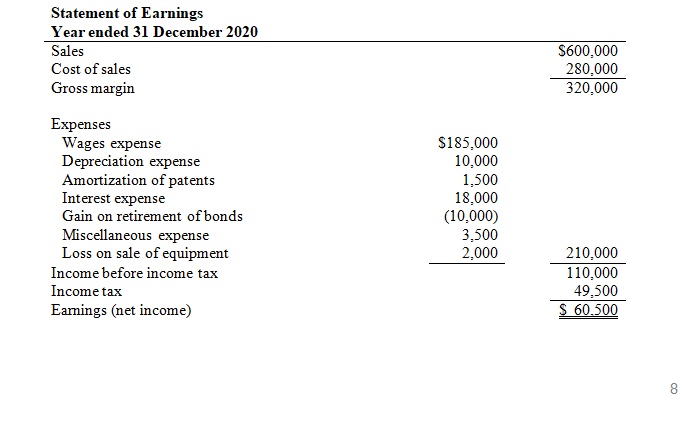

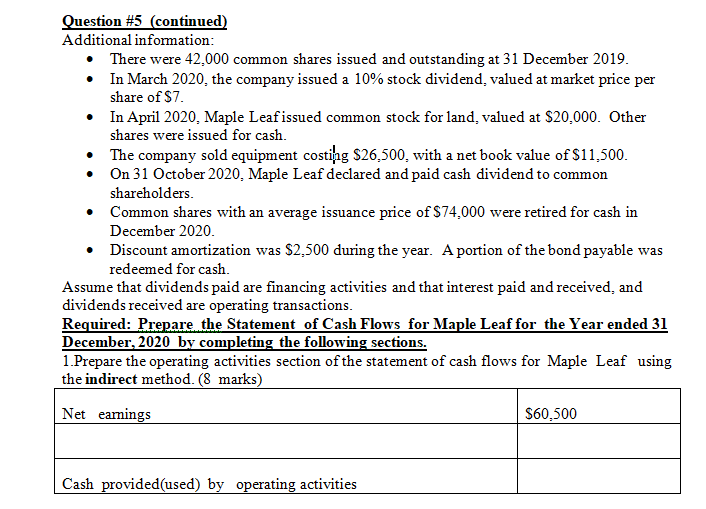

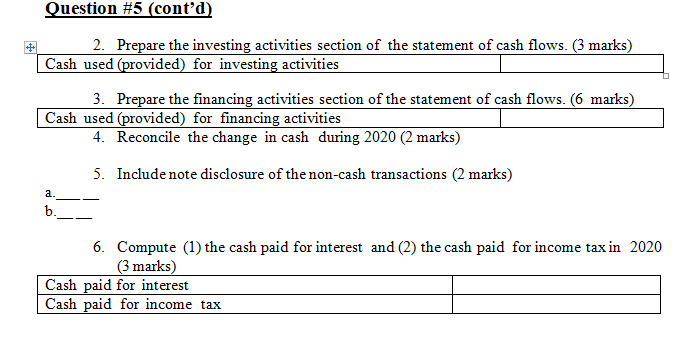

Presented below are the financial statements of Maple Leaf Company, a public company, for the year ending 31 December 2020. Statement of Financial Position 31 December 2020 2019 Assets Cash S 50,000 $ 45,000 Accounts receivable (net) 105,000 70,000 Inventories 130,000 110,000 Land 162,500 100,000 Plant and equipment (net) 245.000 266,500 Patents 15,000 16,500 Total assets $707,500 $608,000 Liabilities and equities Accounts payable Wages payable Interest payable Income tax payable Deferred income tax liability Bonds payable Discount on bonds payable Common shares (no par) Retained earnings Total liabilities and equities 192,600 36,400 6.700 16.900 70,000 80,400 (4.000) 207,500 101.000 $707,500 133,700 45,000 15,800 4.200 50,000 114,300 (10,000) 182.000 73,000 $608,000 Statement of Earnings Year ended 31 December 2020 Sales Cost of sales Gross margin $600,000 280,000 320,000 Expenses Wages expense Depreciation expense Amortization of patents Interest expense Gain on retirement of bonds Miscellaneous expense Loss on sale of equipment Income before income tax Income tax Earnings (net income) $185,000 10,000 1,500 18,000 (10,000) 3,500 2.000 210,000 110,000 49,500 $ 60.500 8 Question #5 (continued) Additional information: There were 42,000 common shares issued and outstanding at 31 December 2019. In March 2020, the company issued a 10% stock dividend, valued at market price per share of $7. In April 2020, Maple Leaf issued common stock for land valued at $20,000. Other shares were issued for cash. The company sold equipment costing $26.500, with a net book value of $11,500. On 31 October 2020. Maple Leaf declared and paid cash dividend to common shareholders. Common shares with an average issuance price of $74,000 were retired for cash in December 2020. Discount amortization was $2,500 during the year. A portion of the bond payable was redeemed for cash. Assume that dividends paid are financing activities and that interest paid and received and dividends received are operating transactions. Required: Prepare the Statement of Cash Flows for Maple Leaf for the Year ended 31 December, 2020 by completing the following sections. 1. Prepare the operating activities section of the statement of cash flows for Maple Leaf using the indirect method. (8 marks) Net eamings $60,500 Cash provided(used) by operating activities Question #5 (cont'd) 2. Prepare the investing activities section of the statement of cash flows. (3 marks) Cash used (provided) for investing activities 3. Prepare the financing activities section of the statement of cash flows. (6 marks) Cash used (provided) for financing activities 4. Reconcile the change in cash during 2020 (2 marks) 5. Include note disclosure of the non-cash transactions (2 marks) a. b. 6. Compute (1) the cash paid for interest and (2) the cash paid for income tax in 2020 (3 marks) Cash paid for interest Cash paid for income tax