Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Presented below is data of EPMP Company ltd at the end of the year 31 December, 2019. Inventory Item Number of units in Original

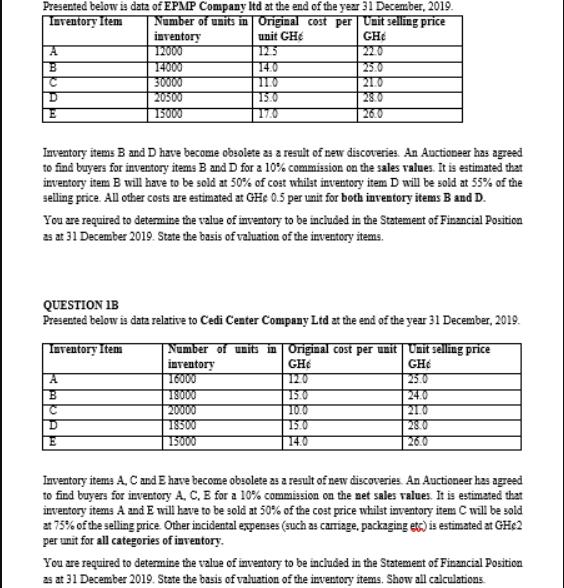

Presented below is data of EPMP Company ltd at the end of the year 31 December, 2019. Inventory Item Number of units in Original cost per Unit selling price inventory unit GHE GHE A 12000 125 22.0 B 14000 14.0 25.0 30000 11.0 21.0 D 20500 15.0 28.0 E 15000 17.0 26.0 Inventory items B and D have become obsolete as a result of new discoveries. An Auctioneer has agreed to find buyers for inventory items B and D for a 10% commission on the sales values. It is estimated that inventory item B will have to be sold at 50% of cost whilst inventory item D will be sold at 55% of the selling price. All other costs are estimated at GHC 0.5 per unit for both inventory items B and D. You are required to determine the value of inventory to be included in the Statement of Financial Position as at 31 December 2019. State the basis of valuation of the inventory items. QUESTION IB Presented below is data relative to Cedi Center Company Ltd at the end of the year 31 December, 2019. Inventory Item A B C D E Number of units in Original cost per unit Unit selling price inventory GHE GHE 16000 120 25.0 18000 15.0 24.0 20000 10.0 21.0 18500 15.0 28.0 15000 14.0 26.0 Inventory items A, C and E have become obsolete as a result of new discoveries. An Auctioneer has agreed to find buyers for inventory A, C, E for a 10% commission on the net sales values. It is estimated that inventory items A and E will have to be sold at 50% of the cost price whilst inventory item C will be sold at 75% of the selling price. Other incidental expenses (such as carriage, packaging etc) is estimated at GH2 per unit for all categories of inventory. You are required to determine the value of inventory to be included in the Statement of Financial Position as at 31 December 2019. State the basis of valuation of the inventory items. Show all calculations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started