Answered step by step

Verified Expert Solution

Question

1 Approved Answer

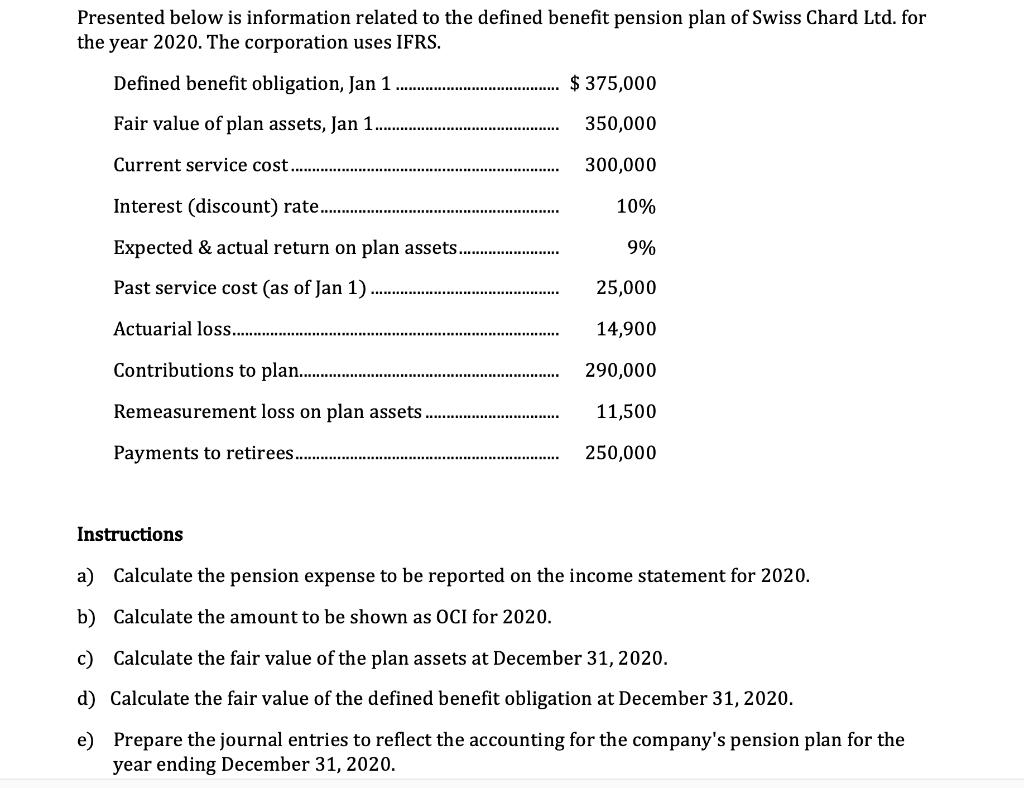

Presented below is information related to the defined benefit pension plan of Swiss Chard Ltd. for the year 2020. The corporation uses IFRS. Defined

Presented below is information related to the defined benefit pension plan of Swiss Chard Ltd. for the year 2020. The corporation uses IFRS. Defined benefit obligation, Jan 1 $ 375,000 Fair value of plan assets, Jan 1. 350,000 Current service cost.. 300,000 Interest (discount) rate 10% Expected & actual return on plan assets. 9% Past service cost (as of Jan 1) 25,000 Actuarial loss.. 14,900 Contributions to plan. 290,000 Remeasurement loss on plan assets 11,500 Payments to retirees. .. 250,000 Instructions a) Calculate the pension expense to be reported on the income statement for 2020. b) Calculate the amount to be shown as OCI for 2020. c) Calculate the fair value of the plan assets at December 31, 2020. d) Calculate the fair value of the defined benefit obligation at December 31, 2020. e) Prepare the journal entries to reflect the accounting for the company's pension plan for the year ending December 31, 2020.

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Answer R econcilation of Plan Assets and Defined Benefit Obligation Plan Assets Defined Benefit Obli...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started