Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Presented below is financial information for Contreras Inc., for the year ended December 31, 2024 Sales Sales Returns and Allowances Sales Discounts Allowance for

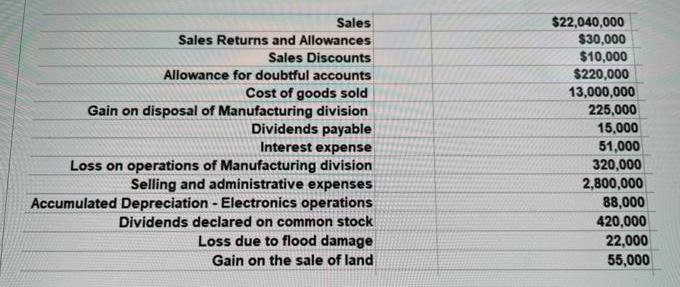

Presented below is financial information for Contreras Inc., for the year ended December 31, 2024 Sales Sales Returns and Allowances Sales Discounts Allowance for doubtful accounts Cost of goods sold Gain on disposal of Manufacturing division Dividends payable Interest expense Loss on operations of Manufacturing division Selling and administrative expenses Accumulated Depreciation - Electronics operations Dividends declared on common stock Loss due to flood damage Gain on the sale of land $22,040,000 $30,000 $10,000 $220,000 13,000,000 225,000 15,000 51,000 320,000 2,800,000 88,000 420,000 22,000 55,000 In 2024, Contreras, Inc decided to discontinue its manufacturing operations and retain its electronics operations. On September 1, Contreras sold the manufacturing operations. In 2024, there were 400,000 shares of common stock outstanding all year. The effective tax rate on all items is 20%. Prepare a Multi-Step Income Statement for Contreras, Inc. Some accounts above may not belong in an income statement. Include the EPS calculation(s).

Step by Step Solution

★★★★★

3.47 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Calculations Sales 22040000 Less Sales Returns and Allowances 30000 Less Sales Discounts 10000 Net S...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started