Presented below is information related to Carla Company. 1. On July 6, Carla Company acquired the plant assets of Doonesbury Company, which had discontinued

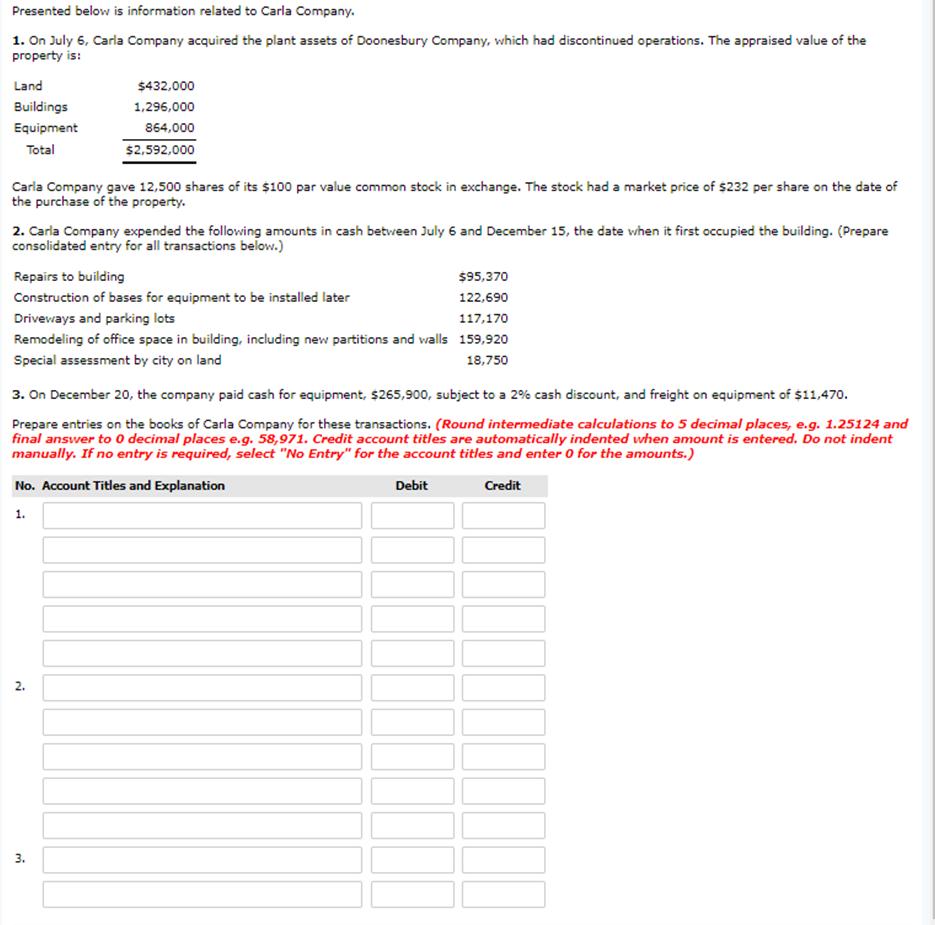

Presented below is information related to Carla Company. 1. On July 6, Carla Company acquired the plant assets of Doonesbury Company, which had discontinued operations. The appraised value of the property is: Land $432,000 Buildings 1,296,000 Equipment 864,000 Total $2,592,000 Carla Company gave 12,500 shares of its $100 par value common stock in exchange. The stock had a market price of $232 per share on the date of the purchase of the property. 2. Carla Company expended the following amounts in cash between July 6 and December 15, the date when it first occupied the building. (Prepare consolidated entry for all transactions below.) Repairs to building $95,370 Construction of bases for equipment to be installed later 122,690 Drivevays and parking lots 117,170 Remodeling of office space in building, including new partitions and walls 159,920 Special assessment by city on land 18,750 3. On December 20, the company paid cash for equipment, $265,900, subject to a 2% cash discount, and freight on equipment of $11,470. Prepare entries on the books of Carla Company for these transactions. (Round intermediate calculations to 5 decimal places, e.g. 1.25124 and final answer to 0 decimal places e.g. 58,971. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) No. Account Titles and Explanation Debit Credit 1. 3. 2.

Step by Step Solution

3.55 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

A D 1 Appraied values 2 Land 2 432000 3 Building 1296000 4 Equipment 864000 2...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started