Answered step by step

Verified Expert Solution

Question

1 Approved Answer

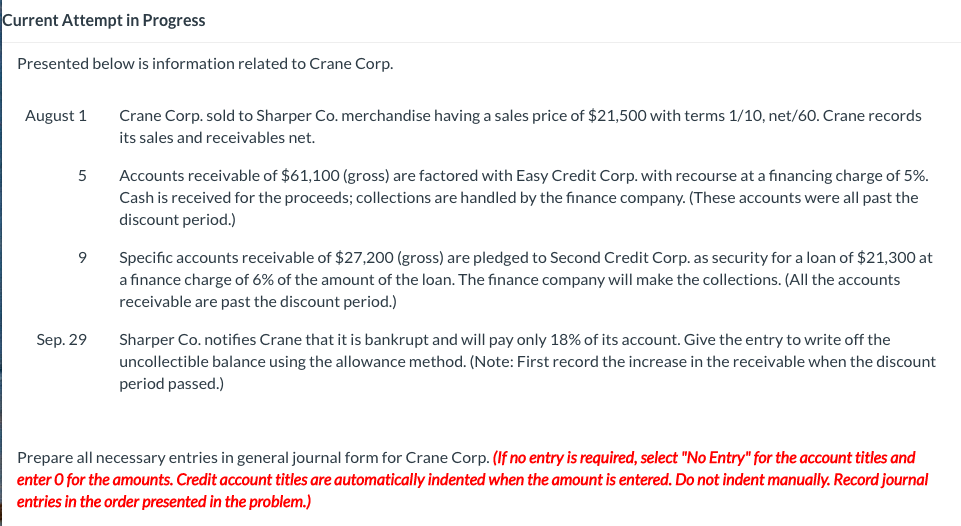

Presented below is information related to Crane Corp. August 1 Crane Corp. sold to Sharper Co. merchandise having a sales price of $21,500 with terms

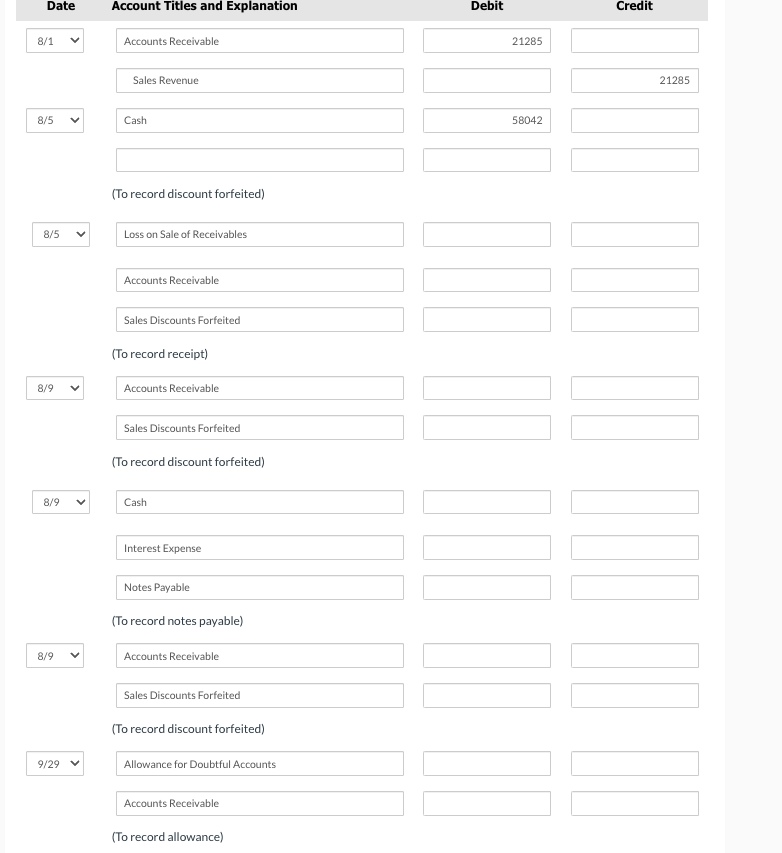

Presented below is information related to Crane Corp. August 1 Crane Corp. sold to Sharper Co. merchandise having a sales price of $21,500 with terms 1/10, net/60. Crane records its sales and receivables net. 5 Accounts receivable of $61,100 (gross) are factored with Easy Credit Corp. with recourse at a financing charge of 5%. Cash is received for the proceeds; collections are handled by the finance company. (These accounts were all past the discount period.) 9 Specific accounts receivable of $27,200 (gross) are pledged to Second Credit Corp. as security for a loan of $21,300 at a finance charge of 6% of the amount of the loan. The finance company will make the collections. (All the accounts receivable are past the discount period.) Sep. 29 Sharper Co. notifies Crane that it is bankrupt and will pay only 18% of its account. Give the entry to write off the uncollectible balance using the allowance method. (Note: First record the increase in the receivable when the discount period passed.) Prepare all necessary entries in general journal form for Crane Corp. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit Accounts Receivable Sales Revenue 21285 Cash 58042 (To record discount forfeited) Loss on Sale of Receivables Accounts Receivable Sales Discounts Forfeited (To record receipt) Accounts Receivable Sales Discounts Forfeited (To record discount forfeited) Interest Expense Notes Payable (To record notes payable) Accounts Receivable Sales Discounts Forfeited (To record discount forfeited) Allowance for Doubtful Accounts Accounts Receivable (To record allowance)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started