Answered step by step

Verified Expert Solution

Question

1 Approved Answer

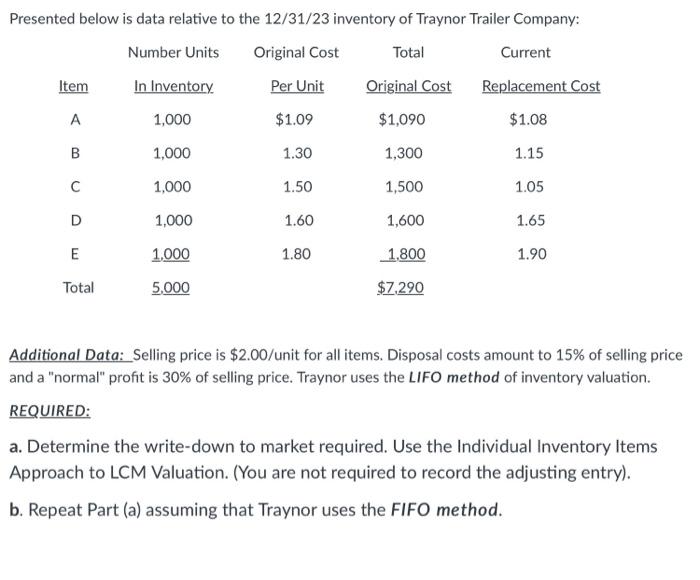

Presented below is data relative to the 12/31/23 inventory of Traynor Trailer Company: Number Units Original Cost Total Current Item In Inventory Per Unit

Presented below is data relative to the 12/31/23 inventory of Traynor Trailer Company: Number Units Original Cost Total Current Item In Inventory Per Unit Original Cost Replacement Cost 1,000 $1.09 $1,090 $1.08 1,000 1.30 1,300 1.15 C 1,000 1.50 1,500 1.05 D 1,000 1.60 1,600 1.65 E 1,000 1.80 1,800 1.90 Total 5.000 $7.290 Additional Data: Selling price is $2.00/unit for all items. Disposal costs amount to 15% of selling price and a "normal" profit is 30% of selling price. Traynor uses the LIFO method of inventory valuation. REQUIRED: a. Determine the write-down to market required. Use the Individual Inventory Items Approach to LCM Valuation. (You are not required to record the adjusting entry). b. Repeat Part (a) assuming that Traynor uses the FIFO method.

Step by Step Solution

★★★★★

3.34 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Calculation of upper limit Upper limit ceiling or net realizable value Selling price Disposal costs ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started