Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Presented below is information related to Sunbuck's Coffee Club for its fiscal year ending April 30, 2023. During the year, the Board of Directors

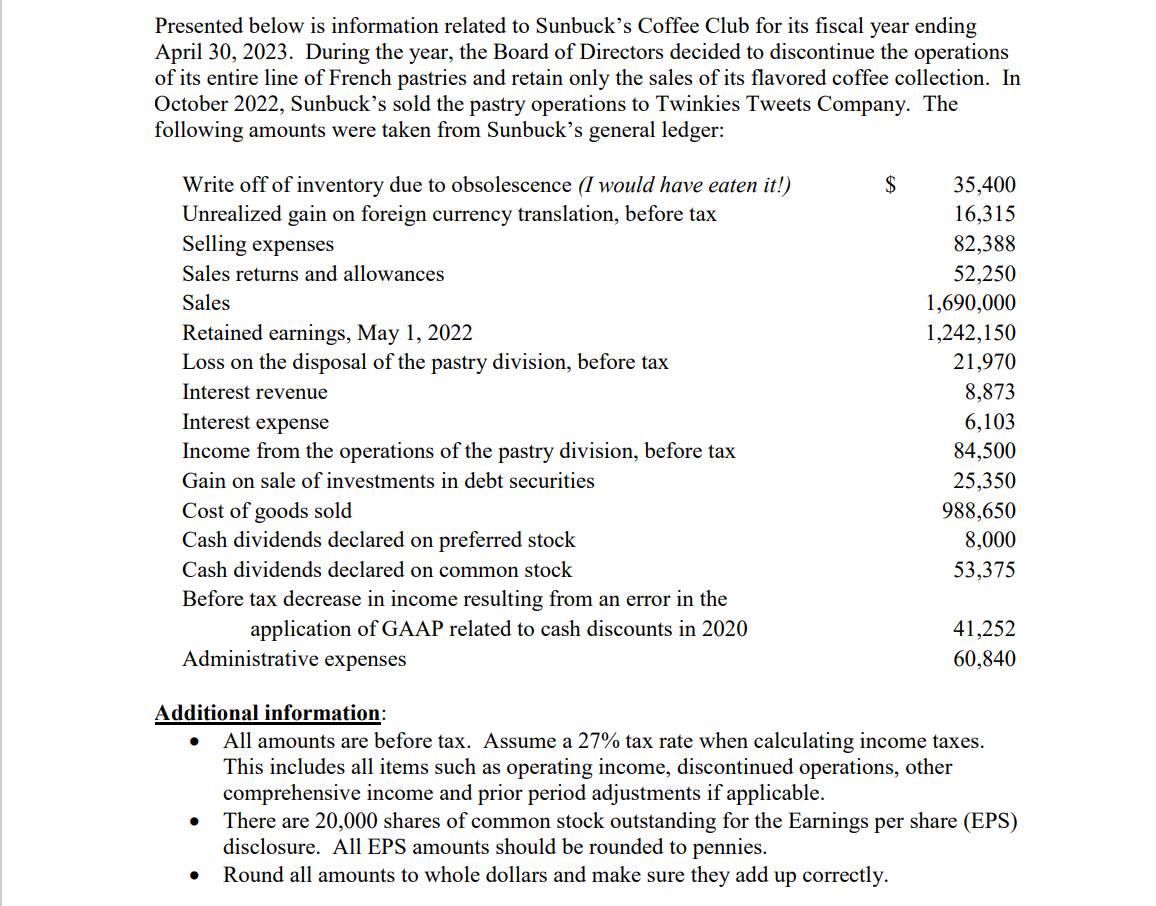

Presented below is information related to Sunbuck's Coffee Club for its fiscal year ending April 30, 2023. During the year, the Board of Directors decided to discontinue the operations of its entire line of French pastries and retain only the sales of its flavored coffee collection. In October 2022, Sunbuck's sold the pastry operations to Twinkies Tweets Company. The following amounts were taken from Sunbuck's general ledger: Write off of inventory due to obsolescence (I would have eaten it!) Unrealized gain on foreign currency translation, before tax Selling expenses Sales returns and allowances Sales Retained earnings, May 1, 2022 $ 35,400 16,315 82,388 52,250 1,690,000 1,242,150 Loss on the disposal of the pastry division, before tax 21,970 Interest revenue 8,873 Interest expense 6,103 Income from the operations of the pastry division, before tax 84,500 Gain on sale of investments in debt securities 25,350 Cost of goods sold 988,650 Cash dividends declared on preferred stock 8,000 Cash dividends declared on common stock 53,375 Before tax decrease in income resulting from an error in the application of GAAP related to cash discounts in 2020 41,252 60,840 Administrative expenses Additional information: All amounts are before tax. Assume a 27% tax rate when calculating income taxes. This includes all items such as operating income, discontinued operations, other comprehensive income and prior period adjustments if applicable. There are 20,000 shares of common stock outstanding for the Earnings per share (EPS) disclosure. All EPS amounts should be rounded to pennies. Round all amounts to whole dollars and make sure they add up correctly.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started